1 Warren Buffett Stock Down 62% to Buy in 2024 and Hold

All-time great investor Warren Buffett is known far more for his winners like Apple and Coca-Cola than for his losing stocks. Food conglomerate Kraft Heinz (NASDAQ: KHC) is a rare example of his investments gone bust. The stock price is down over 60% from a high over six years ago.

Yet, it remains one of Berkshire Hathaway's 10 largest positions, worth over $12 billion. The billion-dollar question for investors is: Why has Buffett held onto the stock for so long? After all, he's owned it since he helped arrange a merger to create the entity in 2015.

Is it stubbornness? Maybe not. Here are three reasons why the future looks bright for Kraft Heinz and its shareholders in 2024 and beyond.

1. Cleaning up messy financials

Kraft Heinz was created in 2015 when Kraft Foods Group merged with Heinz Holding Corporation. The merger was worth roughly $45 billion, creating a food giant that owns such famous brands as Kraft, Heinz, Oscar Meyer, Kool-Aid, Jell-O, Capri-Sun, and more. This is a diverse portfolio of products that consumers buy constantly, making it a durable business model that should thrive in good and bad times.

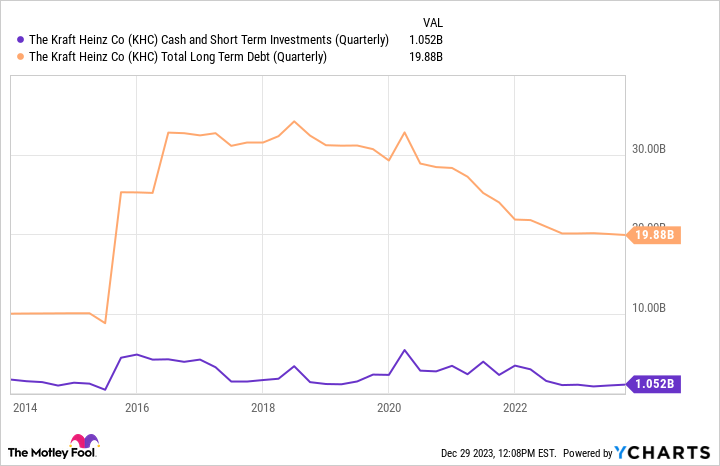

However, the merger also loaded up the new entity with debt. Below, the merger more than tripled the company's debt to over $30 billion. That financial anchor around its neck is a big reason the stock has languished for many years.

But through cost-cutting and divesting non-strategic brands, Kraft Heinz has slowly gotten its debt back under control. Is it perfect yet? No. But management has brought leverage down to 2.9 times its net debt (total debt minus cash) versus its earnings before interest, taxes, depreciation, and amortization (EBITDA). This breathing room has given management the ability to start putting some money to work to grow the business.

2. Incoming improvement in performance

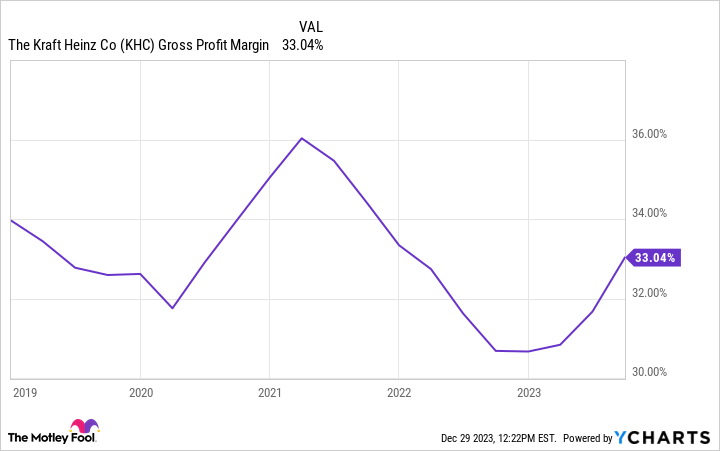

Management hasn't had an easy job these past few years. Inflation has been rampant throughout the consumer goods sector, boosting things like commodity prices and freight costs. But it hasn't stopped Kraft Heinz from making impressive progress.

It began by fixing its gross margin to near pre-pandemic levels, where it believes margins will remain moving forward. Next, it evaluated its supply chain for inefficiencies and believes it can save $2.5 billion by 2027.

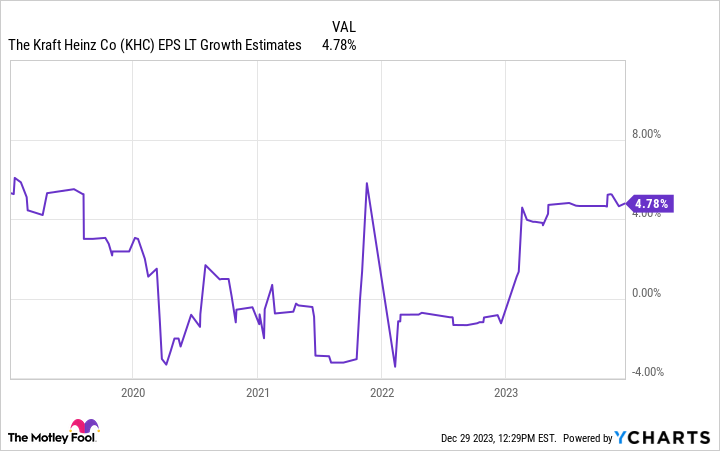

Growth remains a challenge, but there is progress here, too. Management is forecasting full 2023 organic revenue growth at 4%, its highest uptick in five years. Make no mistake, Kraft Heinz won't be a growth stock anytime soon. However, continued progress in paying down debt and cutting costs could position management to get more aggressive in the coming years (think product development and acquisitions).

Kraft Heinz has begun showing a definite turnaround in its business, with analysts projecting its highest outlook for earnings growth in years.

3. Does Buffett believe the stock is undervalued?

Focusing purely on the numbers, Kraft Heinz doesn't look like a screaming buy today. Shares trade at 12 times 2023 earnings, which isn't a bargain for a company growing profits at a mid-single-digit pace. But Buffett could be more optimistic on Kraft Heinz than the broader analyst community.

The company recently authorized a $3 billion share repurchase program. That's a hefty amount of money to buy back stock when you're fixing your balance sheet and trying to grow. Investors should note that Buffett's Berkshire Hathaway owns more than a quarter of Kraft Heinz (Berkshire's second-largest stake in a company), so it seems highly unlikely that management would spend that money on repurchasing stock without Buffett signing off on it.

Buffett's record of identifying value in the stock market speaks for itself, so the $3 billion share repurchase program should raise eyebrows. Kraft Heinz isn't close to finished with its redemption arc. That makes it a stock for the long-term investor. But if Buffett sees value in one of his largest holdings, it's at least worth digging into as an investment idea for 2024 and beyond.

Should you invest $1,000 in Kraft Heinz right now?

Before you buy stock in Kraft Heinz, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Kraft Heinz wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool recommends Kraft Heinz and recommends the following options: long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.

1 Warren Buffett Stock Down 62% to Buy in 2024 and Hold was originally published by The Motley Fool