How $2.2 Billion Barbenheimer Movie Haul Relates To Mortgage Biz

This post originally appeared on The Basis Point: How $2.2 Billion Barbenheimer Movie Haul Relates To Mortgage Biz

Happy Fall everyone, and here’s a Summer 2023 lesson we should all take with us. It’s about how movie and mortgage industries are being upended by market and tech disruption, but true long-gamers are showing how Disruption is just a script that needs rewriting. At a time when AI and streaming are supposed to eat Hollywood, old school tactics and competitors supporting each other are explosive plot twists, which both apply to the mortgage industry too. So take a moment to binge this Barbenheimer mortgage script and flip your disrupted mindset.

Barbie and Oppenheimer — together known as Barbenheimer — have grossed $2.24 billion in global movie theaters so far this year. Movie theaters. Those places people are streaming into to be with other people. The same places that 2 years ago were dismissed as relics. Plus these 2 movies are 33.48% of the $6.69 billion global box office year-to-date.

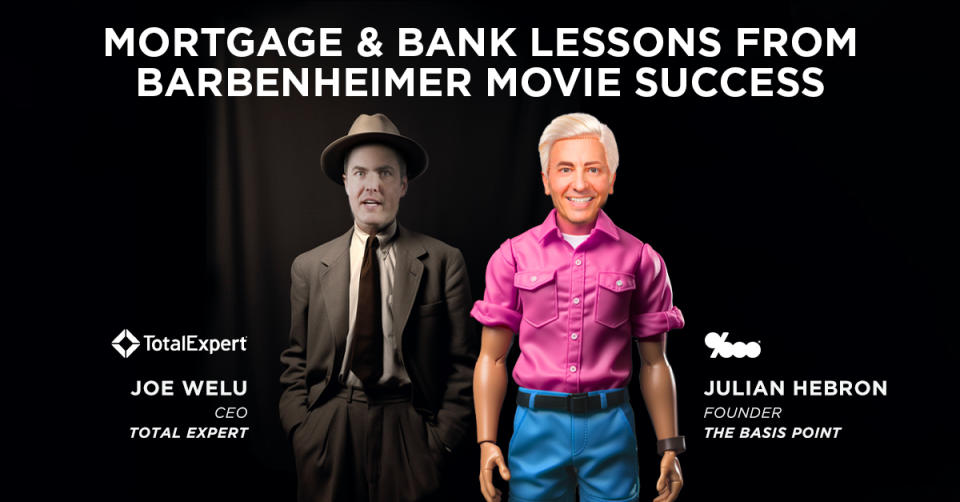

I recently went on Joe Welu’s Total Expert Insights podcast and we laid out 3 mortgage lessons from this year’s Barbenheimer movie success.

1. Old School Tactics Are Cool Again

In Hollywood, the disruption script says that streaming will replace movie theaters and AI will replace storytellers. Then these 2 movies written and directed by 2 of the best storytellers flipped the script and reminded us that good old fashioned originality wins in the end … if you’re among the best, and if you define originality as technique. A cynic could argue Oppenheimer was based on a book and Barbie was based on an established brand. Doesn’t matter. Top storytellers reinvented, remained true to, and sold these stories to all of us with their technique. AI can’t do that (on its own), and people will ALWAYS give their business to other people whose technique they respect.

Same in mortgage. A cynic — or naive ‘disruptor’ — would say this year’s $1.7 trillion in funded mortgages is just selling money for a price. What makes it special is your old school technique. Winning people’s trust. And when better to win people’s trust than when both rates and home prices are peaking again?:

– Rates are now 7.25%, and hit a 2-decade peak of 7.5% as Barbenheimer peaked late-August.

– Existing home prices are back up to $406,700 after dropping from a June 2022 peak of $413,800 to a January 2023 cycle low of $361,200.

– New home prices are back up to $436,700 after dropping from a October 2022 peak of $496,800 to an April 2023 cycle low of $417,200.

– The MBA and Fannie Mae predict rates will drop to 6.2% and 6.6%, respectively, by year end, and home prices will likely rise more as rates drop.

Your technique is to provide this human advice in terms people can understand and apply to their situations, and use smart tech to package and send your advice. This Barbenheimer mortgage technique will always earn respect … and new customers.

2. Competitors Win Bigger By Helping Each Other

This Summer, the whole Barbenheimer phenomenon began as 2 big movies competing with each other. The media started framing it as a Battle For The Future Of The Movie Business, which is your basic competitive cliche. But again, the moviemakers flipped the script, and they started promoting each other. Barbie and Oppenheimer stars and directors each told the media at their respective premieres how they were excited to see the other big movie they were up against. The mutual promo momentum built on itself, and proved that zero sum games are for losers. Meaning it’s a losing mindset to think your competitor must lose for you to win.

Same in mortgage. In an industry that’s averaged $2 trillion per year for the last 29 years and has $13 trillion in outstanding loans that banks and lenders service, there’s room for lots of players collaborating. In the servicing business, subservicing is a great example of friendly competitors supporting each other. And of course the fintech that supports this giant industry is a sprawling ecosystem of cooperative competitors. As Joe noted when we spoke, the future of mortgage fintech is open systems like Total Expert that enable banks and lenders to power their operations their way using multiple tech solutions that are easy to integrate.

3. Barbenheimer Mortgage Has Many Styles

Our final lesson from Summer 2023’s biggest story is that there’s always room for many styles in big industries. Barbie and Oppenheimer are polar opposites from a storytelling standpoint — one about the morals of war and one about the politics of marketing and gender — yet they’ve earned $1.38 billion and $853 million, respectively, so far. There’s a seat for every ass in the movie business, and there’s a loan for every home buyer and owner in the mortgage business.

More specifically, there’s a story that suits each pop culture fan, and a lender or loan officer that suits each person pursuing homeownership.

Loan officers know this best. Marketers sort of get it as they try to make Delighting The Customer or World Class Customer Experience sound cool. But loan officers win customers each day by relating to people’s stories and struggles, and showing people how to hit major life and financial milestones.

Loan officers deliver millions of these Hollywood endings for people every year, and each story is singular and special because of the style the loan officer brings to it.

Last word to marketers: tell these stories and you’ll never run out of cool, original ideas.

___

Reference:

– Joe Welu & Julian Hebron preview rest of 2023 mortgage market (Total Expert podcast) NOTE: This details the inflation, rate, home price, and lender market share outlook, and there’s a transcript if you prefer to reading over listening.

– Shout to Dennis for the Barbenheimer mortgage artwork featuring Joe as Oppenheimer and me as Ken. Here’s a closeup of my Ken hair, which as Robyn noted, is perfect for anyone who knows Barbies.

– More Mortgage, Housing, Fintech, Pop Culture posts on The Basis Point

DO YOU LIKE MONEY? GET MORE AT THE BASIS POINT®

The Basis Point Hosting MBA Annual 2023 Tech Demos – Apply Now!

Existing home prices down $18k from June 2022 peak to $396,100. Is this affordable?

Here’s states homeowners lost most equity 2022-23, but average homeowner still has $274k in equity