2 Reasons to Buy Nvidia Stock Like There's No Tomorrow

Nvidia (NASDAQ: NVDA) has been on top of the world over the last year as it has cornered the market on artificial intelligence (AI) chips, with its stock up more than 247% since last March.

As demand for AI services soared, so has the need for graphics processing units (GPUs) -- the chips necessary for training and running AI models. Meanwhile, Nvidia has held a leading market share in GPUs for years, perfectly positioning it to immediately begin supplying its chips to AI developers everywhere.

Consequently, Nvidia's earnings have skyrocketed as it achieved a majority market share in the AI GPU market while competitors like Advanced Micro Devices and Intel have scrambled to catch up.

Nvidia's meteoric rise has some analysts questioning how much room the company has left to run. However, its stock keeps defying expectations, rising 20% in the last month alone. Given the massive potential of AI and Nvidia's position in the market, I wouldn't bet against it over the long term.

So, here are two reasons to buy Nvidia stock like there's no tomorrow.

1. Getting a head start in artificial intelligence (AI)

The launch of OpenAI's ChatGPT in November 2022 reignited interest in AI and highlighted just how far the technology had come. Companies from countless industries began pivoting their businesses toward the budding arena as it became clear that AI could bolster a wide variety of businesses, from consumer tech to autonomous vehicles, e-commerce, cloud computing, and more.

Data from Grand View Research shows the AI market hit close to $200 billion last year and is expected to expand at a compound annual growth rate of 37% until at least 2030. For reference, that projection would see the industry reach nearly $2 trillion by the end of the decade. As a result, there seems to be no end in sight to the soaring demand for AI GPUs.

Meanwhile, last year, Nvidia's head start in the market saw it achieve an estimated 90% market share in AI chips, leading to soaring earnings.

In its most recent quarter (the fourth quarter of fiscal 2024, which ended in January), the company's revenue increased by 265% year over year to $22 billion. Operating income jumped 983% to nearly $14 billion. This monster growth was primarily thanks to a 409% increase in data center revenue, reflecting a spike in AI GPU sales.

Additionally, Nvidia's free cash flow is up 430% in the last year to more than $27 billion, significantly higher than AMD's $1 billion and Intel's negative $14 billion. So, despite new GPU releases from both competitors, Nvidia's head start in AI potentially pushed the company further ahead, providing it with more significant cash reserves to continue investing in technology and retain market supremacy.

2. Nvidia's stock is trading at its best value in months

Last year, Nvidia became the first chipmaker to achieve a market cap above $1 trillion. In fact, its market cap is currently more than $2 trillion, with Nvidia the world's third most valuable company, only after Microsoft and Apple.

Nvidia has come a long way in a short time. Yet its stock has actually increased in value over the last 12 months.

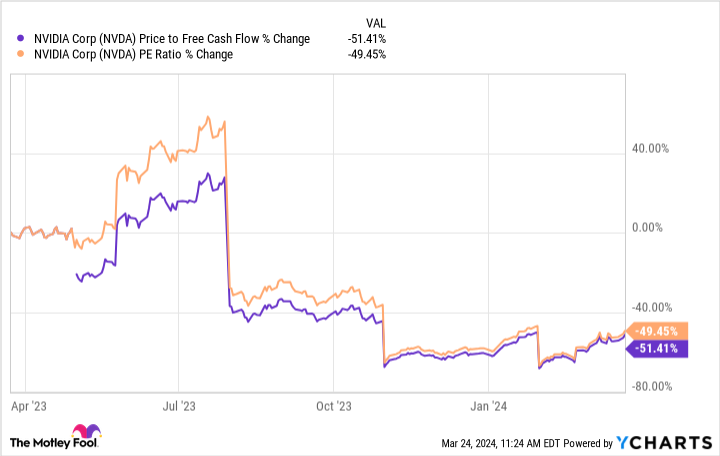

The chart above shows that Nvidia's price-to-free-cash-flow and price-to-earnings ratios plunged in the last year, indicating its stock is at one of its best-valued positions in 12 months.

P/E is calculated by dividing a company's stock price by its earnings per share. Meanwhile, the price-to-free-cash-flow ratio divides its market cap by free cash flow. These are helpful valuation metrics as they take into account a company's financial health. For both, the lower the figure, the better the value.

This, in addition to Nvidia's potent position in a burgeoning industry and significant cash reserves, makes the company's stock worth considering right now for a long-term investment.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

2 Reasons to Buy Nvidia Stock Like There's No Tomorrow was originally published by The Motley Fool