2 Stocks in the Canadian Upstream Industry Worth a Closer Look

Several factors have cast a shadow on the crude demand outlook, impacting the Zacks Oil and Gas - Exploration and Production - Canadian industry. The recent increases in crude and fuel inventories, coupled with an uninspiring production cut announcement from OPEC, have overshadowed the prospects of energy demand.

The situation is further complicated by China's economic downturn. Natural gas is also not immune to the broader market decline, trading notably lower year to date. Despite macro challenges causing uncertainties in demand, the sector exhibits resilience, particularly for companies prioritizing growth and operational efficiency. Canadian Natural Resources CNQ and Ovintiv OVV are noteworthy options for investors navigating this intricate landscape, offering potential amidst prevailing economic headwinds.

About the Industry

The Zacks Oil and Gas - US E&P industry consists of companies primarily based in the domestic market, focused on the exploration and production (E&P) of oil and natural gas. These firms find hydrocarbon reservoirs, drill oil and gas wells, and produce and sell these materials to be refined later into products such as gasoline, fuel oil, distillate etc.

The economics of oil and gas supply and demand is the fundamental driver of this industry. In particular, a producer’s cash flow is primarily determined by realized commodity prices. In fact, all E&P companies' results are vulnerable to historically volatile prices in the energy markets.

A change in realizations affects their returns and causes them to alter their production growth rates. E&P operators are also exposed to exploration risks where drilling results are comparatively uncertain.<

3 Key Investing Trends to Watch in the Oil and Gas - Canadian E&P Industry

Signs of Softening Consumption: WCS crude, the Canadian benchmark, recently closed under $50 per barrel for the first time in months due to a substantial build in fuel inventories and increased production. Despite OPEC+'s announcement of nearly 2 million additional barrels per day in production cuts, oil prices remained weak as the market sought more robust commitments.

China's economic challenges added to the gloom, affecting global demand forecasts. Shifting focus to natural gas, the commodity, which had slumped to a 25-year low in June 2020 but reached $10 per MMBtu in August 2022, is now trading below $3. This decline is attributed to heightened production levels and predictions of lackluster weather-related demand.

Scarcity of Pipeline: Energy consultant IHS Markit sees oil production in Canada surging by some 900,000 barrels per day during 2020-2030. Despite this impressive output growth expectation, the country's exploration and production sector has been out of favor, primarily due to the scarcity of pipelines.

In short, pipeline construction in Canada has failed to keep pace with rising domestic crude volumes — the heavier sour variety churned out of the oil sands — resulting in an infrastructural bottleneck. This has forced producers to give away their products to the United States — Canada’s major market — at a discounted rate.

Following U.S. President Joe Biden’s revocation of TC Energy’s contentious Keystone XL pipeline and the company’s subsequent termination of the project, Canadian oil sands producers will have to wait a little longer for the takeaway capacity issue to be resolved.

Substantial Shareholder Returns: The sharp increase in crude prices last year allowed Canadian upstream operators to deliver a solid financial performance. In particular, cash from operations is on a sustainable path, with revenues improving and companies slashing capital expenditures from the pre-pandemic levels amid higher commodity realizations.

To put it simply, the environment of strong prices in 2022 helped the E&P firms to generate significant “excess cash,” which they intend to use to boost investor returns. In fact, more and more energy companies are allocating their increasing cash pile by way of dividends and buybacks to pacify long-suffering shareholders.

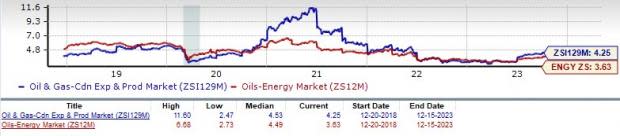

Zacks Industry Rank Indicates Bearish Outlook

The Zacks Oil and Gas - Canadian E&P is a seven-stock group within the broader Zacks Oil - Energy sector. The industry currently carries a Zacks Industry Rank #188, which places it in the bottom 25% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates fairly dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are becoming pessimistic about this group’s earnings growth potential. While the industry’s earnings estimate for 2023 has gone down 33.1% in the past year, the same for 2024 has fallen 50.4% over the said timeframe.

