1st Source Corporation Just Missed Revenue By 5.3%: Here's What Analysts Think Will Happen Next

1st Source Corporation (NASDAQ:SRCE) shares fell 3.1% to US$49.57 in the week since its latest yearly results. Revenues came in 5.3% below expectations, at US$309m. Statutory earnings per share were relatively better off, with a per-share profit of US$3.57 being roughly in line with analyst estimates. This is an important time for investors, as they can track a company's performance in its report, look at what top analysts are forecasting for next year, and see if there has been any change to expectations for the business. With this in mind, we've gathered the latest statutory forecasts to see what analysts are expecting for next year.

View our latest analysis for 1st Source

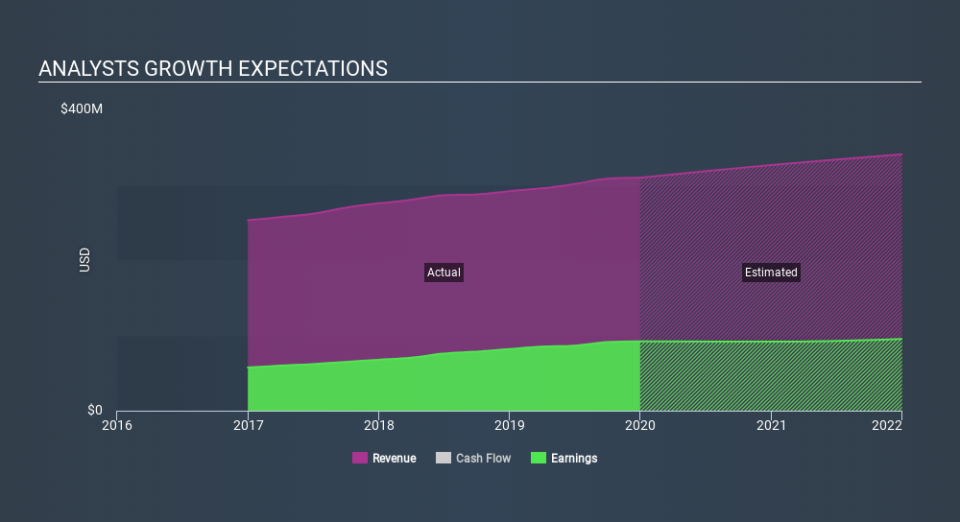

Following the latest results, 1st Source's three analysts are now forecasting revenues of US$326.2m in 2020. This would be an okay 5.5% improvement in sales compared to the last 12 months. Statutory per share are forecast to be US$3.58, approximately in line with the last 12 months. Yet prior to the latest earnings, analysts had been forecasting revenues of US$332.7m and earnings per share (EPS) of US$3.59 in 2020. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

There were no changes to revenue or earnings estimates or the price target of US$52.00, suggesting that the company has met expectations in its recent result. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic 1st Source analyst has a price target of US$56.00 per share, while the most pessimistic values it at US$50.00. Still, with such a tight range of estimates, it suggests analysts have a pretty good idea of what they think the company is worth.

Another way to assess these estimates is by comparing them to past performance, and seeing whether analysts are more or less bullish relative to other companies in the market. Next year brings more of the same, according to analysts, with revenue forecast to grow 5.5%, in line with its 5.7% annual growth over the past five years. Compare this with the wider market, which analyst estimates (in aggregate) suggest will see revenues grow 4.9% next year. So although 1st Source is expected to maintain its revenue growth rate, it's only growing at about the rate of the wider market.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with analysts reconfirming that earnings per share are expected to continue performing in line with their prior expectations. Happily, there were no real changes to sales forecasts, with the business still expected to grow in line with the overall market. The consensus price target held steady at US$52.00, with the latest estimates not enough to have an impact on analysts' estimated valuations.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple 1st Source analysts - going out to 2021, and you can see them free on our platform here.

You can also see whether 1st Source is carrying too much debt, and whether its balance sheet is healthy, for free on our platform here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.