1 Under The Radar Stock That Will Make You Look Like a Genius in 2024

Everyone would love to find that one stock no one has heard about yet, and then tell their friends and family about it after it has skyrocketed. Toast (NYSE: TOST) is one of the stocks with that potential; the best part is it's right under everyone's nose. So, keep reading if you want to know more about this stock and why it has breakout potential from here.

Its subscription business is key

Toast is on the technological side of restaurants and provides hardware and software solutions for its clients. You may have seen a Toast point-of-sale (POS) system at your local restaurant, including the mini versions that waitstaff carry around so they don't have to take your card to an individual kiosk.

However, Toast is using these devices only as a way into a much more lucrative business: subscriptions. Toast offers its customers a full suite of products to help run a restaurant, including payment processing, payroll, gift cards, employee scheduling, and delivery services. By getting clients on board with the Toast ecosystem, it can gradually expand to improve a restaurant's operations.

These add-ons are quite popular, as 43% of Toast's clients use at least six additional products beyond the base functionality. In all, Toast's annual recurring run-rate on the subscription side is $587 million and $631 million on the payments side for a total of $1.22 billion, up 41% from last year. Additionally, the number of locations using Toast rose from 74,000 to 99,000.

But that's just scratching the surface. Toast believes its addressable market is around $15 billion. If Toast can break into even bigger chains, its market will be much larger.

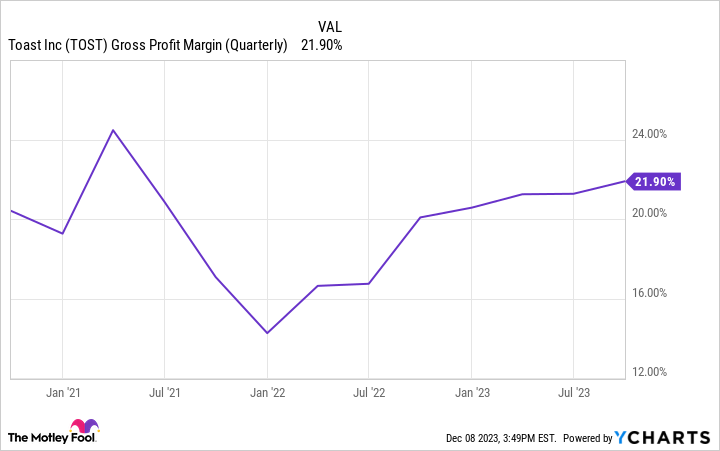

Still, investors must understand Toast's margin picture to invest in it. Because Toast is in the payment processing business and sells hardware, its margins aren't like a standard software-as-a-service (SaaS) company. Although Toast's gross margin is rapidly improving, it will never be in the 80% range like many other SaaS companies.

Toast's low gross margin caps its maximum profit margin, so the stock won't carry as high of a valuation as some of its peers. As for profits, Toast is inching closer. While Toast grew its revenue by 37%, operating expenses rose by only 21%, a sign that the company's breakeven point is getting closer.

Still, Toast's net loss for the quarter was $31 million. But with over $1 billion in cash and marketable securities on its balance sheet, investors don't have to worry about Toast going broke anytime soon.

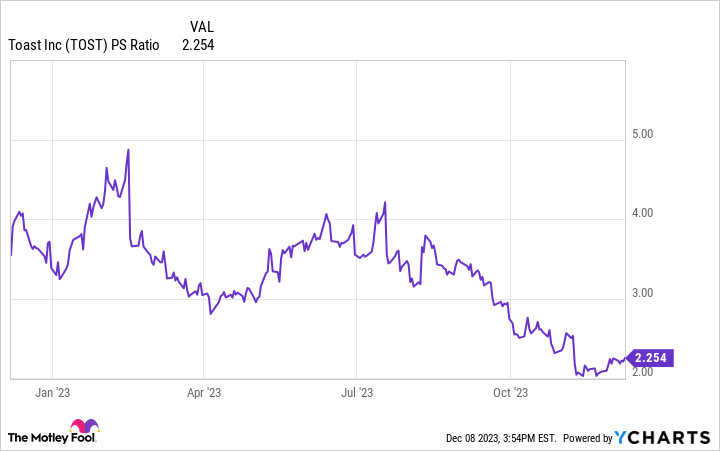

The stock trades at a low valuation

Given that Toast is unprofitable, we need to examine the company from a price-to-sales standpoint. While many companies have seen their multiples expand in 2023, Toast's has contracted. But is 2.3 times sales a reasonable price to pay? After all, its margins won't ever reach the levels of other tech companies.

With a large part of Toast's gross margin consumed by transaction expenses, it's not unrealistic to assume it can achieve a profit margin similar to a company like PayPal, another payment processor. If we project Toast to achieve a 6% profit margin (PayPal's is 12%) over the long term, it gives us a conservative estimate of what Toast could be in a few years. So, if Toast could snap its fingers and become instantly profitable with a 6% margin, it would trade around 38 times earnings.

A company growing revenue at 37% and trading for 38 times earnings is a fairly reasonable price, making me confident that investors can take advantage of Toast's low stock price now and hold it for at least five years to watch the company grow, break even, and finally establish a healthy profit margin.

Should you invest $1,000 in Toast right now?

Before you buy stock in Toast, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Toast wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 7, 2023

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool recommends Toast. The Motley Fool has a disclosure policy.

1 Under The Radar Stock That Will Make You Look Like a Genius in 2024 was originally published by The Motley Fool