A Recovery in Gold Could Make Traders 135% in Less Than a Year

Gold has made a series of higher lows over the past few weeks after a visit to key support at $1,550 per ounce. A move above $1,620 could confirm a bottom and resume the overall bull trend.

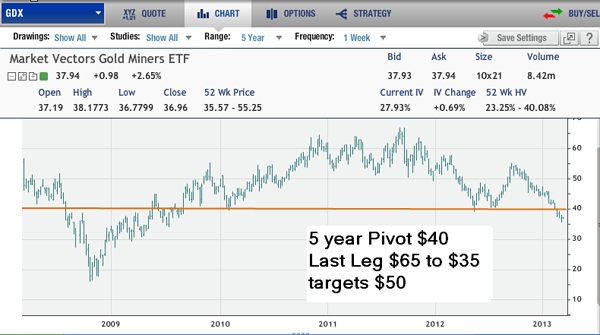

Gold, as measured by the SPDR Gold Shares (GLD), is down 6% over the last year, not catastrophic but certainly disheartening for gold bugs. The Market Vectors Gold Miners ETF (GDX) has been hit even harder than the metal itself, falling close to 30%. This suggests that the selling is GDX is overdone.

In the chart of GDX below, we can see a drop from its 2011 highs around $65 to its 2013 lows near $35. The bullish divergence with new price lows but no new highs in volatility suggests a push to the five-year pivot at $40 and beyond. A halfway recovery rally of the 2011 highs to recent lows targets $50 per share.

The $50 target is more than 35% higher than current prices, but traders who use a capital-preserving, stock substitution strategy could more than double their money on a move to that level.

One major advantage of using long call options rather than buying the stock outright is putting up much less to control 100 shares -- that's the power of leverage. But with all of the potential strike and expiration combinations, choosing an option can be a daunting task.

Simply put, you want to buy a high-probability option that has enough time to be right, so there are two rules traders should follow:

Rule One: Choose an option with 70%-plus probability.

An option's strike price is the level at which the options buyer has the right but not the obligation to purchase the underlying stock or ETF. (In reality, you rarely convert the option into shares, but rather simply sell back the option you bought to exit the trade for a gain or loss.)

Any trade has a 50/50 chance of success. Buying in-the-money options increases that probability. It is important to buy options that pay off from a modest price move in the underlying stock or ETF rather than those that only make money on the infrequent price explosion. In-the-money options are more expensive, but they're worth it, as your chances of success are mathematically superior to buying cheap, out-of-the-money options that rarely pay off.

The options Greek delta also approximates the odds that the option will be in the money at expiration. Delta is a measurement of how well an option follows the movement in the underlying security.

With GDX trading at about $37 at the time of this writing, an in-the-money $30 strike call currently has $7 in real or intrinsic value. The remainder of any premium is the time value of the option.

Rule Two: Buy more time until expiration than you may need -- at least three to six months -- for the trade to develop.

Time is an investor's greatest asset when you have completely limited the exposure risks. Traders often do not buy enough time for the trade to achieve profitable results. Nothing is more frustrating than being right about a move only after the option has expired.

With these rules in mind, I would recommend the GDX Jan 2014 30 Calls at $8.50 or less.

The $30 option strike level is significantly below GDX's 52-week low support. This in-the-money option gives you the right to buy at the lowest point since mid-2009.

A close below $35 in the stock on a weekly basis or the loss of half of the option premium would trigger an exit. If you do not use a stop, the maximum loss is still limited to the $875 or less paid per option contract. The upside, on the other hand, is unlimited. And the January options give the bull trend 10 months to develop.

This trade breaks even at $38.50 ($30 strike plus $8.50 option premium). That is less than $2 above GDX's current price. If shares hit the upside breakout target of $50, then the call options would have $20 of intrinsic value and deliver a gain of more than 100%.

Recommended Trade Setup:

-- Buy GDX Jan 2014 30 Calls at $8.50 or less

-- Set stop-loss at $4.25

-- Set initial price target at $20 for a potential 135% gain in 10 months

Related Articles

Under-the-Radar Biotech Could Score Traders 43%-Plus Profits

Market Outlook: There's a 78.6% Chance Stocks Will Move in This Direction in the Next 3 Months

This Simple Income Strategy Could Produce 49% Annual Returns With Less Risk