15 Most Dangerous States for Natural Disasters

In this article, we will be taking a look at the 15 most dangerous states for natural disasters. To skip our detailed analysis, you can go directly to see the 5 most dangerous states for natural disasters.

The first instance of insurance was recorded thousands of years ago, and the instance was also related to natural disasters. While climate change warnings have been called out for decades, its impact is only being felt right now, not just in the U.S. but across the world. This pans out when considering the total number of disasters by year, with 2020 being the worst such year as per the Federal Emergency Management Agency, though of course, a huge number of the disasters in the year were because of Covid-19, as FEMA includes biological disasters too. While most countries have agreed to reduce carbon emissions in a bid to slow down and ultimately reverse climate change, few nations are actually meeting their goals.

While there are still nearly a month left in 2023, the year has already set a U.S. record for billion-dollar weather and climate disasters, driven by the most dangerous states for natural disaster. In the year alone, there have been more than 23 natural disasters which have cost more than $1 billion in damage, breaking the record set earlier in 2020. Overall, nearly $60 billion worth of damage has been caused and resulted in the deaths of more than 250 people, again concentrated in the states with the most natural disasters.

Pixabay/ Public Domain

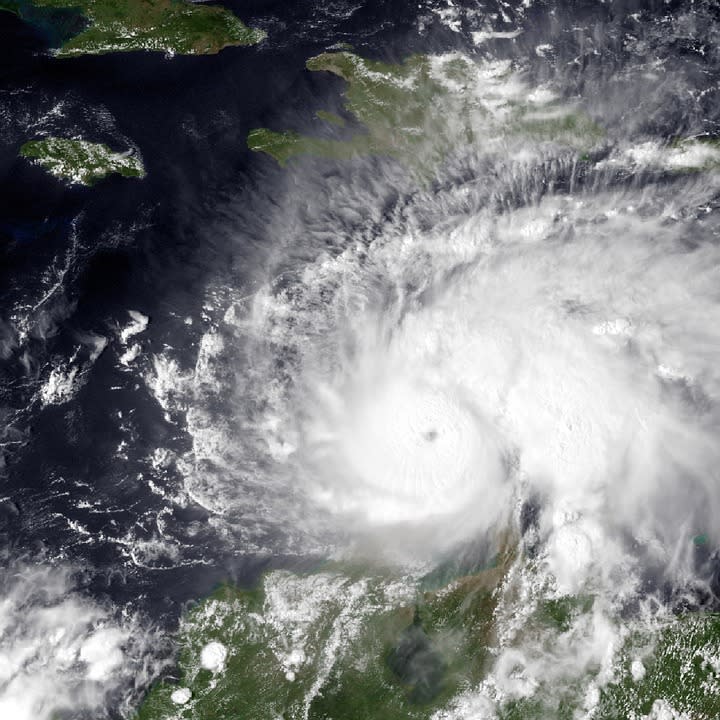

While natural disasters are impacting America's economy due to the massive damage caused, they're also having a major impact on insurance companies, especially those dealing with natural disasters. Most insurance policies by default exclude natural disasters coverage and generally, there is specific insurance to protect companies and even homeowners from the damage caused and an increase in the rate of natural disasters is resulting in an overhaul in the industry. However, while policies related to natural disaster insurance are evolving to cater to this change, it isn't straightforward. After all, a single major natural disaster could result in natural disaster insurance companies becoming bankrupt. This is especially true for major disasters such as hurricanes, whose frequency has increased as well. Of the total damage caused by hurricanes in the last hundred years, around 75% has occurred in just the last 20 years.

