Junior Gold, Silver Miner ETFs Jump Above Key Trendlines

Rebounding bullion prices are pulling up gold and silver stock exchange traded funds, with junior miners breaking above their short-term trends and looking to test long-term resistance levels.

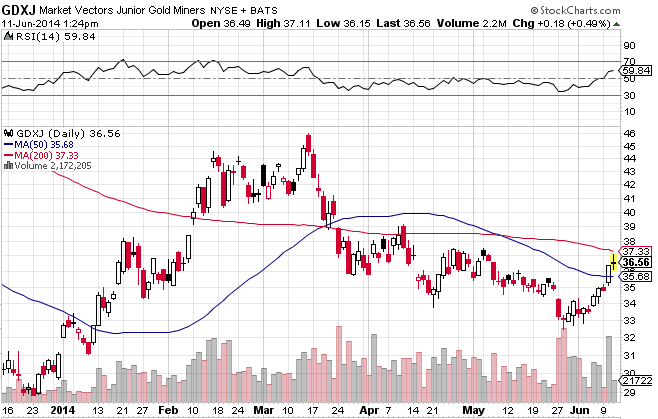

The Market Vectors Junior Gold Miners ETF (GDXJ) was up 0.5% Wednesday while the PureFunds ISE Junior Silver ETF (SILJ) increased 2.1%. Over the past week, GDXJ surged 8.1% and SILJ jumped 6.3%. Both small-cap miner ETFs broke above their 50-day simple moving averages and are hovering below their 200-day trend line. [Silver ETFs Look to Regain Lost Luster]

Large-cap focused Market Vectors Gold Miners ETF (GDX) was up 0.4% Wednesday and the Global X Silvers Miners ETF (SIL) was 0.9% higher. Over the past week, GDX gained 3.0% while SIL climbed 5.2%. Both large-cap miner ETFs are looking to test their 50-day resistance.

The precious metals miners are being supported by stronger bullion prices, with gold heading for its longest rally in six weeks. COMEX gold futures are now trading around $1,261 per ounce Wednesday and COMEX silver futures were hovering around $19.2 per ounce.

Traders are using precious metals to hedge against uncertainty after the World Bank cut its global economic growth projection, Bloomberg reports.

“There is some safe-haven buying,” David Meger, the director of metal trading at Vision Financial Markets, said in the article. “The World Bank lowering forecast for the U.S. is a matter of concern.”

The SPDR Gold Shares (GLD) relatively flat at last check Wednesday, but the fund is up 1.2% over the past week. [Tarnished Gold ETFs Try to Glimmer]

Additionally, precious metal prices were gaining momentum as the recent rally forced bearish traders to cover their shorts, Kitco News reports. The traders would have to buy back borrowed securities to close an open short position, which helps push prices higher.

Market Vectors Junior Gold Miners ETF

For more information on the mining industry, visit our metals & mining category.

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.