Two Key Factors Favor further British Pound Weakness versus US Dollar

- British Pound fails to hold key highs versus Dollar

- A major reversal in forex sentiment suggests it set major high

- Holding below key resistance at $1.6820 keeps price reversal intact

Follow any updates on the US Dollar and other currencies via this author’s e-mail distribution list.

The British Pound has once again failed at significant resistance against the US Dollar. Why might this be the start of a larger GBPUSD move lower?

Last week we warned that the British Pound was at particular risk versus the US Dollar for two key reasons: an important weekly technical reversal pattern and the potential for a sentiment extreme underlined downside risk. We’ve since seen price fall further, while retail FX positions have likewise pulled back from extremes.

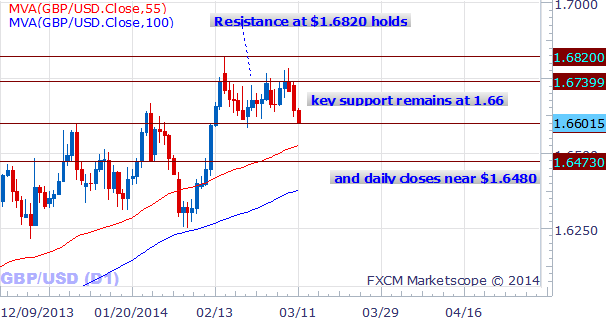

GBPUSD Holds Below Important Resistance, Testing Key Support as Price Pulls Back

Source: FXCM Trading Station Desktop, Prepared by David Rodriguez

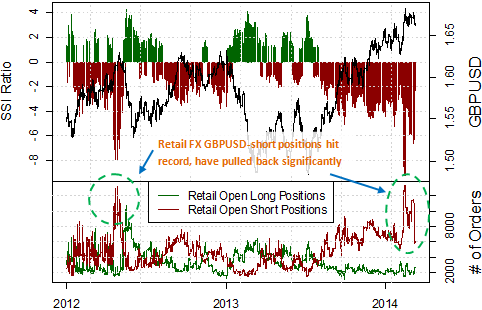

Forex trading crowds recently hit their most short GBPUSD on record. We typically go against the herd; if everyone’s short we prefer to be long and vice versa. Yet the majority of traders are often their most long at key lows and their most short at key tops. The catch is that these extremes are only clear in hindsight.

Short interest has fallen by as much as 50 percent while long interest is up the same amount as the British Pound has fallen nearly 200 pips from Friday’s high. There is obviously no guarantee that this is indeed the start of the larger reversal, but we can’t ignore the clear warning sign.

Retail Forex Sentiment Warns that GBPUSD May Have Set Important Top

Source: FXCM Execution Desk Data, Chart Prepared by David Rodriguez

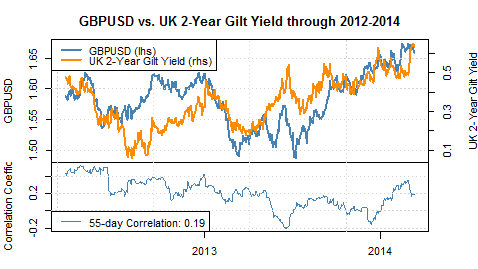

Our Senior Technical Strategist believes that the Sterling could soon trade to $1.6450 as it continues to trade below the 2/17 high of $1.6822. A relatively empty week of UK economic event risk suggests there are few foreseeable catalysts for the move. Yet we’ll likewise note that Cable remains strongly correlated to UK Government debt yields.

We might look to next week’s Bank of England Meeting Minutes to spark the next big move in GBP pairs.

Data source: Bloomberg, Prepared by David Rodriguez

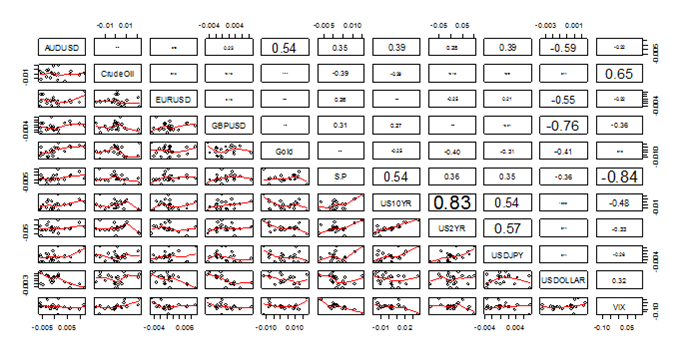

Forex Correlations Summary

View forex correlations to the S&P 500, S&P Volatility Index (VIX), Crude Oil Futures prices, US 2-Year Treasury Yields, and Spot Gold prices.

Data source: Bloomberg. Chart source: R SEE GUIDE ON READING THE ABOVE CHART

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com David specializes in automated trading strategies. Find out more about our automated sentiment-based strategies on DailyFX PLUS.

Contact and follow David via Twitter: https://twitter.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.