2 Mortgage Lending Disruptors

Want Asymmetric Bets? Find the Next Disruptors

Disruptors can be the best investments in public markets due to their ability to transform industries, create new markets, and outpace traditional competitors. A classic example of disruptions in the entertainment industry is Netflix (NFLX) and Blockbuster. Below are three educational takeaways from the Netflix/Blockbuster saga.

1. Innovative Business Model: Disruptors often produce innovative business models that challenge the status quo. In the case of Netflix, the company pioneered the subscription-based streaming model, allowing users to access a vast content library for a fixed monthly fee. This contrasted sharply with Blockbuster’s traditional model of renting physical DVDs from brick-and-mortar stores.

2. Adaptation to Technological Shifts: Disruptors embrace and leverage technological advancements. NFL recognized the potential of online streaming and invested heavily in technology to deliver content directly to consumers over the internet. This not only provided convenience but also aligned with the changing preferences of consumers who increasingly sought on-demand, digital content.

3. Customer-Friendly Approach: The best disruptors make their own businesses more efficient while satisfying the customer. Netflix’s on-demand streaming allowed users to watch content whenever and wherever they wanted, eliminating the need to visit physical stores, pay late fees, or wait for DVDs to arrive by mail. This customer-centric approach resonated with consumers, leading to a shift in market dynamics.

The Mortgage Industry is Ripe for Disruption

The mortgage lending industry is ripe for disruption because mortgage processes are often cumbersome and involve extensive paperwork, slow approval times, and a lack of transparency.

Disruptor #1: Rocket Companies (RKT)

Rocket Companies is a Detroit-based company that provides digital solutions to the mortgage industry.

The Shift to Digital, Painless Mortgage Lending

Through its online platform and mobile app, Rocket Mortgage lets users complete the entire mortgage application, approval, and closing process digitally, minimizing paperwork and significantly expediting the traditionally time-consuming mortgage approval process. This disruption enhances customer experience, increases transparency, and sets a new standard for efficiency in the mortgage lending industry, appealing to modern consumers seeking a more convenient and tech-savvy approach to securing home loans.

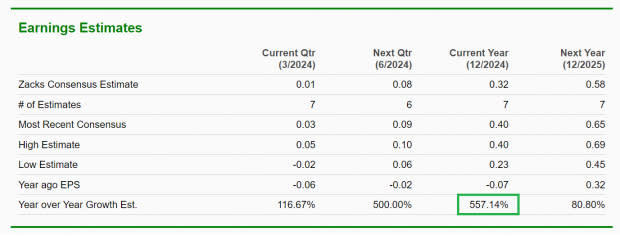

Massive Earnings Estimates

Zacks Consensus Estimates suggest RKT’s EPS will grow at a juicy 557.14% in 2024.

Image Source: Zacks Investment Research

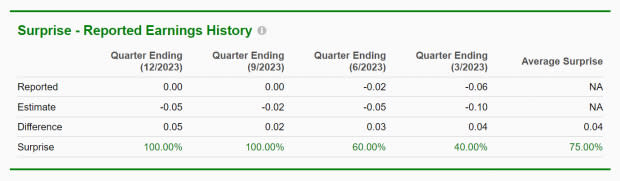

Though Wall Street’s estimates may seem farfetched, RKT’s positive EPS surprise history illustrates that they are realistic. Over the past four quarters, RKT has beat Zacks Consensus Estimates by an average of 75%.

Image Source: Zacks Investment Research

Disruptor #2: Blend Labs (BLND)

Disrupting the Mortgage Industry

Blend Labs specializes in creating software platforms and tools that streamline and enhance the mortgage lending process. Their solutions leverage technology to simplify and automate various stages of the mortgage application and approval process, making it more efficient for both lenders and borrowers.

Digital Mortgage Platform

Blend Labs provides a digital platform that enables lenders to offer a more seamless and user-friendly mortgage application experience. Borrowers can complete applications online, upload necessary documents, and track the progress of their mortgage application through the platform.

Automation and Integration

The company focuses on automating time-consuming tasks in the lending process, reducing manual work for both sides of the transaction. Integration with various data sources and systems is a key feature, allowing for more efficient verification and processing of information.

Compliance & Security

Blend Labs emphasizes on ensuring that its solutions comply with industry regulations and standards. Additionally, the platform is designed to prioritize security and data privacy to protect sensitive borrower information.

Collaboration with Lenders

Blend Labs collaborates with financial institutions, banks, and mortgage lenders to implement its technology solutions. This collaboration aims to enhance the overall efficiency of the mortgage lending process and improve the customer experience.

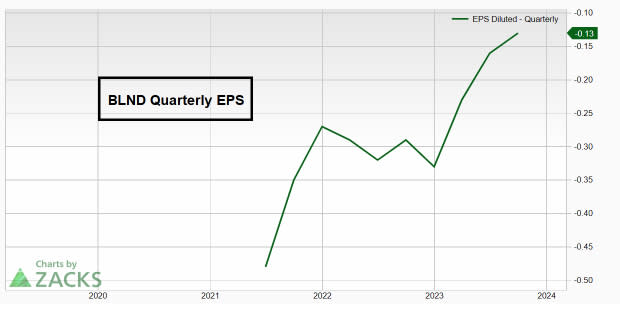

Small but Growing Rapidly

BLND, which has a market cap of less than $1 billion, is grew EPS 78% year-over-year last quarter and has grown EPS consistently since becoming a public company in 2021.

Image Source: Zacks Investment Research

BLND has also beaten Zacks Consensus Estimates for three consecutive quarters, making it a consistent over-achiever.

Strong Technicals

After trending nicely for several months, BLND shares pulled into the 50-day moving average and are bouncing on heavy volume. Such a set up provides an attractive reward-to-risk zone.

Image Source: TradingView

Bottom Line

Rocket Companies and Blend Labs have the potential to disrupt a market that has long been in need of disruption – mortgage lending. Their unique offerings are gaining traction, as evidenced by their strong fundamentals and EPS surprise history.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Rocket Companies, Inc. (RKT) : Free Stock Analysis Report

Blend Labs, Inc. (BLND) : Free Stock Analysis Report