10x Genomics Inc (TXG) Reports Solid Revenue Growth Amid Rising Operating Expenses in FY 2023

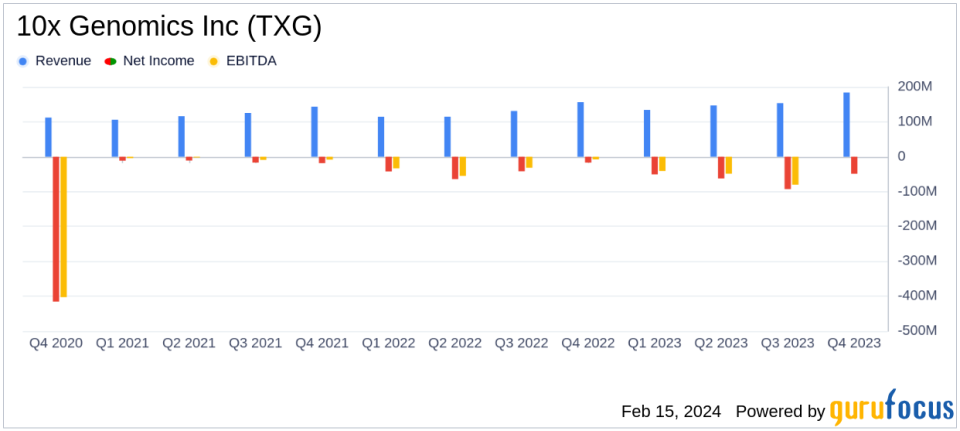

Revenue Growth: 10x Genomics Inc (NASDAQ:TXG) achieved an 18% increase in Q4 2023 and a 20% increase for the full year over the previous periods in 2022.

Gross Margin Decline: Gross margin decreased to 63% in Q4 and 66% for the full year, attributed to a higher mix of Spatial instruments sold.

Operating Expenses and Losses: Operating expenses rose by 20% in Q4 and the full year, leading to higher operating losses compared to 2022.

Net Loss: The company reported a net loss of $49.0 million in Q4 and $255.1 million for the full year, including significant in-process R&D expenses.

2024 Revenue Outlook: TXG anticipates revenue between $670 million to $690 million, signaling 8% to 12% growth over 2023.

On February 15, 2024, 10x Genomics Inc (NASDAQ:TXG), a prominent player in single cell and spatial biology, disclosed its financial outcomes for the fourth quarter and the full year of 2023 through an 8-K filing. The company, known for its comprehensive solutions including instruments, consumables, and software for analyzing biological systems, reported significant revenue growth. However, this growth was offset by increased operating expenses and a notable decline in gross margin.

Financial Performance Overview

10x Genomics Inc (NASDAQ:TXG) saw its revenue rise to $184.0 million in Q4 2023, an 18% increase from the same period in 2022. The full year revenue also climbed by 20%, reaching $618.7 million. This growth was primarily driven by a higher volume of Spatial instruments and consumables sold. Despite the revenue uptick, the company's gross margin suffered, dropping from 76% in the previous year to 63% in Q4 2023, and from 77% to 66% for the full year. The decline in gross margin was mainly due to a change in product mix, with a higher proportion of Spatial instruments sold.

Operating expenses presented a challenge, escalating by 20% to $171.0 million in Q4 and $674.6 million for the full year. This increase was largely due to a $19.6 million in-process research and development expense related to an asset acquisition agreement and impairment charges related to long-lived assets. Consequently, the operating loss widened to $55.2 million in Q4 and $265.3 million for the full year.

Net Loss and Future Outlook

The net loss for 10x Genomics Inc (NASDAQ:TXG) also expanded, totaling $49.0 million for Q4 and $255.1 million for the full year, which included the aforementioned in-process research and development expenses. Looking ahead to 2024, the company expects revenue to be in the range of $670 million to $690 million, indicating a growth of 8% to 12% over 2023.

"Our innovation engine has consistently delivered transformational technologies that have enabled our customers to expand the frontiers of science," said Serge Saxonov, Co-founder and CEO of 10x Genomics. "We're building on last year's extraordinary launch of Xenium with new, franchise-defining products in each of our three platforms that will take our portfolio to the next level. Our priority is to ensure our customers' success with these new products as we work together to deliver on the full promise and potential of single cell and spatial biology to advance human health."

10x Genomics Inc (NASDAQ:TXG) remains committed to innovation and customer success, as evidenced by the launch of new products and technologies. However, the company's financial health is under pressure due to rising operating expenses and a widening net loss. Investors and stakeholders will be closely monitoring the company's ability to manage costs and improve profitability while continuing to drive revenue growth in the competitive healthcare providers and services industry.

For detailed financial tables and further information, readers are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from 10x Genomics Inc for further details.

This article first appeared on GuruFocus.