This jarring chart may explain why investors are flooding into the stock market

It’s curious right? The stock market (^GSPC) keeps going up—making new record highs even—and yet earnings are weak at best and for some companies profits are actually shrinking. So why in the world are stocks going up if the underlying prospects of companies are so poor?

I’ll explain in a second, but one thing to remember about investing is that it really is a zero sum game. If you sell a stock you are always moving money into something else, even if it’s cash. And investors are therefore always comparing the returns of one investment to another. Historical anomalies or distortions often produce equal and opposite reactions à la Newtonian physics. And that’s exactly what’s going on today in the stock market versus the bond market.

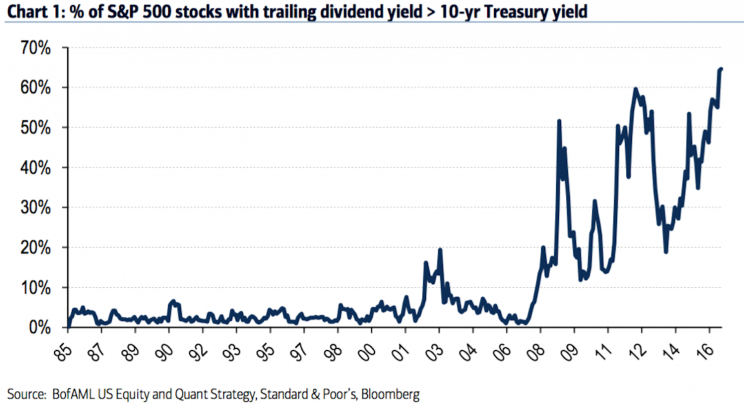

The chart below illustrates this story, graphing the percentage of S&P 500 stocks that have dividend yields greater than the yield on the 10-year Treasury note (^TNX). You can see for years—nay decades—the great majority of S&P 500 companies, like 95% of them, had stocks with dividend yields less than 10-year Treasuries. Things started to go haywire around the financial crisis, when stocks plunged, but companies didn’t cut their dividends, which meant their yields soared relative to Treasuries.

What’s happening now is that Treasury yields, which many market prognosticators thought couldn’t go any lower, or were convinced would rise soon, just keep on dropping. The 10-year Treasury has now fallen from 2.24% in the first week of January to 1.55% —a huge percentage drop. And of course in other countries, like Germany and Japan, yields are even lower—or negative.

That 1.55% Treasury yield, which looks paltry enough on its own, looks even worse compared to stocks. The dividend yield of the S&P 500 currently sits at 2.04% And that’s what the chart reflects, way more than half of S&P stocks yield more than 10-year Treasuries! So think about it. If you buy stocks, you can get a yield more than Treasury bonds. Furthermore, you can capture further dividend hikes and also potential capital gains.

No brainer right?

That’s one reason why investors are flooding into stocks (pushing prices ever higher): to capture this anomaly.

Will it all end badly? Who knows. But when things get this out of whack in the market, they usually, somehow, someway swing the other way.

–

Andy Serwer is editor-in-chief at Yahoo Finance.

Read more:

How Roger Ailes and Peter Thiel reflect GOP angst

Billionaire Bill Macaulay is giving back in a way that should make the wealthy take notice