One ETF Issuer Stands Out From The Rest

For issuers of ETFs, it is no secret that the barriers to entry are relatively high. While many have the ability to create a new exchange-traded product, keeping it alive has proven a difficult task for many. It seems that investors have allocated their trust to the oldest and largest funds, leaving a tough road ahead for young products. But that issue does not stop at the individual fund level; it is also present among the various issuers [see also How To Pick The Right ETF Every Time].

The Biggest ETF Issuers

There are approximately 1,450 ETPs active with nearly $1.4 trillion in total combined assets in the ETF world. But despite those staggering figures, they can be mostly attributed to just three issuers: iShares (BlackRock), State Street and Vanguard. Together, these three account for approximately 85% of all ETF assets.

iShares: $587,383,664,000 in total assets with 279 funds.

State Street: $339,911,267,000 in total assets with 117 funds.

Vanguard: $264,026,690,000 in total assets with 65 funds.

State Street is home to both (SPY, A) and (GLD, A), the two largest ETFs in the world. In fact, SPY accounts for nearly 9% of all ETF assets and is one of the most traded financial instruments currently in existence. Still, iShares dominates total assets with nearly 300 products to choose from. But is having more ETFs necessarily a good thing? If you dive a bit deeper into those numbers, a surprising trend is revealed [see also Visual History Of The S&P 500].

Who Wins?

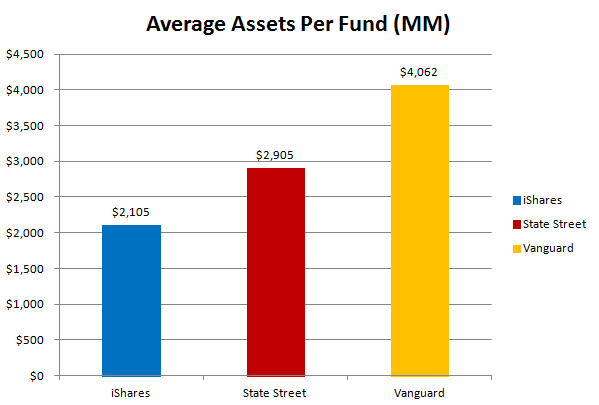

While iShares and State Street may dominate when it comes to total AUM, Vanguard takes the edge in a different category: average assets per fund. Of course, it is blatantly obvious that the latter has significantly fewer funds than the formers, but it still suggests that Vanguard is creating funds that are in high demand. Take a look at the average assets per fund below.

iShares has 82 funds that belong to the exclusive $1 billion club, but it also has 56 funds with less than $25 million in assets. State Street has 29 $1 billion members while another 25 fall into the $25 million-or-less moniker. Vanguard has just three funds with less than $25 million, while 35 of its funds can flash a VIP card at the $1 billion threshold. With its average assets per funds nearly doubling that of the largest issuer in the world, Vanguard certainly has something to be proud of.

Of course, this does not mean Vanguard is a “better” issuer, but it does suggest that their strategy hones in on creating useful products for investors rather than putting a number of ETFs out there and seeing what sticks. So while Vanguard’s issues will not encompass the the diversity or grant the freedom that iShares and State Street can tout, the funds they do put out seem to sit very well with investors on the market. With just 65 funds, don’t expect to see Vanguard dethrone iShares anytime soon, but keep an eye on any newer launches the firm decides to bring in 2013.

[For more ETF analysis, make sure to sign up for our free ETF newsletter or try a free seven-day trial to ETFdb Pro.]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts: