2 Consumer Loan Stocks to Buy Amid Gloomy Industry Prospects

The Zacks Consumer Loans industry continues to bear the brunt of weak consumer sentiments, high inflation and expectations of economic slowdown. This will dampen the demand for consumer loans and hamper industry players’ top-line growth. Deteriorating asset quality is a major near-term headwind too.

However, easing lending standards, which have increased the number of clients eligible for consumer loans, and the digitization of operations will keep benefiting consumer loan providers. Hence, industry players like Mr. Cooper Group Inc. COOP and Navient Corporation NAVI are worth betting on right now.

About the Industry

The Zacks Consumer Loans industry comprises companies that provide mortgages, refinancing, home equity lines of credit, credit card loans, automobile loans, education/student loans and personal loans, among others. These help the industry players generate net interest income (NII), which forms the most important part of total revenues. Prospects of the companies in this industry are highly sensitive to the nation’s overall economic condition and consumer sentiments. In addition to offering the abovementioned products and services, many consumer loan providers are involved in other businesses like commercial lending, insurance, loan servicing and asset recovery. These support the companies in generating fee revenues. Furthermore, this helps the firms diversify revenue sources and be less dependent on the vagaries of the economy.

3 Themes Shaping the Future of the Consumer Loan Industry

Weakening Consumer Sentiments: The persistently high inflation (though cooling now) and other macroeconomic headwinds continue to weigh on consumer sentiments. Though the Conference Board Consumer Confidence Index improved marginally in November, the Expectations Index, which shows a six-month outlook, was below 80 for the third straight month. This level historically indicated a recession within the next year.

Similar sentiments were recently echoed by several top executives of large banks, with their numbers reflecting slowing consumer spending. Therefore, this will result in muted demand for consumer loans in the near term. Thus, growth in net interest margin (NIM) and NII for consumer loan companies is likely to decline.

Worsening Asset Quality: For the major part of 2020, consumer loan providers built additional provisions to tide over unexpected defaults and payment delays due to the economic downturn resulting from the COVID-19 mayhem. This considerably hurt their financials. However, with solid economic growth and support from government stimulus packages, industry players began to release these reserves back into the income statement.

The current macroeconomic headwinds may curtail consumers’ ability to pay back loans. Thus, consumer loan providers are building additional reserves to counter any adverse fallout from unexpected defaults and payment delays. This is leading to a deterioration in industry players’ asset quality, and several credit quality metrics have crept up toward pre-pandemic levels.

Easing Lending Standards: With the nation’s big credit reporting agencies removing all tax liens from consumer credit reports since 2018, several consumers' credit scores have improved. This has raised the number of consumers for the industry participants. Further, easing credit lending standards is helping consumer loan providers meet loan demand.

Zacks Industry Rank Reflects Grim Picture

The Zacks Consumer Loans industry is a 16-stock group within the broader Zacks Finance sector. The industry currently carries a Zacks Industry Rank #225, which places it in the bottom 10% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates underperformance in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a disappointing earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. Over the past year, the industry’s earnings estimates for 2023 have moved 10.2% lower.

Before we present a couple of stocks that you may want to buy, let’s take a look at the industry’s recent stock market performance and valuation picture.

Industry vs. Broader Market

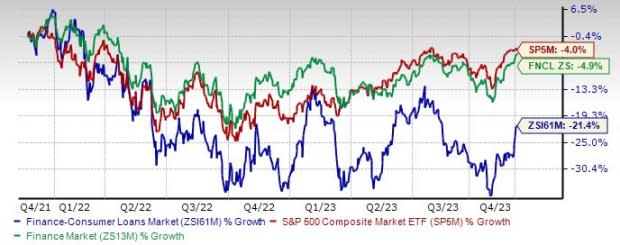

The Zacks Consumer Loans industry has underperformed both the Zacks S&P 500 composite and its sector over the past two years.

The stocks in this industry have collectively dropped 21.4% over this period, while the Zacks S&P 500 composite and the Zacks Finance sector have declined 4% and 4.9%, respectively.

Two-Year Price Performance

Industry's Valuation

One might get a good sense of the industry’s relative valuation by looking at its price-to-tangible book ratio (P/TBV), commonly used for valuing consumer loan stocks because of significant variations in their earnings results from one quarter to the next.

