2 Artificial Intelligence (AI) Stocks Down 46.5% and 54% to Buy Now

No doubt about it, artificial intelligence (AI) is this year's hottest trend. But its impact is still just starting to be felt. Investors are still at the outset of a revolutionary technology shift, and some magnificent AI stocks continue to trade at big discounts despite the market's surging interest in the new tech movement.

Two Motley Fool contributors have identified AI stocks that look like great investments -- one that AI investors have almost certainly heard of, and another name that's flying under the radar. Read on to see why they believe investing in these artificial intelligence stocks would be a great move.

Palantir is on the cutting edge of artificial intelligence

Parkev Tatevosian: Despite the incredible popularity of artificial intelligence, Palantir Technologies (NYSE: PLTR), one of the leading companies in AI, is selling at a price that is 54% off its high. The company has done an excellent job growing revenue and progressing toward profitability on the bottom line. Admittedly, despite the price decrease, the valuation is not cheap, but it has earned a premium due to its performance.

Indeed, Palantir's revenue has increased from $595 million in 2018 to $1.9 billion in 2022. The company offers enterprises, institutions, and governments solutions, including artificial intelligence, to solve their most pressing needs. Its systems help humans make actionable sense of overwhelming volumes of data. Their solutions help users tackle critical challenges in diverse areas like fraud detection, cybersecurity, supply chain optimization, and national security. Unsurprisingly, the rising effectiveness of AI could increase demand for Palantir's services.

Impressively, Palantir's revenue growth is leading to profitability. In 2018, when the company generated $595 million in sales, it reported an operating loss of $623 million. In its most recent quarter, Palantir reported revenue of $558 million and operating income of $40 million. Of course, it must deliver profitability over several more quarters before investors can be confident it has turned the corner in this crucial metric. Still, the improvement is encouraging, to be sure.

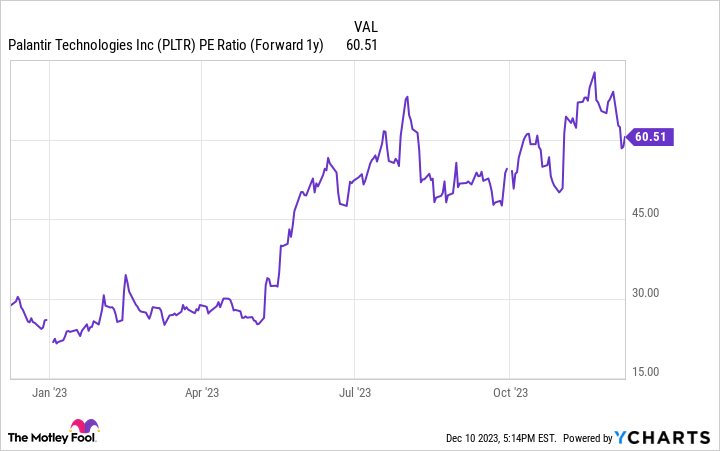

Palantir is trading at a forward price-to-earnings ratio of 60, which is not a cheap valuation. However, given its excellent prospects riding the tailwind of artificial intelligence and the growth in profitability, it could be an excellent option for investors looking to capitalize on the AI wave.

This overlooked stock could be explosive

Keith Noonan: Smartsheet (NYSE: SMAR) might not be a household name, but it's a stock that investors could look back on five years from now and regret missing out on. With shares still down 46.5% from their valuation peak, now could be a great time to build a position in this underappreciated artificial intelligence stock.

Smartsheet provides project management software for businesses and institutions, and it's recently rolled out a suite of AI tools to make handling daily operations and long-term projects easier for its customers. Customers were already loving the company's up-front, highly visible cost structure and getting huge value from its services prior to the artificial intelligence rollout, and early indicators suggest the new AI tools are on track to be a hit and help build its recurring revenue base.

The enterprise software specialist generates most of its revenue from subscription-based software, but it also has a smaller support services business. For context, subscription revenue increased 23% year over year in the period to reach $232.5 million in the third quarter, while professional services revenue was roughly flat at $13.4 million.

Overall revenue was up 23% year over year in Q3, and the company swung to generating positive free cash flow of $11.4 million in the period after having posted a cash outflow of $4.6 million in last year's quarter. The company's non-GAAP (adjusted) gross margin also climbed to 84%, its highest margin in the last five quarters.

Eighty-nine customers increased their spending with the company by more than $100,000 in Q3, while 256 increased spending by more than $50,000. In short, Smartsheet continues to expand its customer base, boost contract values, and improve margins at an encouraging pace.

The company's current valuation leaves room for long-term investors to see strong upside, and continued momentum for the business may power Smartsheet stock to become an explosive multi-bagger.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Palantir Technologies wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Keith Noonan has no position in any of the stocks mentioned. Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies and Smartsheet. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks Down 46.5% and 54% to Buy Now was originally published by The Motley Fool