Despite the dim near-term prospects of the industry, we will present a few stocks that you may want to consider for your portfolio. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

Industry Outperforms Sector But Lags S&P 500

The Zacks Oil and Gas - Canadian E&P has fared better than the broader Zacks Oil - Energy sector over the past year but has underperformed the Zacks S&P 500 composite over the same period.

The industry has edged down 1% over this period compared with the broader sector’s increase of 23.9% and the S&P 500’s drop of 1.1%.

One-Year Price Performance

Industry's Current Valuation

Since oil and gas companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity but also the level of debt. For capital-intensive companies, EV/EBITDA is a better valuation metric because it is not influenced by changing capital structures and ignores the effect of non-cash expenses.

On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, the industry is currently trading at 3.94X, significantly lower than the S&P 500’s 13.07X. However, it is higher than the sector’s trailing-12-month EV/EBITDA of 3.77X.

Over the past five years, the industry has traded as high as 16.32X, as low as 2.17X, with a median of 4.35X.

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio (Past Five Years)

Stocks in Focus

Canadian Natural Resources: This Calgary-based energy major boasts a diversified portfolio of crude oil (heavy as well as light), natural gas, bitumen and synthetic crude oil. CNQ’s balanced and diverse production mix facilitates long-term value and reduces risk profile, thereby lending its results a high level of stability. Lower capital expenditure needs, accretive acquisitions and improving operational efficiencies are the other positives in Canadian Natural’s story, allowing the company to generate a significant free cash flow of C$10.9 billion (post capital spending and dividends) in 2022.

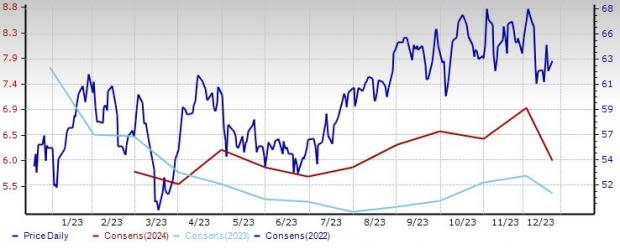

Notably, over the past 90 days, the Zacks Consensus Estimate for CNQ’s 2023 earnings has moved up 5.6%. Canadian Natural shares have gained 17.5% in a year. The stock carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: CNQ

Ovintiv: Ovintiv is an independent exploration and production (E&P) operator with an attractive oil and gas production portfolio in three major North American unconventional basins: Montney, Anadarko and the Permian. Following the Newfield acquisition in 2019, the company has achieved a higher liquids focus, greater scale and cost synergies. Ovintiv has done a commendable job of cutting its expenses in a Disciplined manner, which should boost free cash flow generation. Ovintiv’s cash flows will also receive downside protection from attractive oil and gas hedges.

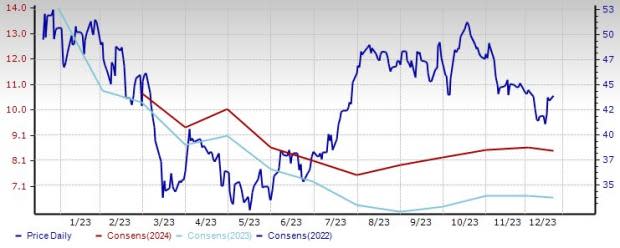

Over the past 90 days, the Zacks Consensus Estimate for Ovintiv’s 2023 earnings has moved up 3.9%. The company’s Value and Growth Score of A and B help it to round out with a VGM Score of B. With a market capitalization of around $11.8 billion, OVV has lost 11.5% in a year.

Price and Consensus: OVV

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

Ovintiv Inc. (OVV) : Free Stock Analysis Report