The industry currently has a trailing 12-month P/TBV of 0.95X, below the median level of 1.13X, over the past five years. This compares with the highest level of 1.56X and the lowest level of 0.48X over this period. The industry is trading at a considerable discount when compared with the market at large, as the trailing 12-month P/TBV ratio for the S&P 500 is 9.93X and the median level is 10.10X.

Price-to-Tangible Book Ratio (TTM)

As finance stocks typically have a lower P/TBV, comparing consumer loan providers with the S&P 500 may not make sense to many investors. However, a comparison of the group’s P/TBV ratio with that of its broader sector ensures that the group is trading at a decent discount. The Zacks Finance sector’s trailing 12-month P/TBV of 4.54X for the same period is way above the Zacks Consumer Loan industry’s ratio, as the chart below shows.

Price-to-Tangible Book Ratio (TTM)

2 Consumer Loan Stocks to Invest in

Cooper Group: Headquartered in Coppell, TX, the company is engaged in non-banking services for mortgage loans. The company operates through its primary brands — Mr. Cooper and Xome.

Though the demand for mortgages is subdued now due to higher rates, COOP is well-placed to leverage its scale (it is one of the largest non-bank mortgage servicers in the United States) and bolster its top-line growth. Further, the strategic acquisitions of Home Point Capital Inc. and Roosevelt Management Company, LLC in August 2023 will boost the company’s servicing business.

With the Federal Reserve likely to keep interest rates high in the near term to control inflation, this Zacks Rank #2 (Buy) company’s NII and NIM are expected to witness improvements, though rising funding costs will weigh on both. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

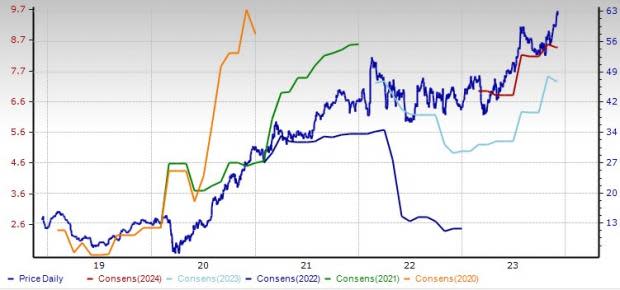

The Zacks Consensus Estimate for earnings for 2023 and 2024 has remained unchanged over the past seven days. Also, COOP shares have jumped 27.3% over the past six months.

Price and Consensus: COOP

Navient: This Zacks Rank #2 stock is a leading provider of education loan management and business processing solutions. Headquartered in Wilmington, DE, the company is one of the leading servicers to the U.S. Department of Education under its Direct Student Loan Program.

NAVI is growing its in-school originations. Nonetheless, with the increase in overall interest rates, the extension of the federal loan payment holiday, loan forgiveness proposals and programs are anticipated to create uncertainty and limit refinance loan origination volume in the near term. However, the demand for refinancing loans is likely to rebound once direct federal loan repayments begin.

A focus on introducing new products leveraged with technology and cost-control efforts will continue supporting Navient in the quarters ahead. Also, the company focuses on delivering operating efficiency and improving customer experience by building technology-enabled solutions.

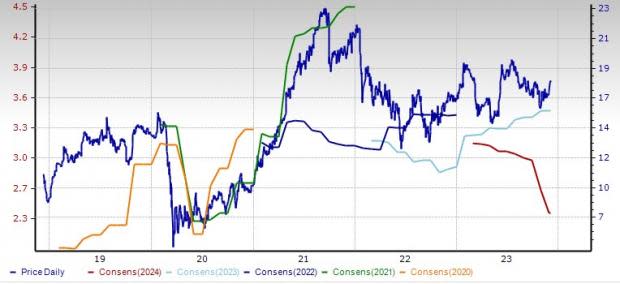

Navient shares have rallied 1.1% over the past six months. Over the past week, the Zacks Consensus Estimate for earnings has remained unchanged for both 2023 and 2024.

Price and Consensus: NAVI

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MR. COOPER GROUP INC (COOP) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report