10 Biotech Stocks with Biggest Upside

In this article, we discuss 12 biotech stocks with biggest upside. If you want to skip our detailed discussion on the recent developments in the biotech industry, you can go directly to 5 Biotech Stocks with Biggest Upside.

According to Precedence Research, the size of the biotechnology industry stood at $1.22 trillion at the end of 2022. The industry is set to compound annually at an average rate of 12.8% to reach $3.21 trillion by 2030. Governments across the world are providing favorable initiatives to this industry, given its strong growth potential. The biotechnology industry owes much of its growth to biopharmacy, which currently holds the largest market share at 41.5% as of 2022. The field of biotechnology is witnessing substantial progress in the development of innovative strategies to address diseases and genetic disorders.

Over the past decade, significant milestones have been achieved in early disease detection and the development of treatments for life-threatening conditions such as HIV, malaria, and tuberculosis (TB) due to the application of genomic analytical techniques. Furthermore, the rapid development of mRNA-based COVID-19 vaccines by some of the best biotech stocks like Pfizer Inc. (NYSE:PFE), BioNTech SE (NASDAQ:BNTX), and Moderna, Inc. (NASDAQ:MRNA) during the pandemic demonstrated the potential of biotech innovation. As of 2022, global biotech drug sales were valued at an impressive $421 billion. Interestingly, biopharmaceuticals or biotech drugs accounted for a substantial 40% share of the global drug sales market.

The potential of the biotechnology industry can be gauged by the fact that leading Danish pharmaceutical company Novo Nordisk A/S (NYSE:NVO) has leveraged the power of recombinant DNA biotechnology to develop Wegovy, an injectable drug for chronic weight management. It was approved by the FDA in 2021. According to ResearchAndMarkets.com, the estimated size of the global weight loss and weight management market is expected to grow at a CAGR of 7.2% to reach $425.4 billion by 2033. The drug works by mimicking the activity of a gut hormone that reduces appetite. It helps patients feel fuller faster and for a longer period of time. It is approved for long-term weight management in overweight adults who have at least one obesity-related health condition. Following the launch of Wegovy in the UK, Novo Nordisk A/S (NYSE:NVO) has become the most valuable European company with a market capitalization of $437.2 billion as of September 8.

Rowan Street Capital shared its stance on Novo Nordisk A/S (NYSE:NVO) in its Q2 2023 investor letter. Here's what the firm said:

“Our current portfolio is made up of just 10 companies — we are very focused! We described our ‘10-Player All-Star Team’ philosophy in our Q1 2018 Letter (we encourage you to review it). We have been building this portfolio since our founding in 2015. In total, over the past 8 years, we bought stock in 47 different companies (that’s ~6 per year), and obviously, for anyone who is good at arithmetic, we sold 37 of them (~4.6 per year). We are constantly trying to learn from every decision (good or bad) that we make. We went through every position that we’ve sold since 2015 and analyzed how we would have done had we held on to those positions. The top 3 performing positions would have been: Chipotle (CMG) +630%, Tractor Supply (TSCO) +315% and Novo Nordisk A/S (NYSE:NVO) +387%. Your managers are at fault here because we sold all of these (in 2017-18) for non-fundamental reasons. All of these continued to be great businesses and management has executed at very high levels. In all three cases, we made a decision to sell because we thought the stock price got way ahead of itself. Our main take-away lesson has to be Do NOT sell your winners and avoid adding more to your losers. Or as Peter Lynch once famously put it: “Selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

It must be noted that investing in biotech companies involves a high level of risk. Biotech stocks can experience big swings in stock prices based on developments related to clinical trials, approval by the FDA, and real-world applications. For those seeking investment opportunities in the industry, Intellia Therapeutics, Inc. (NASDAQ:NTLA), Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR), and Denali Therapeutics Inc. (NASDAQ:DNLI) are amongst the biotech stocks with biggest upside potential. Investors can also gain broad exposure to the biotechnology industry by investing in popular ETFs such as iShares Biotechnology ETF (NASDAQ:IBB). The ETF came into being in February 2001 and has net assets of $7.45 billion as of September 8. You can read more about the 12 Best Biotech ETFs To Buy here.

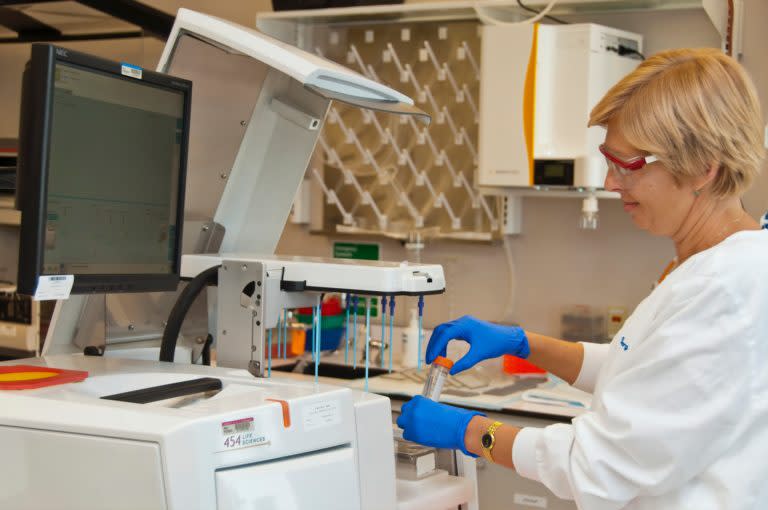

Photo by National Cancer Institute on Unsplash

Our Methodology

To shortlist the 10 biotech stocks with biggest upside, we referred to multiple reputable sources such as CNN, Barron’s Forbes, and Finviz. We used these sources to compute the average 12-month target price of the stocks. Additionally, we applied a minimum market capitalization threshold of $2 billion as a screening criterion to narrow down the selection. All the stocks on our list offer more than 50% upside potential as of September 8. Furthermore, the top 5 stocks have higher than 100% upside potential. In addition, we have also provided information regarding the hedge fund sentiment toward each stock as of Q2 2023. The stocks have been ranked in ascending order of their potential upside.

10 Biotech Stocks with Biggest Upside

10. Moderna, Inc. (NASDAQ:MRNA)

Average Target Price: $177.60

Potential Upside: 62.4%

Number of Hedge Fund Holders: 40

Value of Hedge Fund Holdings: $1,992,031,100

Moderna, Inc. (NASDAQ:MRNA) is a Cambridge, Massachusetts-based biotech company.

Moderna, Inc. (NASDAQ:MRNA) developed a COVID-19 vaccine, which demonstrated an impressive 95% effectiveness in preventing complications associated with the illness, as reported by Healthline. Based on an expected rise in COVID-19 cases in September 2023, Moderna, Inc. (NASDAQ:MRNA) has increased its revenue guidance for the second half of 2023 to a range of $6 billion to $8 billion. The company also conducted a share buyback of $600 million during Q2 2023. This reflects that the management believes Moderna, Inc. (NASDAQ:MRNA) stock is undervalued. Moderna, Inc. (NASDAQ:MRNA) finished the three months with a cash balance of $14 billion and long-term debt of $1.7 billion. Click here to read the company’s Q2 2023 earnings call transcript.

9. Royalty Pharma plc (NASDAQ:RPRX)

Average Target Price: $48.79

Potential Upside: 65.4%

Number of Hedge Fund Holders: 32

Value of Hedge Fund Holdings: $1,038,990,600

Royalty Pharma plc (NASDAQ:RPRX) is a New York-based biotech company founded in 1996 that specializes in acquiring pharmaceutical royalties and developing innovative financing solutions for the life sciences industry.

Royalty Pharma plc (NASDAQ:RPRX) has a unique business model that is focused on generating royalties rather than drug development. On September 5, Royalty Pharma plc (NASDAQ:RPRX) entered into a $150 million royalty funding agreement with Ascendis Pharma A/S (NASDAQ:ASND) for a human growth hormone that is used for the treatment of growth hormone deficiency.

Of the 910 hedge funds in Insider Monkey’s database, 32 funds reported holding a stake in Royalty Pharma plc (NASDAQ:RPRX) as of Q2 2023.

8. Cytokinetics, Incorporated (NASDAQ:CYTK)

Average Target Price: $60.72

Potential Upside: 72.7%

Number of Hedge Fund Holders: 34

Value of Hedge Fund Holdings: $453,291,900

Cytokinetics, Incorporated (NASDAQ:CYTK) is a San Francisco, California-based biotech company founded in 1997. The company is focused on the development and discovery of muscle activators and muscle inhibitors as potential treatments for debilitating diseases.

On August 15, SVB Securities initiated coverage on Cytokinetics, Incorporated (NASDAQ:CYTK) stock with an Outperform rating and a target price of $58. The analyst highlighted that Cytokinetics, Incorporated (NASDAQ:CYTK) is in the process of developing several therapies that are intended to meet the demand for hypertrophic cardiomyopathy and heart failure. The disease is growing rapidly in the US and is placing a heavy burden on the healthcare sector.

7. Madrigal Pharmaceuticals, Inc. (NASDAQ:MDGL)

Average Target Price: $331.19

Potential Upside: 79.5%

Number of Hedge Fund Holders: 33

Value of Hedge Fund Holdings: $1,230,347,600

Madrigal Pharmaceuticals, Inc. (NASDAQ:MDGL) is a West Conshohocken, Pennsylvania-based company that came into being in 2011.

The biotech company is in the clinical stage of developing drugs to combat non-alcoholic steatohepatitis (NASH). Resmetirom is one of the leading drugs in the company’s portfolio that has been given the Breakthrough Therapy designation by the FDA to treat NASH. In a filing with the SEC, John Paulson’s hedge fund, Paulson & Co., disclosed that it initiated a new position in Madrigal Pharmaceuticals, Inc. (NASDAQ:MDGL) during Q2 2023. Amongst the new positions taken by the hedge fund, the biggest position was taken in Madrigal Pharmaceuticals, Inc. (NASDAQ:MDGL).

6. Harmony Biosciences Holdings, Inc. (NASDAQ:HRMY)

Average Target Price: $69.19

Potential Upside: 96.5%

Number of Hedge Fund Holders: 29

Value of Hedge Fund Holdings: $316,844,940

Harmony Biosciences Holdings, Inc. (NASDAQ:HRMY) is a Plymouth Meeting, Pennsylvania-based biotech company that went public in August 2020. The entity is focused on developing and commercializing therapeutics to combat rare neurological disorders.

Harmony Biosciences Holdings, Inc.’s (NASDAQ:HRMY) lead product is Wakix (pitolisant), approved by the FDA in 2019 for treating excessive daytime sleepiness in adults with narcolepsy. Harmony Biosciences Holdings, Inc. (NASDAQ:HRMY) is also developing pitolisant for other potential indications, including Prader-Willi syndrome and pediatric narcolepsy. The FDA granted orphan drug designation to pitolisant on September 5.

In addition to Harmony Biosciences Holdings, Inc. (NASDAQ:HRMY), Intellia Therapeutics, Inc. (NASDAQ:NTLA), Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR), and Denali Therapeutics Inc. (NASDAQ:DNLI) are also amongst the 10 biotech stocks with biggest upside.

Click to continue reading and see 5 Biotech Stocks with Biggest Upside. Suggested Articles:

Disclosure: None. 10 Biotech Stocks with Biggest Upside is originally published on Insider Monkey.