Another rising risk in the most dangerous states for natural disasters is the risk of floods, as erratic weather patterns have resulted in more torrential downpours which in turn have increased insurance risks. Allianz, one of the largest financial services companies in the world, called out the need for a smarter collaboration to mitigate rising flood risks. It mentioned that between 1980 and 2019, flood damage crossed $1,092 billion and only 12% of this amount had been insured, and in 2021 alone, over 50 severe flood events occurred across the world. Floods alone contributed to nearly a third of all damage caused by natural disasters globally in 2021, and even then, around 75% of flood risks remain uninsured. “Climate change is changing the way we need to look at physical risk for our customers,” says Holger Tewes-Kampelmann, CEO of Allianz SE Reinsurance. “Our job in the insurance industry is to make sure that we have a thorough and diligent risk assessment in place that goes hand in hand with mitigation actions to keep our business model sustainable.”

To protect themselves against the risk of being bankrupted by major natural disasters, insurance companies themselves also get insured, with reinsurance companies. Both insurance and reinsurance companies have already been impacted by rising interest rates by central banks to combat inflationary increase, and research from the Treasury Department has shown that inflation also negatively impacts insurers, though higher interest rates allow for greater returns for insurance companies as most insurance companies invest in bonds. One of the largest reinsurance companies in the world, Arch Capital Group Ltd. (NASDAQ:ACGL) announced catastrophe losses derived mainly from Hurricane Ian in Q3 2022, which orimarily impacted Florida, one of the most dangerous states for natural disasters. Arch Capital Group Ltd. (NASDAQ:ACGL) announced that estimates for pre-tax net catastrophe losses ranged from $530 million to $560 million. Arch Capital Group Ltd. (NASDAQ:ACGL) also called this out in its Q3 2023 earnings call when comparing a favorable performance in 2023 to 2022, where it stated "Similar to the quarterly results, our reinsurance segment grew net written premium by 45% over the same quarter last year, led by the property other than catastrophe line which was 73% higher than the same quarter one year ago. As for our property catastrophe business, it's worth mentioning that the net written premium in the third quarter one year ago included approximately $34 million of reinstatement premiums, mostly as a result of Hurricane Ian". A superior performance in 2023 has seen the share price of Arch Capital Group Ltd. (NASDAQ:ACGL) increase by a stunning 36.7% YTD 2023.

Madison Mid Cap Fund made the following comment about Arch Capital Group Ltd. (NASDAQ:ACGL) in its Q3 2023 investor letter:

“In the third quarter, the top five contributors were Arch Capital Group Ltd. (NASDAQ:ACGL), Arista Networks, Liberty Broadband, CDW, and Progressive. Arch Capital is a multi-line insurance company with operations across property and casualty, reinsurance, and mortgage insurance. Their culture of prudent risk management has enabled them to benefit from attractive market conditions in the P&C and reinsurance markets, where pricing has firmed up considerably over the last couple of years. We believe the attractive market conditions will continue for a couple more years, and Arch is very well positioned to benefit from these dynamics.”

Similarly, another major reinsurance company, RenaissanceRe Holdings Ltd. (NYSE:RNR) was impacted by natural disasters in 2023. In its Q3 2023 earnings call, the Senior Vice President of Finance and Investor Relations for RenaissanceRe Holdings Ltd. (NYSE:RNR) said "Catastrophes this quarter were a mix of large events and secondary perils. Beginning with Hurricane Idalia, which made landfall on the Florida Peninsula in August 29th as a strong Category 3 hurricane. This storm impacted a sparsely populated area of the state, which should limit industry loss to low-single digits billions of dollars. Additionally, the Hawaiian town of Lahaina was impacted by severe wildfires in August. Industry loss estimates around mid-single digits billions still persist. And finally, there were a handful of other events in the third quarter. These included ongoing severe convective storm in the United States, flood in Hong Kong, and a tornado that hit a Pfizer plant in North Carolina. Over the course of 2023, natural catastrophe activity has persisted."

