Is 13%-Yielding Annaly Capital the Best Dividend Stock for You?

Dividend investors love high yields. I know -- I'm a dividend investor, and I can't help but look at a stock with a double-digit yield. That's not a bad thing, but it is a tendency that requires me to take a very critical approach when it comes to actually buying stocks. Simply put, I have to remind myself that a high yield is often a sign of big risks.

Annaly Capital (NYSE: NLY) is a great example. Here's what you need to know before you buy this 13%-yielding real estate investment trust (REIT).

Annaly is a complex company

I generally love REITs. Most dividend-focused investors should probably own a few, given that they are specifically designed to pass income on to shareholders. But not all REITs are created equal, just like all companies aren't created equal.

The majority of REITs are simple landlords, owning institutional-level properties that get rented out to tenants. This way small investors can gain access to properties that they could never buy on their own. However, some REITs own less desirable properties than others, and some REITs use too much debt. So you have to be discerning, and if you are a long-term dividend investor like me, you have to focus on best-of-breed businesses. If you buy opportunistically (basically when they appear historically cheap), you can add a healthy dose of highly reliable income to your dividend portfolio.

So where does Annaly fall in this equation? Well, Annaly is a mortgage REIT. It buys mortgage securities that have been grouped together into bond-like investments. This is an institutional-level real estate investment, but it isn't the same as buying a physical property. The mortgage market is far more complex.

For example, interest rate moves have a dramatic impact on mortgage securities. These securities rise and fall, so the yield provided adjusts to the current yield environment, which can dramatically impact the value of a mortgage REIT's portfolio. Second, interest rate moves can speed up or slow down mortgage repayments, which impacts the income provided from the bond-like securities mortgage REITs own. And third, rate moves have a profound impact on the property market, which can lead to fewer mortgages available to package into the bond-like securities that Annaly and its peers buy. This is not an easy industry to understand, let alone track. As if to make things even more complicated, mortgage REITs usually use leverage, with their portfolios acting as collateral, to try to enhance returns.

I got burned by mortgage REITs during the Great Recession and I avoid them now. (I can admit at this point that I simply didn't know enough about what I was buying last time around -- a mistake I try to avoid at all costs today.) It's just too much work to invest in the space, and I have other things I would prefer to do with my time.

However, that 13% yield might still be enticing to you.

Annaly is not a reliable dividend stock

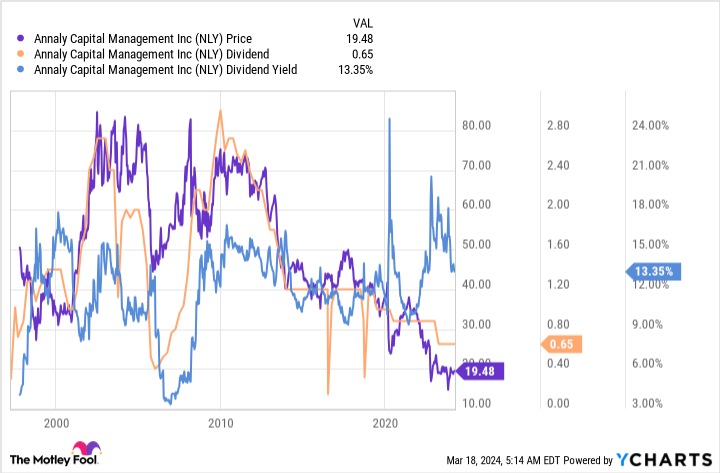

I've looked at Annaly. But what I saw was enough to make me say no to the stock. It doesn't actually take much explanation to see why, just a simple graph.

Okay, that graph isn't actually simple, so let's break it down. The orange line is the big one, that's the dividend. Look how volatile it is, and note that for most of the last decade it has headed steadily lower. This is not what most dividend investors want to own.

The next most interesting line is probably the blue one, which is the dividend yield. Notice that over most of the graph the yield is very high, often in the double digits. Given the dividend dynamics, this is made possible because the stock price, the purple line, tends to rise and fall along with the dividend payment. Over the past decade that has meant a fairly steady decline in the stock price.

To put it another way, if you bought Annaly you would have ended up with less capital and less income. This trend could change, but if history is any guide here you simply can't rely on Annaly as a dividend stock. There's too big a risk that you will get burned.

Annaly isn't meant for most investors

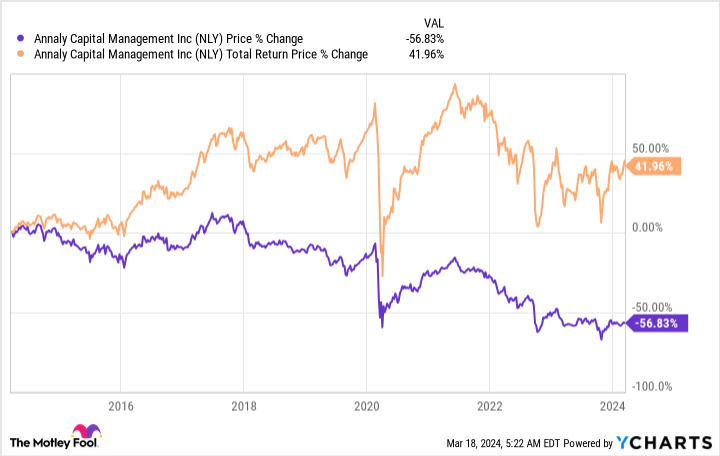

The real story here is that Annaly is actually not meant for small investors. It exists so institutional-level investors can get access to mortgages as they look to fill in the boxes of an asset allocation model. As the chart above shows, reinvesting the dividends over the past decade actually resulted in positive total returns, even though the stock-only return was pretty dismal.

If you are willing to spend the time and energy to dig deep into the mortgage sector, by all means consider buying Annaly for your portfolio. Just go in knowing that it isn't a great income investment if you are trying to live off of the dividends your portfolio generates. For most investors, that will probably lead you to follow my lead and simply avoid Annaly and its brethren.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is 13%-Yielding Annaly Capital the Best Dividend Stock for You? was originally published by The Motley Fool