Global X Emerging/Frontier ETF Debuts

The Global X Next Emerging & Frontier ETF (NYSE Arca: EMFM) debuted today as a new spin on emerging and frontier markets ETFs investing.

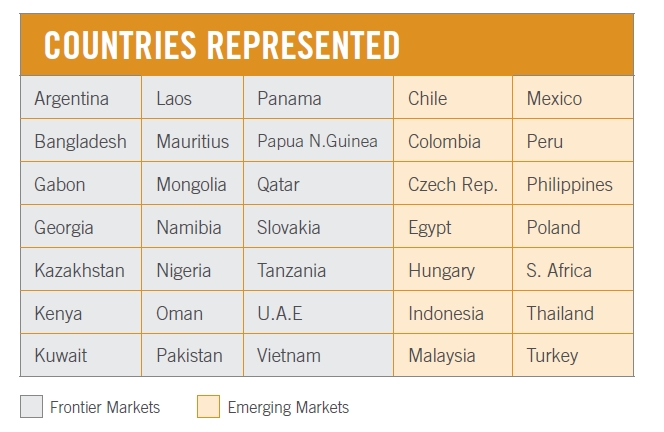

The new ETF is comprised of 35 countries and 200 holdings, and specifically excluded from the fund are the BRICs, South Korea and Taiwan. With exclusion of the BRIC nations of Brazil, Russia, India and China, EMFM adds to the list of ETFs that are plays on the “beyond BRICs” theme. [Beyond BRICs ETF Moves to New Index]

Like the rival EGShares Beyond BRICs (BBRC), EMFM charges 0.58% per year.

“ The Next Emerging & Frontier ETF offers exposure to specific economies that we expect will experience a long period of high growth rates, similar to what the BRIC nations experienced over the past 15 years,” said Bruno del Ama, chief executive officer of Global X Funds, in a statement.

“Investing in emerging markets continues to be an important strategy for portfolio diversification and growth, but investors must now look beyond more mature economies to regions with accelerating growth rates and expanding populations. This is because ‘traditional’ emerging market investments have begun to slow down and are too closely correlated with developed markets.”

EMFM stands as a play on the next generation of emerging markets, countries such as the Philippines, Chile and Colombia.

Global X is no stranger to frontier markets ETFs as the firm issues the Global X FTSE Argentina 20 ETF (ARGT) , the Global X Nigeria Index ETF (NGE) and the Global X Central Asia & Mongolia (AZIA) . [Global X EM/Frontier ETF on Deck]

EMFM tracks the Solactive Next Emerging & Frontier Index. “Countries represented in the index represent 24% of the world’s population, but just 12% of the world’s GDP and 8% of the world’s equity market cap. Economists expect developing and frontier nations to close the gap with their developed counterparts as GDP becomes more representative of the population size and the market cap- to-GDP ratio climbs,” according to Global X.

EMFM’s largest country is a 10.5% allocation to Malaysia and the largest sector weight is 20% to financial services.

EMFM Country Matrix

Chart courtesy: Global X