1 Monster Opportunity Amid the Global Chip Shortage

The semiconductor industry is coming off a difficult couple of years. Sales were flat in 2022 and dropped 11% last year, according to Gartner, due to the weak demand in key industries such as smartphones and personal computers (PCs), which created a glut.

However, 2024 is predicted to be a turnaround year for the semiconductor market. Deloitte is forecasting a 13% increase in the industry's revenue this year to $588 billion. That's not surprising because sales of PCs and smartphones are expected to climb 4% in 2024. For comparison, PC sales were down 14% last year, while smartphone shipments fell 3.5%.

The good part is that both these markets could sustain their growth in the long run, especially with the emergence of artificial intelligence (AI). As it turns out, AI alone is driving a solid turnaround in the semiconductor industry, with the demand for AI chips forecast to grow at an annual pace of 38% through 2032, generating an annual revenue of $372 billion at the end of the period.

The increasing demand from these markets is going to fuel the need for more semiconductor equipment. Businesses and governments are already investing huge sums to boost their production capacities so that they can reduce the shortage of AI chips. All this tells us why this is a good time to buy Applied Materials (NASDAQ: AMAT), a company that sells semiconductor manufacturing equipment and services to the world's leading chip foundries.

Applied Materials is sitting on a secular growth opportunity

To meet the rising demand for chips, several semiconductor fabrication plants are being constructed across the globe. According to industry association SEMI, 42 new fabrication plants are expected to go on line this year. That would be a big jump from 29 fabs in 2022 and 11 fabs last year.

Given that the global semiconductor market is projected to more than double in revenue between 2023 and 2029, generating an estimated $1.38 trillion in revenue after five years, it won't be surprising to see more fabs coming on line in the long run. As a result, the spending on semiconductor manufacturing will likely increase as well to cater to the growing demand.

Not surprisingly, the semiconductor manufacturing equipment market is predicted to generate revenue of almost $154 billion in 2028 versus $84 billion in 2021. Applied Materials is in a nice position to capitalize on this opportunity. It boasts Samsung, Taiwan Semiconductor Manufacturing, and Intel among its key customers. They accounted for around 40% of Applied Materials' total revenue in the previous fiscal year.

Samsung, for instance, is set to invest $760 million into a new advanced chip plant in South Korea, while Intel plans to shell out more than $100 billion on building plants in the U.S. and Europe. The good part is that the spending by these foundry giants should positively impact Applied Materials' financials.

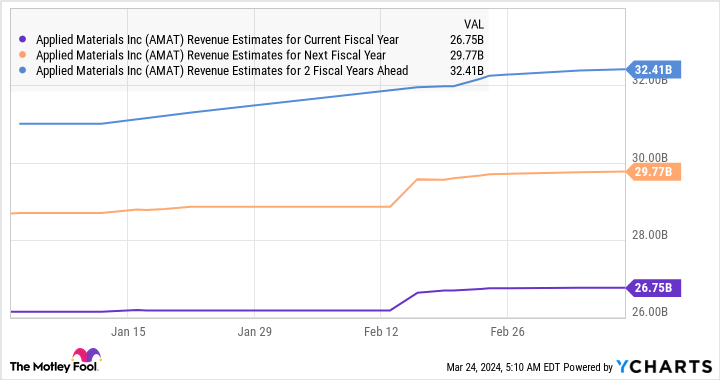

Its revenue in the first quarter of fiscal 2024 (for the period ending Jan. 28) was flat on a year-over-year basis at $6.7 billion. While that may not look impressive at first, and analysts are predicting its fiscal 2024 revenue will remain flat at $26.8 billion, it is worth noting that Applied Materials' revenue estimates have been heading higher lately.

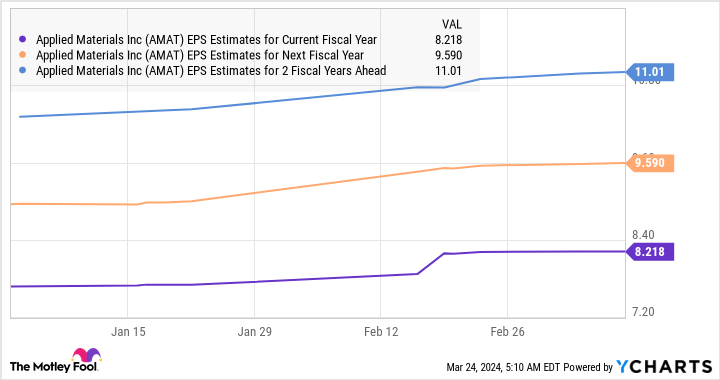

Additionally, as the chart above shows, Applied Materials' top-line growth is set to accelerate from the next fiscal year. More importantly, the top-line expansion is set to filter down to the bottom line as well, with analysts expecting the company to deliver double-digit growth for the next couple of years.

Moreover, Applied Materials is expected to sustain its earnings growth momentum over a longer period as well, with analysts forecasting its bottom line to increase at an annual rate of 15% for the next five years.

Terrific upside seems to be in the cards

Applied Materials finished fiscal 2023 with $8.05 per share in earnings. Assuming it can maintain a 15% annual earnings growth rate for the next five years thanks to the long-term opportunity in the semiconductor equipment market, its bottom line could jump to $16.19 per share.

Multiplying the projected earnings after five years with the Nasdaq-100's forward earnings multiple of 29 points toward a share price of $470 (using the index as a proxy for tech stocks). That would be a 124% jump from current levels, indicating that this semiconductor stock is set for impressive upside going forward.

Moreover, with Applied Materials shares trading at a relatively cheap 24 times earnings right now -- a discount to the Nasdaq-100 -- investors are getting a good deal on the stock currently. So, investors looking to capitalize on the growing demand for semiconductors would do well to buy Applied Materials before it jumps higher following the 30% gains it has posted year to date.

Should you invest $1,000 in Applied Materials right now?

Before you buy stock in Applied Materials, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Applied Materials wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Applied Materials and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Gartner and Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

1 Monster Opportunity Amid the Global Chip Shortage was originally published by The Motley Fool