2 Auto-Related Stocks to Buy for Value as Markets Move Higher

Investors will continue to search for stocks that offer sound value as the broader market indexes have kept moving higher with the S&P 500 now up +17% this year and the Nasdaq up +35%.

Naturally, monitoring valuation will be imperative at some point and this makes stocks that stand out in this regard more reassuring going forward.

With that being said, Avis Budget Group (CAR) and Genuine Parts (GPC) are two auto-related stocks that fit the bill.

Earnings Estimates

As a leading vehicle rental operator Avis earnings are naturally expected to decline after what will be a streak of monstrous years with EPS at an astonishing $58.05 per share in 2022. Still, Avis stock looks undervalued at current levels and earnings estimates have continued to rise.

Fiscal 2023 earnings estimates have now climbed 17% over the last quarter to projections of $35.14 per share compared to $29.92 a share three months ago. Plus, FY24 earnings estimates are slightly up as well.

Image Source: Zacks Investment Research

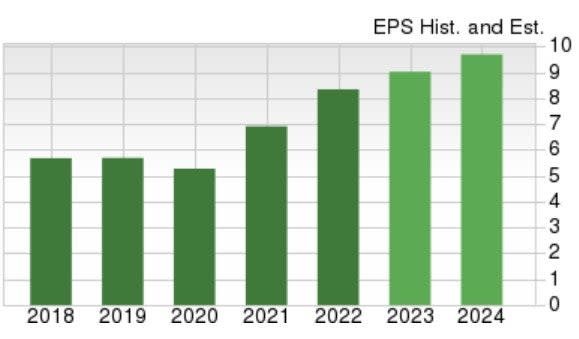

The trend of rising earnings estimate revisions is positive for Genuine Parts as well which has one of the largest networks of distributive automotive and industrial replacement parts.

Throughout the quarter Genuine Parts’ FY23 and FY24 earnings estimates have trended up 1% and 2% respectively. More impressive, while Genuine Parts’ bottom line hasn’t been as robust as Avis, steady growth is expected.

Genuine Parts earnings are now forecasted to rise 9% this year and jump another 8% in FY24 at $9.80 per share. Furthermore, fiscal 2024 EPS projections would represent 86% growth over the last five years with 2020 earnings at $5.27 per share.

Image Source: Zacks Investment Research

Price to Earnings Valuation

What is most intriguing about the rising earnings estimates and indicative of more upside in Avis and Genuine Parts stock is their attractive P/E valuations.

Trading at $237 a share, Avis stock trades at just 6.6X forward earnings which is well below its industry average of 19.8X and the S&P 500’s 20.9X.

Image Source: Zacks Investment Research

Looking at Genuine Parts, its stock trades at $164 a share and 18.7X forward earnings. This is modestly above its own industry average of 12.4X but Genuine Parts is a growing leader in its space and still trades nicely beneath the benchmark’s forward-looking P/E multiple.

It’s also noteworthy that Genuine Parts stock trades below its decade-long high of 23.4X and at a slight discount to the median of 18.9X.

Image Source: Zacks Investment Research

Bottom Line

Avis stock currently boasts a Zacks Rank #1 (Strong Buy) with Genuine Parts sporting a Zacks Rank #2 (Buy). Both stocks also have an “A” Zacks Style Scores grade for Value.

The rising earnings estimates and attractive P/E valuations are starting to make Avis and Genuine Parts stock more intriguing than others as markets have continued to climb and investors may start weighing risk going forward.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Genuine Parts Company (GPC) : Free Stock Analysis Report