2 Artificial Intelligence (AI) Stocks That Could Go Parabolic

The excitement of artificial intelligence (AI) is seemingly carrying the stock market higher. Those stocks that Wall Street has deemed to be AI winners, like Nvidia or Super Micro Computer, have multiplied in value over the past year, a parabolic journey that's made investors very wealthy.

Perhaps the next big AI move will be companies that integrate AI technology to become better businesses. In this category, stocks like UiPath (NYSE: PATH) and Monday.com (NASDAQ: MNDY) come to mind. These two stocks have done well over the past 18 months, but more upside could be ahead.

1. UiPath: Accelerating with AI

UiPath is an excellent example of artificial intelligence positively impacting a company's business model. UiPath is a leader in robotic process automation (RPA). This software can observe, learn, and automate repetitive office tasks like filling out or filing documents, managing interfaces, or sending communications. UiPath has been in business since the early 2000s, so the product has improved as broader technology has improved, especially over the past decade.

Today, UiPath is implementing AI in all three phases of RPA: discovery, automation, and operation. Management noted a study during its Q4 earnings call that indicated demand for AI-driven automation among 70% of surveyed executives. In other words, leveraging AI to make businesses more efficient could become a big theme.

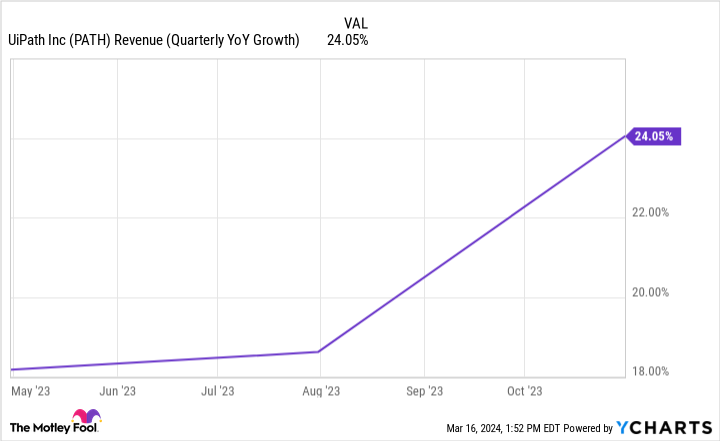

UiPath's revenue growth has accelerated since early last year, closing the year with 24% year-over-year growth.

The business is profitable, and analysts believe that earnings will grow by an average of 35% annually over the next three to five years. At a forward P/E of just 45 today, UiPath is a bargain if it can live up to analysts' expectations. The company has outperformed analysts' top- and bottom-line estimates every quarter as a public company, which is promising for the future.

Outperforming expectations, AI tailwinds, and a cheap starting valuation? UiPath could be on the way to monster gains in the years ahead.

2. Monday.com: Changing the work environment

Monday.com is reimagining how employees collaborate, which makes the addition of generative AI a potential game-changer for the company. Monday.com is cloud-based collaboration software. You could think of it like an operating system for your job. Rather than working through a dozen disjointed apps, employees can work seamlessly on Monday.com via dashboards that can be updated in real-time.

The company is adding AI powered by OpenAI and Azure, which creates a ChatGPT-like bot within Monday.com's platform. Users can ask the bot to quickly generate questions, task ideas, and other content.

The company has become increasingly profitable over time. Roughly 28% of revenue is free cash flow.

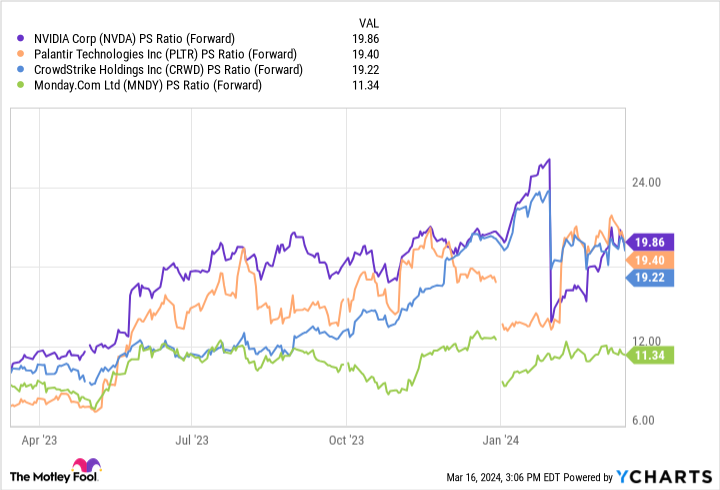

Can the stock go parabolic from here? Today, Monday.com has a $10 billion market cap and trades at just over 11 times its revenue. That's a notable discount to some of the hot AI stocks on the market, including Palantir Technologies (19 times sales), CrowdStrike (19 times sales), and Nvidia (20 times sales). Monday.com is growing revenue similarly to CrowdStrike and faster than Palantir. Admittedly, Nvidia is in a group by itself.

There's an argument that Wall Street is sleeping on Monday.com. The company must keep proving itself, including exceeding analyst estimates over the coming quarter. If AI can help Monday.com do that, perhaps Wall Street will see the stock in a new light.

Monday.com is small enough and growing fast enough that a positive change in sentiment could send shares soaring.

Should you invest $1,000 in UiPath right now?

Before you buy stock in UiPath, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UiPath wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 18, 2024

Justin Pope has positions in Monday.com. The Motley Fool has positions in and recommends CrowdStrike, Monday.com, Nvidia, Palantir Technologies, and UiPath. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic was originally published by The Motley Fool