2 Reasons to Like iRobot Right Now

iRobot Corporation (NASDAQ:IRBT) stock gapped down more than 23% on April 24, in reaction to a rare revenue miss for the Roomba maker. IRBT shares have been chopping near the $98 level since, but a pair of data points is suggesting the tech stock could be ready to run higher.

For starters, iRobot stock is hovering near oversold territory, per its 14-day Relative Strength Index (RSI). The indicator was last seen at 30.3, after spending some of the last few trading days of April below the 30 mark. Data from Schaeffer's Senior Quantitative Analyst Rocky White shows the RSI indicator has been one of the best buy signals for stocks in recent years.

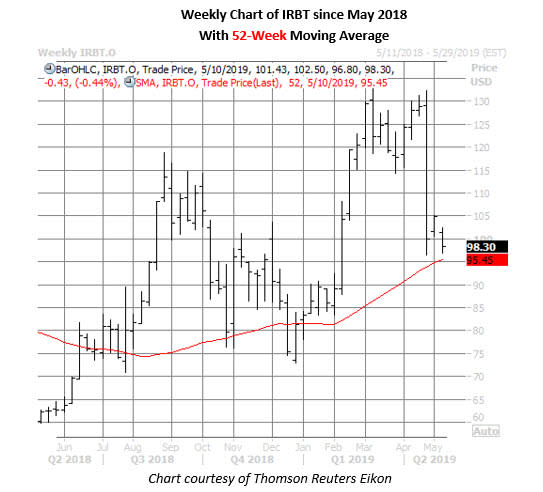

Plus, the security's recent pullback has it trading within one standard deviation of its 52-week moving average after a lengthy stretch above it, defined as being above the moving average 80% of the time for the past 20 weeks. According to the previous nine signals that have flashed over the past 15 years, IRBT stock was up an average 3.9% one month later.

A continued round of short covering could create tailwinds for iRobot stock. Short interest dropped 8.6% in the two most recent reporting periods to 8.14 million shares. This still accounts for nearly 30% of the security's float, or 17.7 times the average daily pace of trading.

Ahead of its recent slide, the stock was trading near its March 5 record high of $132.88, topping out at an intraday high of $132.30 on April 23. IRBT shares are still up 17.5% year-to-date, and nearly 58% year-over-year.