These 2 Dow Stocks Are Set to Soar in 2024 and Beyond

When investors think of stocks from the Dow Jones Industrial Average, some might think the index has more than its share of stodgy industrial companies unlikely to produce more than nominal returns and ignore its component parts. But in recent years, Dow parent S&P Global has replaced old-economy companies such as Alcoa and General Electric in the index with more dynamic stocks that better represent the new economy.

This still-relevant index still has some stocks that hold the potential for significant gains. Two Dow components that remain relevant are Amazon (NASDAQ: AMZN) and Nike (NYSE: NKE). Let's find out a bit more about these two stocks and why they are set to soar in 2024 and beyond.

1. Amazon

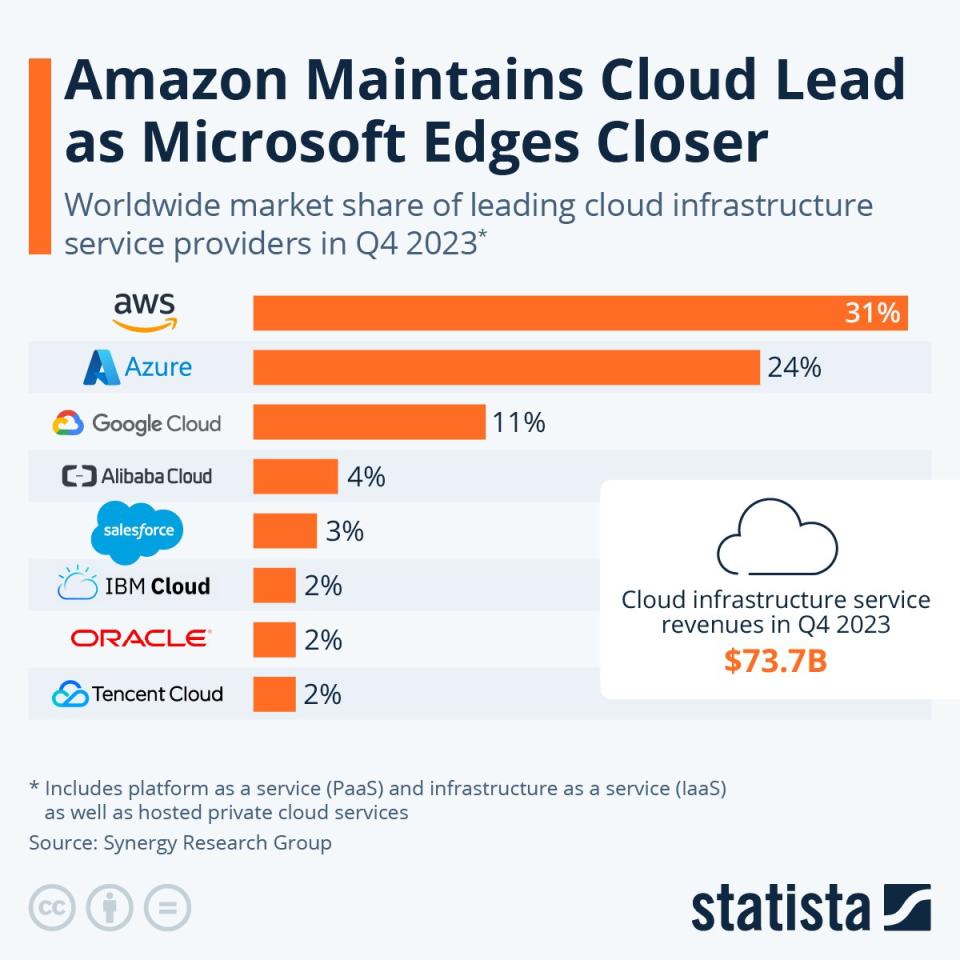

Most people know Amazon best for its e-commerce site and its various Prime subscription services. But its potential as a growth stock primarily lies in its Amazon Web Services (AWS) segment. As a cloud provider, AWS plays a crucial role in supporting third-party applications and services of all sorts, including those driven by artificial intelligence (AI).

AWS has long been the largest cloud provider, and it wants to leverage that leadership into a "full stack" approach to AI. This means building customized chips, writing software layers, training its models, and providing simple front ends that allow convenient connections to various AI services.

In 2023, just 16% of the company's revenue came from AWS. At the same time, though, it supplied two-thirds of Amazon's operating income that year.

The company's other segments include fast-growing businesses such as advertising, subscriptions, and third-party seller services. The largest segment is online sales. It's also the segment with the slowest growth at the moment and the narrowest margins.

Still, because of Amazon's segment diversity, it can grow fast even though it already has a mammoth $1.8 trillion market cap. Analysts forecast 44% net income growth this year and 26% in 2025. Also, at a forward price-to-earnings (P/E) ratio of 42 for the company, investors can benefit from Amazon's AI-driven growth without paying a massive premium.

2. Nike

Nike accomplished something seemingly impossible in the consumer space: It built competitive advantages in the sports apparel and equipment businesses. Aside from owning one of the world's most recognized brands, its well-managed global supply chain allows it to reduce production costs while building a worldwide following. Moreover, Nike has spent heavily on research and development to innovate in its respective specialties, and it invests a lot in marketing and maintaining a considerable social media presence.

A big marketing investment is celebrity endorsements from popular athletes in multiple sports. And for all the focus on active athletes, the strategy works with retired athletes as well (perhaps the best example of this strategy is the enduring popularity of the Jordan brand more than two decades after Michael Jordan's NBA retirement).

Unfortunately for Nike, the company's performance has suffered in recent quarters amid a sluggish economy. For the first six months of fiscal 2024 (ended Nov. 30, 2023), net income of just over $3 billion rose 8% versus the same period last year.

The stock has struggled to gain traction since reaching its pandemic-driven highs in late 2021. Currently, it sells at a 45% discount from that high.

However, it could be poised for a comeback. A refresh of its more popular brands in the spring and the upcoming Summer Olympics could be a marketing win for the company.

Also, by next year, analysts expect profits to rise by 18%. Such growth could take the sting out of the forward P/E ratio of 28 and spark a long-awaited comeback for Nike stock.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Nike, and S&P Global. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

These 2 Dow Stocks Are Set to Soar in 2024 and Beyond was originally published by The Motley Fool