These 2 AI Stocks Under $5 Have Triple-Digit Upside Potential, Says Analyst

We live in a digital world, powered by a digital economy, and that means that in the long term, we should look to the tech sector for strong stock results. Specifically, we need to be cognizant of AI.

AI stocks have been in the public market for several years now, as the technology has made inroads into various niches – interactive chatbots, of course, but also autonomous vehicles, robotics, warehousing… even online content writing. There’s no doubt that AI is here to stay, and there’s no doubt that, in the long term, it will bring about radical changes.

H.C. Wainwright analyst Scott Buck would most definitely agree; he has flagged a pair of stocks with a strong AI connection that could see their value climb by over 100% in the next year. And all of this for a cost of entry below $5. Let’s take a closer look.

BigBear.ai Holdings (BBAI)

The first of Buck’s picks that we’ll look at is BigBear.ai, a company specializing in AI and machine learning, and applying both to automate decision-making processes. The company provides data-driven AI decision solutions for enterprise customers in multiple fields, including government & defense; manufacturing & warehouse ops; and healthcare & life sciences. BigBear.ai’s solutions can be applied to autonomous systems such as geospatial tracking, as well as to cybersecurity, supply chains & logistics, and professional services.

BigBear.ai was founded in 2008, and went public in December of 2021 through a SPAC transaction. That transaction, a business combination with GigCapital4, saw the BBAI ticker debut on the NASDAQ on December 8 of that year. Since that time, BBAI shares have dropped from more than $9 per share to less than $2.

On August 8th, the company announced its latest quarterly results for 2Q23, revealing a quarterly revenue of $38.5 million. This figure fell more than $854K below expectations, but slightly up by 2.2% year-over-year. At the bottom line, BigBear.ai’s earnings registered a net loss of 12 cents per share – 5 cents below the forecast – but marked a significant improvement over the 45-cent net loss reported for 2Q22.

In a metric that bodes well for future business, BigBear.ai finished Q2 with a work backlog totaling $206 million. This represented a 5% increase from the end of 1Q23.

This company’s solid customer base and significant work backlog caught the attention of Scott Buck, who wrote, “The company’s AI-powered decision intelligence solutions address the needs of three primary markets, supply chains & logistics, cybersecurity, and autonomous systems. With an existing backlog exceeding $206.0M, a customer base comprised of recognized commercial and government entities, we believe BigBear.ai is positioned to be a leader in the growing field of AI driven data analytics. We recommend investors accumulate BBAI shares ahead of an acceleration in revenue growth in 2024 and more defined path to profitability.”

In-line with this bullish stance, Buck rates BBAI shares as a Buy, with a $4 price target that suggests a gain of ~133% out to the one-year time horizon. (To watch Buck’s track record, click here)

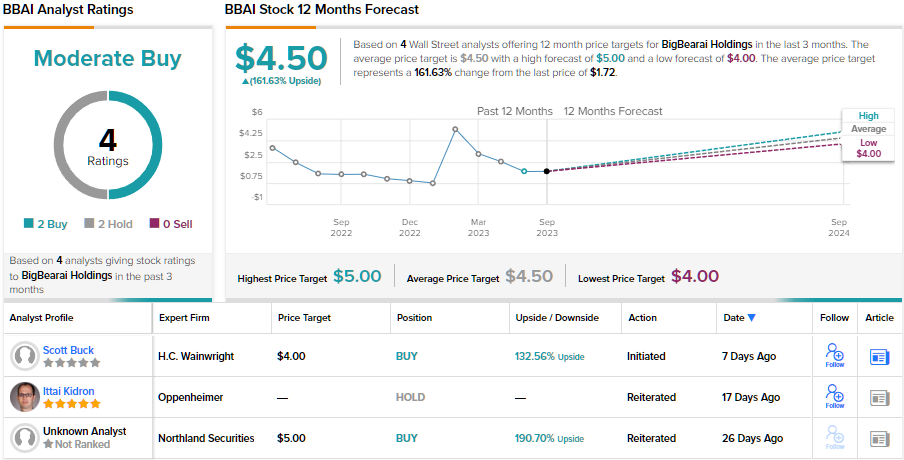

Overall, BigBear.ai gets a Moderate Buy consensus rating from the Street’s analysts, based on 4 recent analyst reviews that include 2 Buys and 2 Holds. The shares are priced at $1.72, and the average price target of $4.50 implies a robust one-year upside potential of ~162%. (See BigBear.ai’s stock forecast)

