10% Owner Mark Cuban Sells 2,969 Shares of Reading International Inc (RDI)

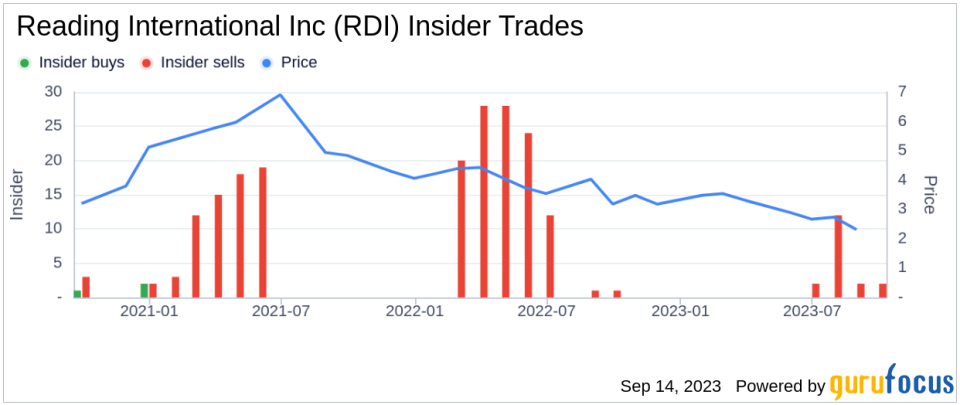

On September 12, 2023, Mark Cuban, a 10% owner of Reading International Inc (NASDAQ:RDI), sold 2,969 shares of the company. This move is part of a larger trend for the insider, who over the past year has sold a total of 35,531 shares and made no purchases.

Mark Cuban is a well-known entrepreneur and investor, best known for his role as a "shark" on the television show "Shark Tank." His involvement with Reading International Inc, a leading entertainment and real estate company, has been significant. Reading International operates cinemas and develops, owns, and operates multiplex cinemas and retail and commercial real estate in the United States, Australia, and New Zealand.

The insider's recent sell-off is part of a broader trend within Reading International Inc. Over the past year, there have been 18 insider sells and no insider buys. This could potentially signal a lack of confidence in the company's future prospects from those with the most intimate knowledge of its operations.

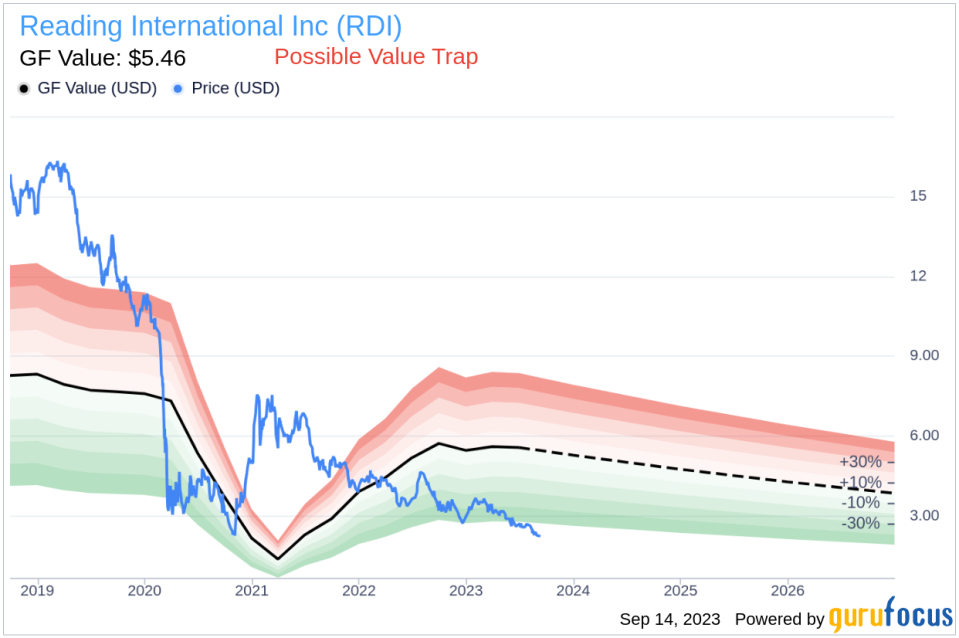

On the day of the insider's recent sell, shares of Reading International Inc were trading for $20.21 each, giving the company a market cap of $78.298 million. However, the company's GuruFocus Value is significantly lower at $5.46, resulting in a price-to-GF-Value ratio of 3.7. This suggests that the stock may be overvalued and could be a potential value trap for investors.

The GF Value is a proprietary measure developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts. In the case of Reading International Inc, the high price-to-GF-Value ratio suggests that the stock's current price may not be justified by its intrinsic value.

In conclusion, the insider's recent sell-off, combined with the lack of insider buys over the past year and the stock's high price-to-GF-Value ratio, could be cause for concern for potential investors. As always, it's crucial to conduct thorough research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.