Smucker Still Looks Fine, but Traders Stamp Feet

When your stock's near an all-time high, you've often got to do better than meet estimates to keep shareholders happy. That's what J.M. Smucker (SJM) was dealing with Friday.

Smucker's shares were dropping on the final trading day of the week despite the peanut butter and jelly maker's in-line quarterly report, a higher earnings forecast for the year and upbeat comments on consumer spending. After the results, Smucker was down 2.7% to $83.12. Smucker is up 7.5% this year, and just a month ago it recorded its best close ever at $87.47. However, since peaking, it's fallen nearly 5%.

What's going on? A sub-3% selloff isn't remotely the end of the world, but it speaks to the high bar for stocks akin to Smucker when their earnings come out -- you meet or miss, you pay the price, even with better projections -- as well as to the general unease with the stock market at the moment.

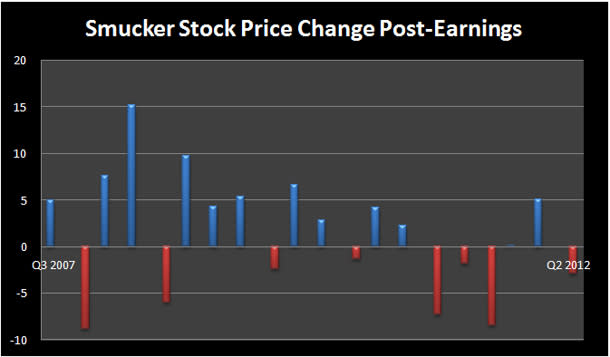

That said, sizable shifts on earnings days aren't exactly abnormal for Smucker. Following a little more than half of the past 20 quarterly releases, the stock has moved 5% or more, with an average of 5.36%. Something that does make this pullback a bit of an outlier is the fact that normally when Smucker has fallen after earnings, it's missed on at least one major metric, namely sales or earnings. You have to go back to the third quarter of fiscal 2010 for the last time it at least met both lines and still had a loss in the stock for the session, FactSet data show.

For the fiscal second quarter, Smucker earned $1.45 a share, matching the consensus Wall Street estimate, and sales of $1.63 billion were about $1 million ahead of what was expected. For fiscal 2013, the company now says it should earn $5.12 to $5.22 a share, up from its previous forecast of $5 to $5.10. While sales for the quarter grew by about $115 million, or 8%, from the same quarter of the prior year, an acquisition accounted for the bulk of the change. Smucker acquired the North American foodservice coffee and hot drink business of Sara Lee in January, and that added $90.7 million to the top line.

"Overall consumer spending appears to be on the upswing, which is welcome news for the industry," Vince Byrd, Smucker's president and COO, said in a press release discussing the numbers. "The tactical adjustments we made to address market conditions are working." He added that the company was "well-poised for the holiday season and another year of growth."

In terms of prices and product volume, the quarter was mixed. Prices in total were a bit lower, the company says, with declines on coffee offsetting increases in peanut butter. Brands like Folgers coffee and Five Roses flour moved more volume, but Crisco, Jif peanut butter and Smucker fruit spreads were among the lines that had lower volume.

Commodity prices are critical to Smucker's business, and costs all told were slightly down compared with last year, the company said. Green coffee bills fell, but spending went up on peanuts.

On the domestic coffee side, sales rose 1%, with single-serve K-Cups starring for the segment. U.S. consumer foods' sales also were up 1%, thanks to higher prices making up for a year-over-year drop in product volume. Those two domestic operations are around the same size measured by sales, and added together they make up about three-quarters of Smucker's revenue. The other part -- international, foodservice and natural foods -- had sales growth of 38%, driven by the Sara Lee unit acquisition.

Combining management's remarks on consumers with the profit projection, there's not an obvious signal here for Smucker owners to panic, especially since the company has a history of being good to shareholders, with nearly 12% average yearly appreciation in the stock price the past five years and regular hikes in the dividend.

Even so, there's little doubt the company and its investors want more volume pulled off store shelves, and that trend will bear watching. If not that, it will have to raise list prices where it can, but the problem there is far too many consumers are still living with at best fair-to-middling personal finances. (For now, the latter approach seems unlikely, at last as a significant implementation. Reuters quoted Byrd as saying on a conference call after the earnings that the company was cutting prices on some items in the spreads line.)

So for Smucker, it's entirely likely the day's pullback is simply the type of reaction that sometimes accompanies earnings results that fall short of being classified as a blowout. In this company's situation, if the stock keeps heading lower, it probably won't be an indictment of Smucker: It's going to have much more to do with the broader market and the economy overall. And in that case, we'll all have more to worry about than Smucker alone.