TimesSquare Capital U.S. Mid Cap Growth Strategy made the following comment about RenaissanceRe Holdings Ltd. (NYSE:RNR) in its Q2 2023 investor letter:

“There were also challenges from the Financials sector. That included the -7% showing from the reinsurance provider RenaissanceRe Holdings Ltd. (NYSE:RNR). At the start of the quarter, RenRe’s shares climbed sharply ahead of its earnings report. The company announced operating income that surpassed expectations with notable improvements in book value, fee income, and underwriting activities. However, levels of premiums written beyond its property catastrophe segment were lower than expected—though that was caused by RenRe’s avoidance of unappealing policies. The market’s reaction seemed to embody a “good as it gets” outlook for RenRe, which we believe ignores the company’s financial strength and market opportunity.”

Because of the geographical area encompassed by the U.S., some states are more susceptible to natural disasters as opposed to others, and the safest states from natural disasters in 2023 are Nebraska, New Jersey, Rhode Island, Wyoming and Kansas, who each faced 1 disaster in 2023. While Kansas is more susceptible to tornadoes than most states and is among the most dangerous states for natural disasters, 2023 has been a good year for it, and only one major fire incident was declared in the state in 2023. All of this data is excluding biological disasters as most such incidents relate to Covid-19. Meanwhile, there are some states which have no tornadoes and hurricanes, with Alaska and Rhode Island both averaging zero tornadoes in the last quarter of a century. Meanwhile, Michigan is among the states with the lowest probability of hurricanes.

Methodology

To determine the most dangerous states for natural disasters, we headed over to the FEMA website which has categorization of every natural disaster by state. We then excluded some disasters including biological, terrorist and chemical disasters and determined total disasters faced by each state, from 2000 to 2023. This includes various disasters such as hurricanes, floods, ice storms, fire and floods.

15. Iowa

Total number of natural disasters from 2000 to 2023: 960

Tornadoes and snowstorms are some of the most common natural disasters faced by Iowa, and spring flooding in 2023 resulted in several counties in one of the most dangerous states for natural disasters being made eligible for federal disaster assistance.

14. New York

Total number of natural disasters from 2000 to 2023: 971

New York is increasingly vulnerable to natural disasters, and is slowly sinking, with the state on track for record rainfall and flooding.

13. Alabama

Total number of natural disasters from 2000 to 2023: 985

Alabama has faced a serious drought in 2023, as more and more counties in the state are being declared as natural disaster areas by the U.S. Department of Agriculture.

12. Arkansas

Total number of natural disasters from 2000 to 2023: 987

In the past two decades, natural disasters have increased by 186% in Arkansas. In April 2023, tornadoes in Arkansas destroyed over 100 homes in the state.

11. Mississippi

Total number of natural disasters from 2000 to 2023: 1,171

Mississippi is one of the most impacted states from natural disasters, as the financial cost has been particularly high in the state.

10. Kansas

Total number of natural disasters from 2000 to 2023: 1,215

While Kansas has been able to avoid major disasters in 2023, it is still among the most dangerous states for natural disasters. An extreme fire danger declaration in March 2023 was the only major disaster that Kansas has faced in 2023, according to FEMA.

9. North Carolina

Total number of natural disasters from 2000 to 2023: 1,228

Between 1851 and 2020, North Carolina faced 58 hurricanes, fourth highest among any states in the U.S.

8. Virginia

Total number of natural disasters from 2000 to 2023: 1,238

In the last two decades, Virginia saw the rate of natural disasters increase by 140% and major recent floods including Whitewood and Hurley floods have resulted in the state considering relief funds.

7. Georgia

Total number of natural disasters from 2000 to 2023: 1,321

Northwest Georgia countries have been designated as primary natural disaster areas, and recently, a major drought has impacted one of the most dangerous states for natural disasters.

6. Florida

Total number of natural disasters from 2000 to 2023: 1,635

Florida's geographical location has resulted in the state facing a higher risk of tornadoes, floods and hurricanes, and in 2023, Florida faced the most natural disasters in the U.S.

Click to continue reading the 5 Most Dangerous States for Natural Disasters.

Suggested articles:

Disclosure: None. 15 most dangerous states for natural disasters is originally published at Insider Monkey.