AudioEye, Inc. (AEYE)

Let’s now turn our attention to AudioEye, a software company offering customers and users a top-rated digital accessibility platform, one that puts websites into compliance with the Americans with Disabilities Act (ADA) and the WCAG standards. AudioEye’s platform includes a range of accessibility tools, including alternative text, closed captioning, content organization, keyboard input, subtitling, and warnings. The company can also offer legal protections, such as ADA certification.

From a user’s perspective, AudioEye’s products are easy-to-use, and touch on every aspect of web accessibility. The platform makes it simple to find and resolve issues on sites, to navigate the ever-shifting landscape of legal compliance requirements, and to monitor and maintain sites’ accessibility add-ons. The platform can do all of this, without installing fundamental alterations to the site owners’ webpage architecture or source code.

AudioEye’s Digital Accessibility platform is powered by a patented AI, which provides a sound base for a highly automated software system. The platform is designed to operate independently, providing active monitoring, automated fixes, and detailed reports for the human operator. The end result is industry-leading legal protection; a recent survey of legal claims related to accessibility showed that customers using AudioEye’s platform were 67% less likely to face a valid lawsuit.

Turning to the bottom line, we find that AudioEye’s last financial report, covering 2Q23, was in-line with expectations. Revenue was reported as $7.84 million, a company record, that was 3.5% above the year-ago top line – and skated just $7,330 over the forecast. At the bottom line, the company’s EPS came in at a loss, of 2 cents per share, as expected.

Scott Buck, in his note for H.C. Wainwright, sees this stock primed for growth going forward. He notes that AudioEye has a solid work pipeline, and is perfectly positioned to capitalize on new accessibility rules from the Department of Justice.

“Pipeline growth is being driven by a combination of new products and a revamped sales effort, which should open new enterprise opportunities. In addition, a proposed rule from the Department of Justice last week on website accessibility, should in our view begin to drive new business to AudioEye over the next several quarters. As a result, we expect a meaningful acceleration in revenue beginning in 4Q23 and continuing through 2024. As more meaningful revenue growth returns, we believe investors should begin to recognize the significant operating leverage in the business model,” Buck opined.

For Buck, all of this adds up to a Buy rating and a $10 price target that points toward a 115% potential upside in the year ahead.

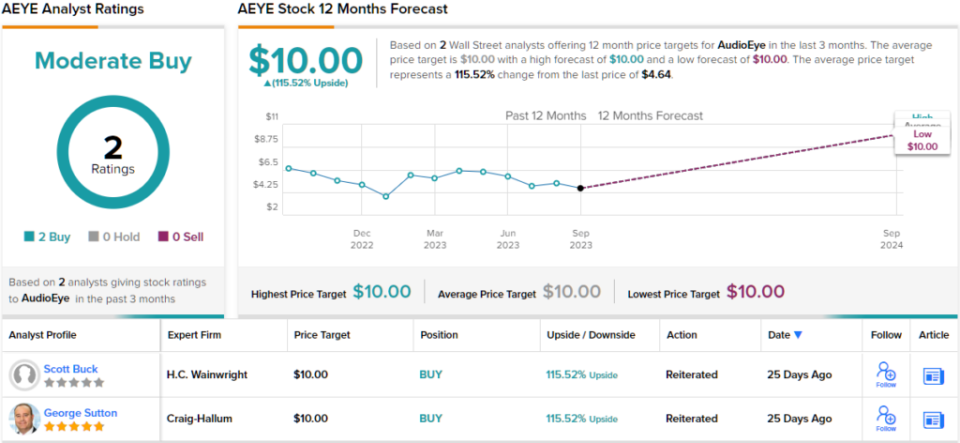

Overall, this micro-cap firm has slipped under the radar, and only has 2 recent analyst reviews. They both agree, however, that it’s a stock to buy, making the Moderate Buy analyst consensus unanimous. The shares are selling for $4.64 and their $10 average target indicates room for ~115% upside over the next 12 months. (See AudioEye stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.