1-800-Flowers.com Inc (FLWS) Reports Fiscal 2024 Second Quarter Results

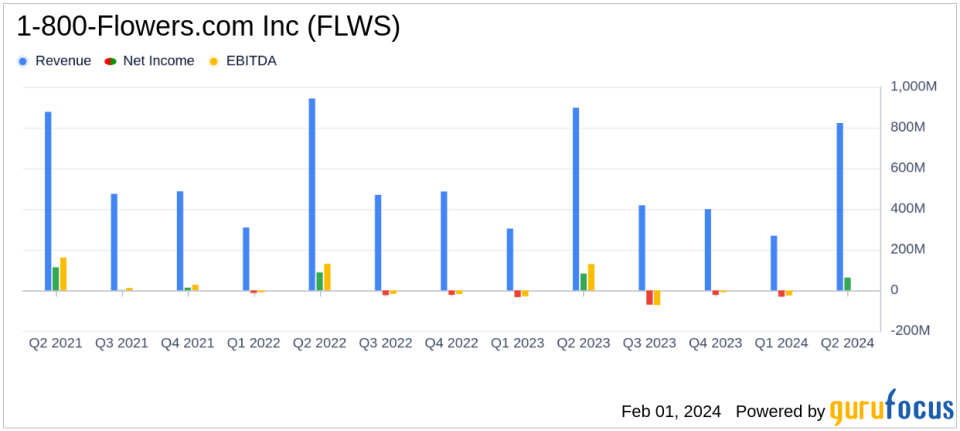

Revenue: Reported $822.1 million, a decrease from the prior year.

Net Income: Posted $62.9 million, or $0.97 per share, including a non-cash impairment charge.

Adjusted Net Income: Reached $82.7 million, or $1.27 per share.

Gross Profit Margin: Improved by 230 basis points to 43.3%.

Adjusted EBITDA: Generated $130.1 million.

Guidance: Fiscal 2024 revenue outlook reduced, while maintaining Adjusted EBITDA and Free Cash Flow expectations.

On February 1, 2024, 1-800-Flowers.com Inc (NASDAQ:FLWS) released its 8-K filing, detailing its financial performance for the fiscal second quarter ended December 31, 2023. The company, a leading provider of gifts designed to help customers express, connect, and celebrate, reported a decline in revenues to $822.1 million compared to the previous year, while net income stood at $62.9 million, or $0.97 per share. This included a non-cash impairment charge of $19.8 million. Adjusted for this charge, the net income was $82.7 million, or $1.27 per share.

Financial Performance and Challenges

Despite the revenue decline, 1-800-Flowers.com Inc achieved a gross profit margin improvement of 230 basis points to 43.3%, marking the fifth consecutive quarter of year-over-year expansion. This growth in margin is attributed to a reversion to the mean of certain commodity costs and the company's "Work Smarter" initiatives, which aim to operate more efficiently. These initiatives have also positively impacted operating expenses.

Chairman and CEO Jim McCann commented on the performance, stating,

Our second quarter earnings came in line with our expectations, as our gross profit margin recovery and expense optimization efforts helped offset a softer than anticipated consumer environment."

He further noted the company's commitment to maintaining its full-year Adjusted EBITDA estimate and the positive impact of their initiatives on the business.

Segment Results and Company Guidance

The company's Gourmet Foods and Gift Baskets, Consumer Floral and Gifts, and BloomNet segments all experienced a decrease in net revenues year-over-year. In response to the softer than anticipated revenue improvement, the company has updated its Fiscal 2024 guidance, reducing its revenue outlook but maintaining its Adjusted EBITDA and Free Cash Flow expectations.

Financial Metrics and Importance

Key financial metrics from the income statement, balance sheet, and cash flow statement highlight the company's ability to manage its finances effectively in a challenging consumer environment. The improvement in gross profit margin is particularly important for a retail-cyclical company like 1-800-Flowers.com Inc, as it indicates the company's ability to control costs and optimize pricing strategies.

The balance sheet shows a healthy cash and cash equivalents position of $312.017 million as of December 31, 2023, up from $126.807 million at the beginning of the fiscal year. This increase in liquidity is a positive sign for the company's financial stability.

The cash flow statement reveals that the company generated $212.760 million in net cash provided by operating activities for the six months ended December 31, 2023, which is an increase from the prior year. This demonstrates the company's capacity to generate cash from its core business operations.

Analysis of Performance

1-800-Flowers.com Inc's performance in the fiscal second quarter reflects a resilient business model capable of navigating a difficult consumer spending environment. The company's focus on margin improvement and cost control measures has allowed it to maintain profitability and cash flow generation despite the top-line pressure. The updated guidance suggests management's confidence in their strategic initiatives and their ability to adapt to market conditions.

For value investors and potential GuruFocus.com members, 1-800-Flowers.com Inc's ability to sustain margins and generate cash in a challenging retail landscape is a testament to the company's operational efficiency and strategic focus. The company's performance and management commentary provide a balanced view of its current position and future prospects.

For more detailed financial analysis and insights into 1-800-Flowers.com Inc's performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from 1-800-Flowers.com Inc for further details.

This article first appeared on GuruFocus.