10% Owner Carl Icahn Buys 127,731 Shares of Southwest Gas Holdings Inc

On September 12, 2023, Carl Icahn, a 10% owner of Southwest Gas Holdings Inc (NYSE:SWX), purchased 127,731 shares of the company. This move is significant as it indicates the insider's confidence in the company's future prospects.

Carl Icahn (Trades, Portfolio) is a renowned American businessman and investor. He is the founder and controlling shareholder of Icahn Enterprises, a diversified conglomerate holding company based in New York City. He is also a major shareholder in Southwest Gas Holdings Inc, holding a 10% stake in the company.

Southwest Gas Holdings Inc is a leading energy company based in the United States. The company provides natural gas service to over two million customers in Arizona, Nevada, and California. Its primary subsidiaries are Southwest Gas Corporation and Centuri Group, Inc. The former is involved in the purchasing, distributing, and transporting of natural gas, while the latter is a comprehensive utility infrastructure services enterprise.

Over the past year, Carl Icahn (Trades, Portfolio) has purchased a total of 4,360,782 shares and has not sold any shares. This indicates a strong belief in the company's potential and a long-term investment strategy.

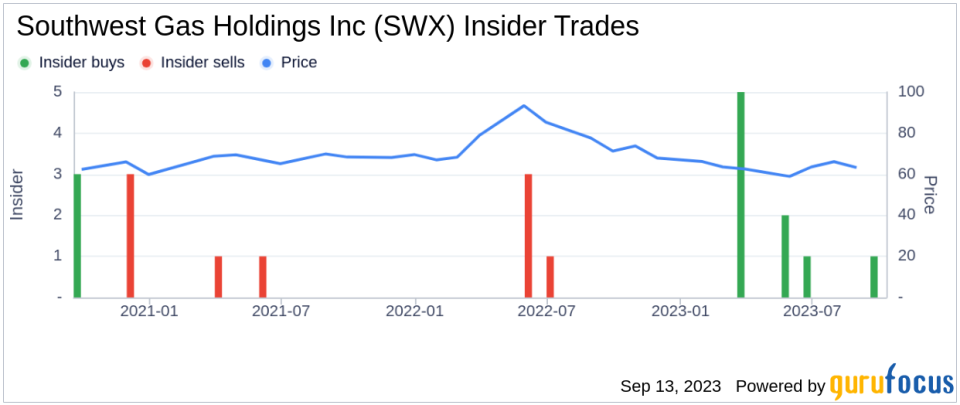

The insider transaction history for Southwest Gas Holdings Inc shows a total of 9 insider buys over the past year, with no insider sells recorded over the same timeframe. This trend suggests that insiders at the company are bullish about its future prospects.

On the day of the insider's recent buy, shares of Southwest Gas Holdings Inc were trading for $61.45 apiece, giving the stock a market cap of $4.51 billion.

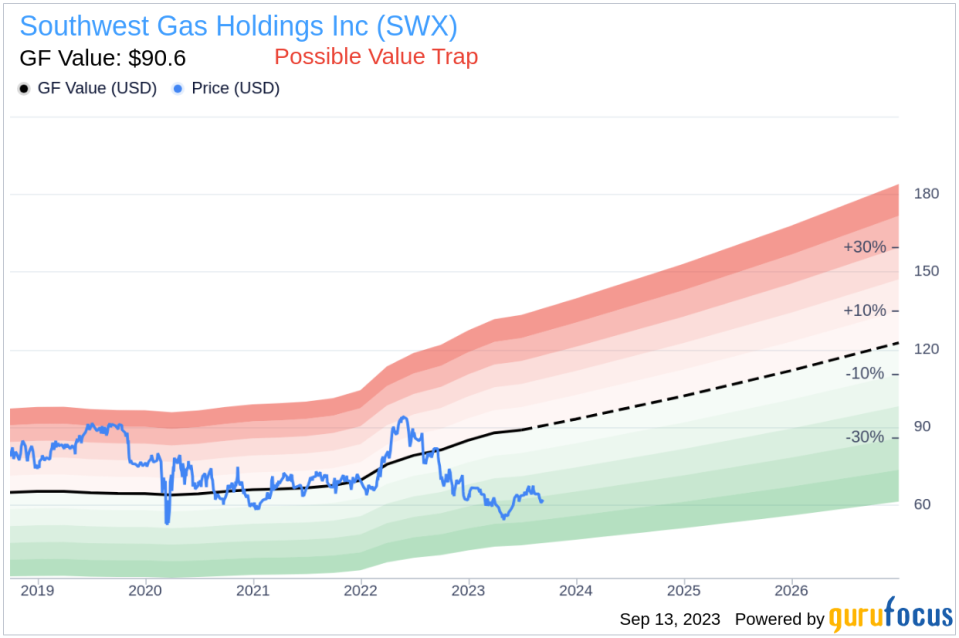

With a price of $61.45 and a GuruFocus Value of $90.60, Southwest Gas Holdings Inc has a price-to-GF-Value ratio of 0.68. This suggests that the stock is a possible value trap, and investors should think twice before investing. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

In conclusion, the insider's recent purchase of Southwest Gas Holdings Inc shares, coupled with the company's strong insider buying trend, suggests a positive outlook for the company. However, the stock's current valuation indicates that it may be a value trap, and investors should exercise caution.

This article first appeared on GuruFocus.