2 Financially Strong Tech Names With Market-Beating Yields

Companies in the technology sector do not often pay dividends. This is because these companies are usually reinvesting back in the business in order to grow. As the companies mature and profits become more stable, distributing dividends can be a method with which to reward shareholders.

Dividends can help an investor to create a steady stream of income, but can also be a sign the company is in excellent financial shape. Financially strong companies are often favored by investors as they can prosper in good times and perform better during periods of economic adversity. Therefore, they have the potential to produce better returns for their shareholders over long periods of time.

Criteria for tech companies paying dividends

This discussion will examine two technology names that meet the following criteria:

Have a financial strength rating of at least 8 out of 10 from GuruFocus.

Trade at or below their GF Value.

Yield at least 2.5%.

Have a GF Score of at least 85 out of 100.

Overview of Cisco Systems

First up is Cisco Systems Inc. (NASDAQ:CSCO), a leading provider of routers and switches used to connect networks around the world through the internet. It is estimated that the vast majority of the data transmitted over the internet has been through the companys products over the last three decades. Cisco generates approximately $57 billion in annual revenue and has a market capitalization of more than $228 billion.

Cisco Systems receives an 8 out of 10 for financial strength from GuruFocus.

Financial strength and dividend growth

Cisco generally rates very well against its peer group in most areas. Its best showing is on debt-to-Ebitda, which tops 76% of companies in the hardware industry. Debt-to-equity is also easily ahead of most of its competitors. The company benefits from a massive cash position on its balance sheet, $26 billion as of the most recent quarterly report, which gives it one of the better cash-to-debt ratios in the industry and provides interest coverage that comes in ahead of two-thirds of its peer group.

Where Cisco does struggle is the equity-to-asset ratio, which is below 69% of the companys peer group. That said, the company's other rankings are also near the high end of its 10-year history. This shows that not only is Cisco outperforming its competition, it is performing at decade highs for the company.

The Piotroski F-Score, which measures financial strength, is an 8 out of 9 and the companys Altman Z-Score, which measures the chances a company could go bankrupt, is considered safe. Additionally, Cisco is especially good at generating returns on invested capital as the ROIC is 15.9%. This is above the companys weighted average cost of capital of 10.5%.

Having a strong financial position, along with an enviable cash balance, has allowed Cisco to raise its dividend for 13 consecutive years. This is one of the longest dividend growth streaks in the tech sector. The expected payout ratio for this fiscal year is just 39%. Shares yield 2.8%, well above the average yield of 1.6% for the S&P 500 Index.

GF Score and valuation

An impressive showing on financial strength, along with excellent scores for profitability, momentum and growth, offset by a low score on value, have resulted in a GF Score of 88 out 100 for Cisco Systems. This implies the company could see higher returns moving forward based on GuruFocus research.

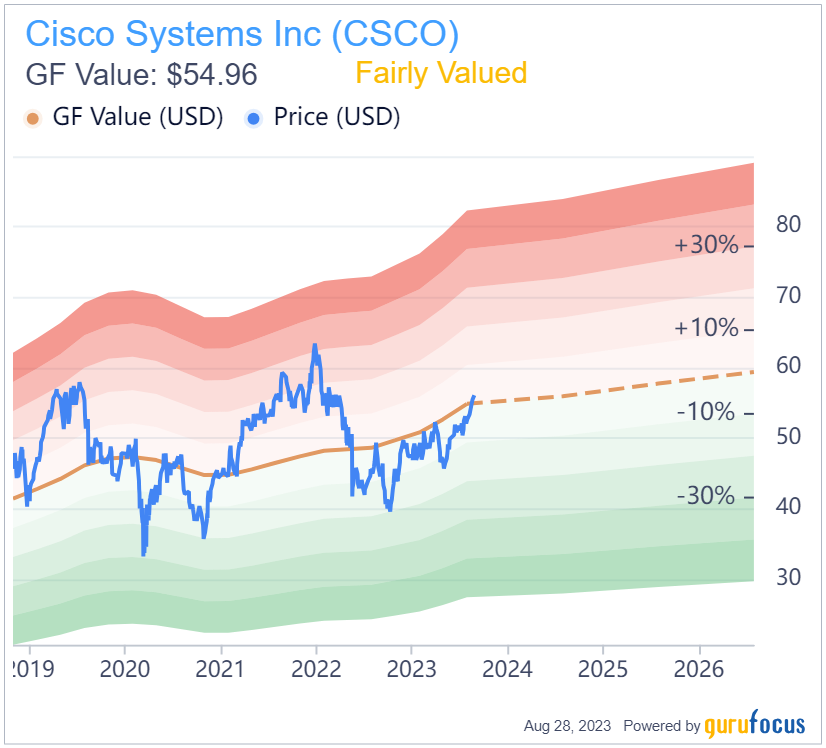

Shares of Cisco Systems trade very close to its GF Value. The stock trades at $56 presently, slightly ahead of its GF Value of $54.95. With a price-to-GF Value ratio of 1.02, it receives a rating of fairly valued from GuruFocus.

