10% Owner Polaris Venture Management Co. VI, L.L.C. Sells 500,000 Shares of Alector Inc

On September 11, 2023, Polaris Venture Management Co. VI, L.L.C., a 10% owner of Alector Inc (NASDAQ:ALEC), sold 500,000 shares of the company. This move is part of a trend observed over the past year, where the insider has sold a total of 500,000 shares and purchased none.

Polaris Venture Management Co. VI, L.L.C. is a venture capital firm specializing in early-stage investments. As a 10% owner of Alector Inc, the firm has a significant stake in the company and its trading activities are closely watched by investors and market analysts.

Alector Inc is a clinical-stage biopharmaceutical company that focuses on harnessing the body's immune system to cure neurodegenerative diseases and cancer. The company's product candidates are designed to trigger immune responses against pathogenic proteins associated with diseases.

The insider's recent sell-off is part of a broader trend within Alector Inc. Over the past year, there have been 15 insider sells and no insider buys. This could be a signal to investors about the company's future prospects.

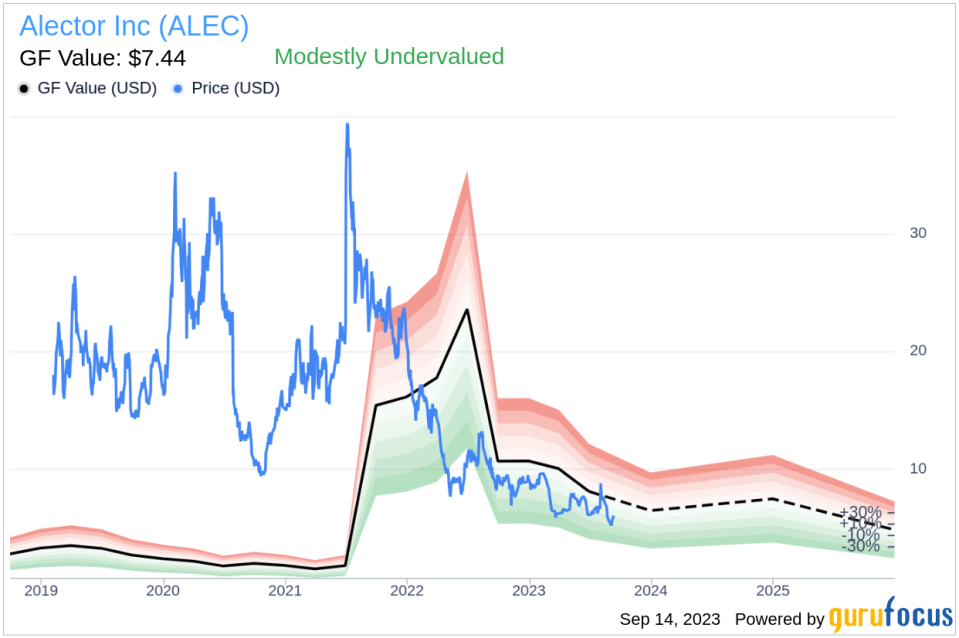

The stock price of Alector Inc was trading at $6 per share on the day of the insider's recent sell. This gives the company a market cap of $513.041 million. Despite the insider's sell-off, the stock appears to be modestly undervalued based on its GuruFocus Value of $7.44, with a price-to-GF-Value ratio of 0.81.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's sell-off and the stock's modest undervaluation could be a signal to investors to keep a close eye on Alector Inc. While the insider's trading activities do not necessarily reflect the company's future performance, they are an important factor to consider in investment decisions.

As always, investors are advised to do their own due diligence and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.