1stdibs.com Inc (DIBS) Reports Decline in Revenue and Narrowing Net Loss for Q4 and Full Year 2023

Net Revenue: Q4 net revenue decreased by 9% year-over-year to $20.9 million.

Gross Profit: Gross profit for Q4 fell by 8% year-over-year to $15.0 million.

Gross Margin: Improved to 71.5% in Q4 from 70.5% in the same period last year.

Net Loss: Q4 GAAP net loss narrowed to $2.9 million from $6.9 million year-over-year.

Adjusted EBITDA: Improved to $(1.7) million in Q4, with a margin of (8.1)%.

Liquidity: Cash, cash equivalents, and short-term investments totaled $139.3 million as of December 31, 2023.

On February 28, 2024, 1stdibs.com Inc (NASDAQ:DIBS), a premier online marketplace for luxury design products, released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its curated selection of vintage, antique, and contemporary furniture, home decor, and more, faced a challenging year with a decrease in net revenue and gross profit, yet showed signs of improved operational efficiency and cost management.

Financial Performance Overview

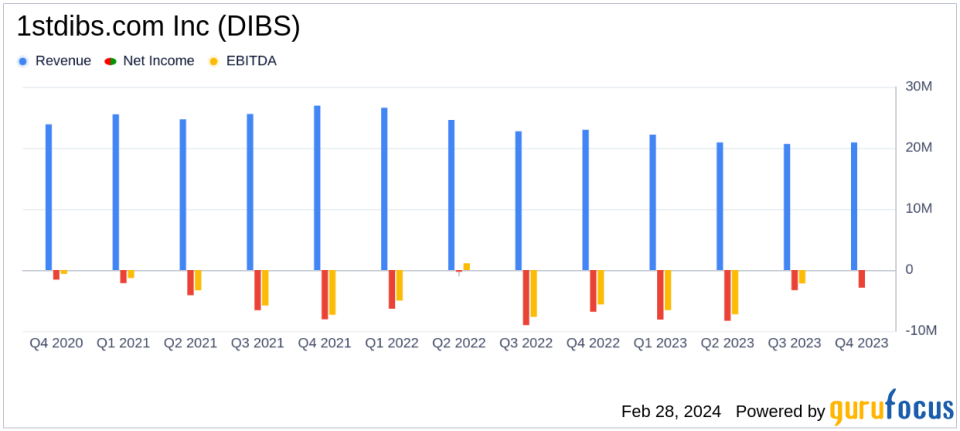

For the fourth quarter of 2023, 1stdibs.com Inc (NASDAQ:DIBS) reported a 9% decrease in net revenue year-over-year, amounting to $20.9 million. Gross profit also saw a decline of 8% to $15.0 million. However, the company's gross margin improved slightly to 71.5%, up from 70.5% in the fourth quarter of the previous year. The GAAP net loss for the quarter was $2.9 million, which is an improvement from the net loss of $6.9 million reported in the same period last year. The non-GAAP Adjusted EBITDA was $(1.7) million with an Adjusted EBITDA Margin of (8.1)%, showing a significant improvement from $(4.5) million and (19.5)% respectively, in the fourth quarter of 2022.

For the full year 2023, 1stdibs.com Inc (NASDAQ:DIBS) experienced a 13% decrease in net revenue, totaling $84.7 million. Gross profit for the year was down by 11% to $59.6 million, while gross margin increased to 70.3% from 69.4% in the previous year. The GAAP net loss for the year was relatively flat at $22.7 million compared to $22.5 million in the year ended December 31, 2022. The non-GAAP Adjusted EBITDA for the year was $(13.3) million with an Adjusted EBITDA Margin of (15.8)%, an improvement from $(20.7) million and (21.3)% in the previous year.

Operational Highlights and Challenges

1stdibs.com Inc (NASDAQ:DIBS) CEO David Rosenblatt commented on the company's efforts throughout the year, stating,

Throughout 2023, we laid the groundwork for future success. Over the past year we have reduced our cost structure, accelerated the path to profitability, focused our roadmap on the highest-ROI projects and begun returning capital to shareholders. Our efforts are producing tangible results, including a return to conversion growth."

CFO Tom Etergino also highlighted the company's progress, noting,

The benefits of the actions we have taken to streamline our business and re-engineer our cost structure over the past two years are on display this quarter, with operating expenses down 19% and adjusted EBITDA margins improved meaningfully. We have made significant strides toward bettering our financial health, positioning ourselves for sustainable growth and driving operating leverage going forward."

Despite these positive developments, the company faced headwinds with a 17% year-over-year decrease in Gross Merchandise Value (GMV) to $86.4 million, an 11% decrease in the number of orders to approximately 34K, and a 10% decrease in active buyers to approximately 61K. These declines reflect the challenges in the retail-cyclical sector, where consumer demand can be highly sensitive to broader economic trends.

Looking Ahead

1stdibs.com Inc (NASDAQ:DIBS) provided guidance for the first quarter of 2024, projecting GMV between $83 million and $90 million, net revenue between $20.6 million and $21.9 million, and an Adjusted EBITDA margin (non-GAAP) of (13%) to (8%). These projections are indicative of the company's cautious optimism about its ability to navigate the uncertain market conditions while continuing to focus on efficiency and growth.

The company's balance sheet remains strong with a total of $139.3 million in cash, cash equivalents, and short-term investments, providing a solid foundation for future investments and operational flexibility. As 1stdibs.com Inc (NASDAQ:DIBS) continues to adapt to the evolving market landscape, investors and stakeholders will be closely monitoring its ability to leverage its unique marketplace and drive sustainable growth.

For more detailed information on 1stdibs.com Inc (NASDAQ:DIBS)'s financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from 1stdibs.com Inc for further details.

This article first appeared on GuruFocus.