A record number of consumers think Trump is positive for business

American consumers are fired up about President Donald Trump’s impact on U.S. business.

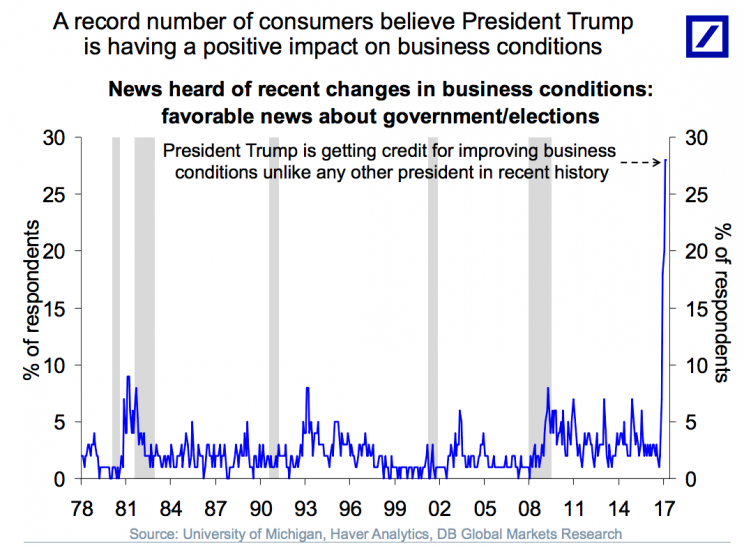

According to the latest University of Michigan survey of consumer sentiment, a record number of consumers mentioned that they’d seen favorable news about the government’s role in business conditions.

And as the chart below shows, there have been a few brief spikes in consumer mentions of the government positively impacting business conditions. But what we’ve seen since Trump’s election is simply unprecedented.

Since the election, the jump we’ve seen in consumer and business confidence has been the dominant economic story and the jump in confidence surveys is seen as a leading indicator for future economic activity.

And with consumer spending accounting for about 70% of GDP and business investment having been a laggard since the recovery, increases in confidence among both consumers and business owners is seen as a positive sign for this year and beyond.

A country divided

Now, the same University of Michigan survey from which the above chart is pulled has also highlighted the diverging views of the economy based on political affiliations. For Democrats, things are bleak. For Republicans, things have rarely been better.

“Among Democrats, the Expectations Index at 55.3 signaled that a deep recession was imminent, while among Republicans the Index at 122.4 indicated a new era of robust economic growth was ahead,” Richard Curtin, chief economist for the survey, said earlier this month.

Curtin added, “Importantly, there was no moderation in these extreme views from [February], with the maintenance of the partisan divide fueled by selective attention to economic news, with Democrats more frequently reporting unfavorable developments and Republicans more frequently hearing of favorable changes.”

And so the jump in consumers seeing positive news stories about the government’s role in business is almost certainly a jump in Republicans seeing positive stories about the economy.

That consumers who identify with one political party over another feel better than those on other side of the aisle does not invalidate the idea that consumer confidence can lead to better economic outcomes overall. But it is certainly worth tempering expectations that the overall economy will take off quickly if half of the population is bummed out about the state of the world.

Additionally, confidence surveys are part of what economists call “soft data” — or data based on survey responses — which is different from “hard data” like the jobs numbers and GDP reports which pull from data collected by government agencies. Since the election, soft data have rallied while hard data have been lagging in their rate of improvement.

On Thursday, we learned that in the fourth quarter, the economy grew at an annualized rate of 2.1%, better than Wall Street economists had forecast, but still below the 4% Trump has pledged to oversee during his time in office. In 2016, the economy grew just 1.6%, the slowest rate since 2011.

Some economists, however, have said that the “hard data vs. soft data” meme is one that needs to be disposed of and misrepresents a divergence in the U.S. economy that doesn’t really exist.

And as Neil Dutta — an economist at Renaissance Macro and one of those against the idea of “hard data vs. soft data” — said Thursday after the GDP numbers, “You don’t need to be a raging bull to come up with a positive case for 2017… 2017 will be a year where growth broadens out from the consumer to businesses.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: