10% Owner Capital Cannell Sells 6,425 Shares of Sportsman's Warehouse Holdings Inc

On September 11, 2023, Capital Cannell, a 10% owner of Sportsman's Warehouse Holdings Inc (NASDAQ:SPWH), sold 6,425 shares of the company. This move is significant as it provides insight into the insider's perspective on the company's current valuation and future prospects.

Capital Cannell is a significant stakeholder in Sportsman's Warehouse Holdings Inc, a prominent outdoor sporting goods retailer. The company provides a one-stop shopping experience for outdoor enthusiasts, with a comprehensive selection of high-quality hunting, fishing, camping equipment, and outdoor apparel.

Over the past year, Capital Cannell has sold a total of 6,425 shares and has not made any purchases. This trend suggests that the insider may perceive the company's current stock price as overvalued or anticipate a potential downturn.

The insider transaction history for Sportsman's Warehouse Holdings Inc shows a total of 1 insider buy and 2 insider sells over the past year. This trend could indicate a cautious sentiment among insiders about the company's current valuation.

On the day of the insider's recent sell, shares of Sportsman's Warehouse Holdings Inc were trading at $3.32, giving the company a market cap of $137.393 million. The price-earnings ratio stands at 33.41, significantly higher than the industry median of 16.72 and the companys historical median price-earnings ratio. This high P/E ratio could be a contributing factor to the insider's decision to sell.

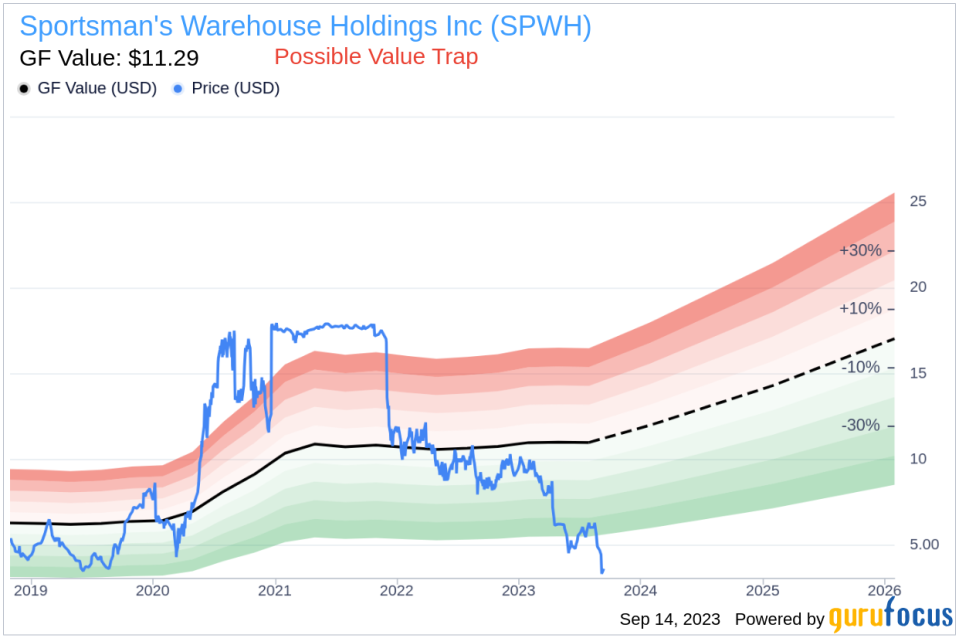

The GuruFocus Value of Sportsman's Warehouse Holdings Inc is $11.29, resulting in a price-to-GF-Value ratio of 0.29. This suggests that the stock is a possible value trap, and investors should think twice before investing. The GF Value is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

In conclusion, the recent sell by Capital Cannell could be a signal of the insider's cautious sentiment towards the company's current valuation. Investors should carefully consider these insider trends and the company's valuation metrics when making investment decisions.

This article first appeared on GuruFocus.