2 Bank Stocks Wall Street Analysts Recommend Buying for 2024

Banks were under pressure for a large part of 2023. The primary reason was the Federal Reserve’s ultra-aggressive monetary tightening that led interest rates to touch a 22-year high of 5.25-5.5%. The faster pace of rate hikes since the 1980s placed banks in a disadvantageous position as the demand for loans gradually waned and funding costs increased. This also triggered a regional banking crisis in early March, which was the main reason for the collapse and failure of three banks — Silicon Valley Bank, Signature Bank and First Republic Bank.

The central bank’s hawkish monetary stance has increased the chances of an economic slowdown next year. The Fed’s December Summary of Economic Projections suggests that the U.S. economy will slow down next year, with 1.4% growth. For 2023, the U.S. economy is anticipated to grow 2.6%.

However, as 2023 comes to an end and we prepare to enter 2024, investors are gradually turning bullish toward bank stocks. This optimistic stance is driven by the Fed’s signal of no further rate hikes this cycle. Further, given that inflation is steadily cooling down and the U.S. economic growth is surprisingly robust, the central bank is now expected to cut rates thrice in 2024.

Thus, bank stocks are in the spotlight now. However, in the current situation, selecting stocks and generating solid returns is not easy. Hence, investors can follow stocks — First Citizens BancShares, Inc. FCNCA and Wintrust Financial Corporation WTFC — in which analysts show interest as they have a better understanding of the company fundamentals.

Analysts have a detailed insight into the overall sector and industry. They place company fundamentals against the current economic backdrop to determine how a particular stock will fare as an investment. Hence, analyst recommendations can help pick suitable stocks for generating robust returns.

2 Analyst-Suggested Bank Stocks for 2024

We shortlisted the abovementioned two bank stocks with the help of the Zacks Stock Screener. These stocks have a Zacks Rank of 2 (Buy). Further, more than 70% of brokers recommend these stocks as a strong buy or buy. Our research shows such stocks provide good investment opportunities. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here..

The chosen banks lost value due to ongoing headwinds but have robust earnings prospects and are expected to perform well in 2024. This optimistic stance signifies bullish analyst sentiments, reflecting solid fundamentals and the expectation of outperformance going forward.

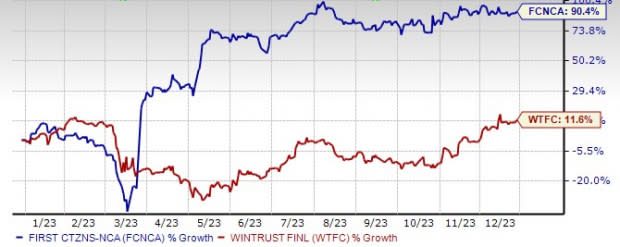

Year-to-Date Price Performance

Image Source: Zacks Investment Research

First Citizens BancShares, based in Raleigh, NC, provides retail and commercial banking services. The company has been under analysts’ focus because it acquired failed Silicon Valley Bank from the Federal Deposit Insurance Corporation.

This buyout is by far the biggest challenge for First Citizens BancShares, which has a history of buying failed banks. The deal allows the company to build on its experience with innovation hubs by leveraging SVB's strength in serving the private equity, venture capital and technology sectors.

Acquisitions remain a major part of FCNCA’s business expansion plan and top-line and footprint diversification efforts. Since the 2008 financial crisis, it has successfully integrated nearly 20 failed banks. The company is not averse to acquiring more regional banks if those complement the existing operations.

First Citizens BancShares, with a market cap of $21 billion, has jumped 90.4% in the year-to-date period. The company’s earnings are expected to surge 127.8% for 2023 and 6.7% for 2024. The current average target price of $1,722.22 represents an upside of 20.33%.

Currently trading at $1,444.28, it has an average brokerage recommendation (ABR) of 1.70 on a scale of 1 to 5 (Strong Buy to Strong Sell). ABR is the calculated average of actual recommendations made by brokerage firms and portends the future potential of the stock.

Wintrust Financial, based in Rosemont, IL, has more than 150 Wintrust Community Bank locations in Illinois, Wisconsin and Indiana through its 15 community bank subsidiaries. Higher interest rates, decent loan demand and efforts to improve fee income will continue to support the company’s financials.

Over the years, WTFC has grown substantially through acquisitions. Also, a solid liquidity position and capital levels keep aiding the company.

For 2023, Wintrust Financial’s earnings are projected to witness year-over-year growth of 27.4%. For 2024, earnings are expected to rise 4%. The company has a market cap of $5.8 billion.

The company’s shares have rallied 11.6% year to date. Wintrust Financial’s current average target price of $97 represents an upside of 4.44%. Currently trading at $94.31, it has an ABR of 1.33 on a scale of 1 to 5.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wintrust Financial Corporation (WTFC) : Free Stock Analysis Report

First Citizens BancShares, Inc. (FCNCA) : Free Stock Analysis Report