2 No-Brainer Dividend Stocks to Buy Right Now for Less Than $500

Buying dividend stocks isn't exactly rocket science, but you do have to stop yourself from getting tempted into risky investments. In other words, you need to weigh the yield you are collecting against the potential for a dividend cut. Bank of America (NYSE: BAC) and Realty Income (NYSE: O) are two out-of-favor dividend stocks you might want to look at today even if you have as little as $500 to invest. Here's what you need to know.

Bank of America is back in growth mode

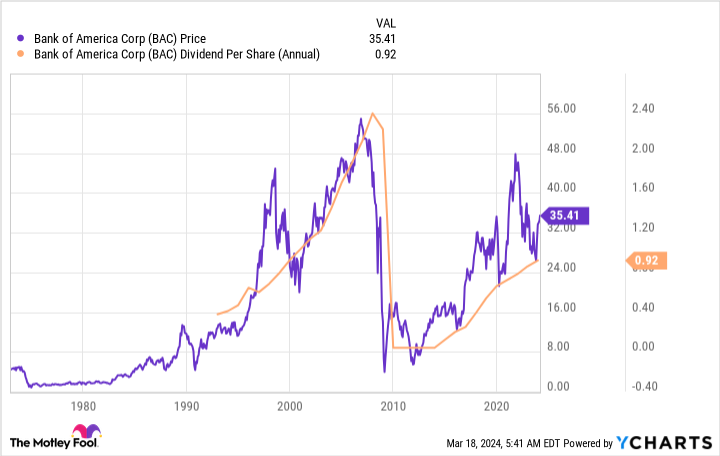

More risk-averse dividend investors will probably look at the dividend cut Bank of America was forced to make during the Great Recession and cringe. In fact, they might prefer other banks, such as the Canadian giants, which didn't reduce their dividends. But BofA isn't the same bank it used to be; it is far more conservatively run now. A key part of that is based on new regulations within the banking industry. Another part is related to business changes within the company. That said, that the stock still hasn't recovered to its pre-dividend cut highs.

That's the type of thing that management notices and adjusts to. Investors have made it clear that they want consistency when it comes to the business, not negative shocks. Today, Bank of America is among the largest financial institutions in the United States and the world. It easily sailed through the early 2023 bank runs that felled a number of smaller, regional banks. For investors that prefer to stick with domestic companies, it is a great choice in the bank sector.

Its business spans across traditional banking, investment banking, global banking, and global wealth management. In other words, if you want a simple bank, this isn't it. But if you want a diversified bank, BofA has you covered. And the dividend has been heading steadily higher for a decade.

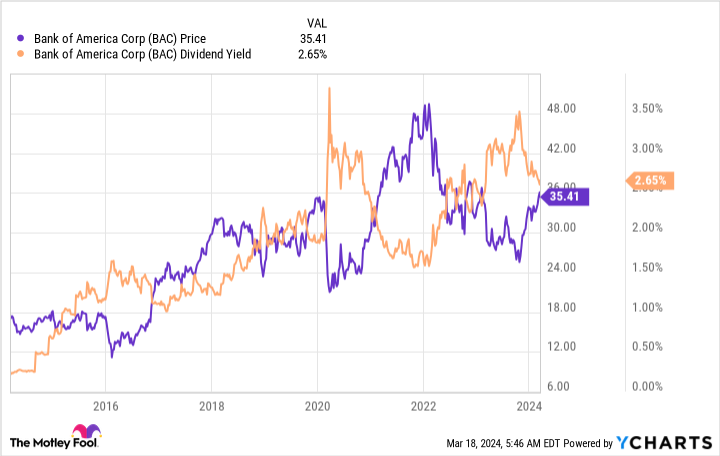

The real attraction right now, however, is the dividend yield. At roughly 2.7%, it is near its highest levels over the past decade. That's largely because interest rate increases have investors broadly worried about banks. With a Tier 1 capital ratio of 11.8%, however, Bank of America more than meets regulatory requirements. It should easily weather any fallout from rising rates. For long-term dividend growth investors, Bank of America is a solid choice if you want to own a U.S.-based bank.