Overview of Skyworks Solutions

The second technology stock to consider is Skyworks Solutions Inc. (NASDAQ:SWKS), which is a semiconductor company that creates, develops and sells its products around the world. The companys products are used in a variety of end markets, such as automotive, smartphones, defense and the connected home. The company has annual sales approaching $5 billion and is valued at nearly $17 billion today.

Skyworks Solutions also receives an 8 out of 10 rating for financial strength.

Financial strength and dividend growth

Admittedly, the company does not rank as high against the competition as Cisco Systems does. Skyworks Solutions best metric is the equity-to-asset ratio, where it is ranked higher than 60% of companies in the semiconductor industry. On the reverse side, the cash-to-debt score is lower than 80% of its peer group. This has occurred as the company has greatly increased the presence of debt on its balance sheet in recent years. The companys ratios for debt-to-equity, debt-to-EBITDA and interest coverage are all middle of the pack.

These scores should begin to improve as Skyworks Solutions' cash flows continue to grow. For example, the most recent quarter saw a record year-to-date operating cash flow of nearly $1.5 billion. The company ended the third quarter with $722 million in cash, which was used aggressively to pay down its debt by $500 million during the period.

As cash flow generation has improved, so too has Skyworks Solutions ability to pay and raise its dividend. Shareholders have received a dividend increase for 10 consecutive years. Dividend increases are likely to continue as the expected payout ratio for fiscal year 2023 is just 30%. Shares offer a yield of 2.6%.

Skyworks Solutions Piotroski F-Score is somewhat lower at 6, but still within a safe range. The companys Altman Z-Score, on the other hand, is near the top of the safe range. The company is also very good at turning invested capital into profits as the ROIC of 15.2% is ahead of its WACC of 9.7%. Altogether, these metrics speak to the safety of the companys financial position.

GF Score and valuation

Skyworks Solutions does not just receive a solid score for financial strength, but in all areas that make up the GF Score ranking. In fact, the company has at least an 8 out of 10 for all five components. This leads to an excellent GF Score of 95 out of 100, implying the potential for outsized returns.

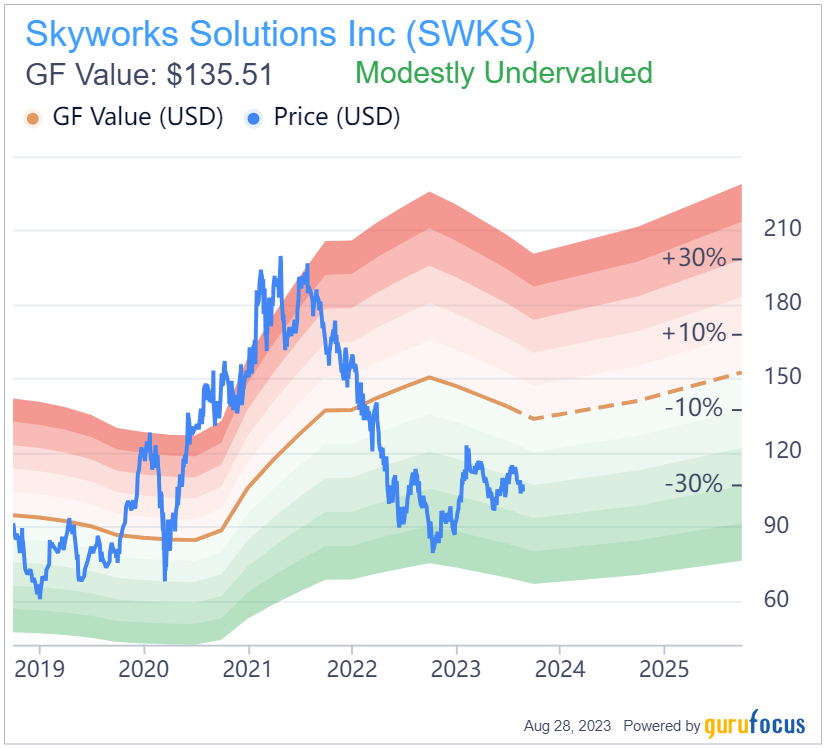

The stock trades at a discount to its GF Value by a wide margin at $105. With a GF Value of $135.57, Skyworks Solutions has a price-to-GF Value ratio of 0.77. Reaching the GF Value would represent a return of 29%. Factor in the dividend and the total return stretches into the low 30% range. The stock is rated as modestly undervalued by GuruFocus.

Final thoughts

While many companies in the technology sector do not pay dividends, there are names that do. These companies must be on firm financial footing to do so, otherwise their ability to grow and further fund the dividend could be at risk.

Cisco Systems and Skyworks Solutions are two companies that have strong financial strength scores that have made it possible for dividends to be distributed to shareholders. Both names have high GF Scores and market-beating yields. While Cisco trades near its GF Value, Skyworks could provide high returns.

Investors looking for financially strong tech names paying dividends should consider adding these two stocks to their watchlists.

This article first appeared on GuruFocus.