Realty Income is a reliable, high-yield tortoise

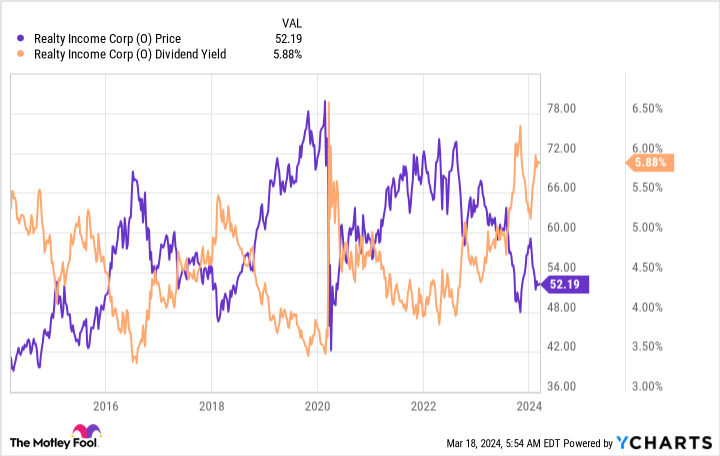

Interest rates have also been a headwind for real estate investment trusts (REITs), because higher rates increase the cost of capital. That makes it more expensive for REITs like Realty Income to grow their businesses. The downward pressure on stock prices in the sector has pushed Realty Income's yield up toward 10-year highs, opening up a buying opportunity for conservative long-term term dividend investors.

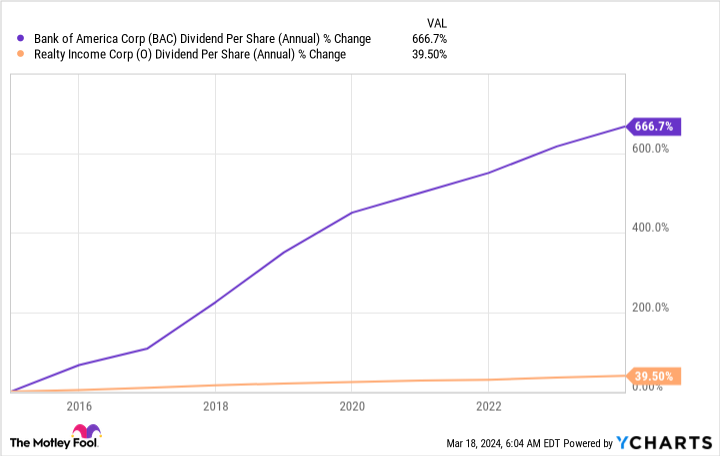

Realty Income has increased its dividend for 29 consecutive years, so it has proven its ability to weather adversity. Its 5.9% yield is attractive both on a relative basis to the REIT's own yield history and on an absolute basis. For investors trying to maximize the income their portfolios generate, it is probably a better choice than Bank of America. That said, Realty Income's dividend growth tends to be comparatively slow over time. Bank of America has more dividend growth potential as it continues to build back from the Great Recession dividend cut.

The real attraction of Realty Income is its business. Like Bank of America, Realty Income is an industry giant. It has the scale and financial strength (it's investment grade rated) to do deals that its peers couldn't even consider, including acting as an industry consolidator. And it has been working to expand its reach into new areas (like casinos) and new geographic regions (Europe). Rising interest rates are a headwind, but property markets will adjust in time and Realty Income will likely keep growing just fine.

Doing a lot with a little

You might think that $500 isn't enough money to invest with. But you can buy Bank of America and Realty Income shares for less than that and start building a position in one (or two) industry-leading companies. Bank of America's Great Recession dividend cut might turn some investors off, but the dividend has grown steadily since then and it's worth a second look if you want to own a U.S. bank. Realty Income offers a high yield and a rock-solid dividend track record, which will probably appeal to most yield-focused dividend investors.

Should you invest $1,000 in Bank of America right now?

Before you buy stock in Bank of America, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bank of America wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Reuben Gregg Brewer has positions in Realty Income. The Motley Fool has positions in and recommends Bank of America and Realty Income. The Motley Fool has a disclosure policy.

2 No-Brainer Dividend Stocks to Buy Right Now for Less Than $500 was originally published by The Motley Fool