2 Stocks to Navigate the Bumpy Roads of the Domestic Auto Industry

The historic UAW-Detroit 3 strike has somewhat muted the near-term prospects of the Zacks Domestic Auto industry. Although the United Auto Workers have ratified new contracts with Stellantis, Ford and General Motors after a nearly seven-week strike, the effects of the stoppage are likely to be felt in the near term. Apart from the lost production and revenues amid the strike, high interest rates may prompt consumers to deter the purchase of big-ticket items. While robust electric vehicle sales are acting as a tailwind, increased capex and R&D expenses associated with the same may limit cash flows. Nonetheless, industry players like PACCAR PCAR and Canoo GOEV stand tall amid broader challenges and are well-positioned to brave headwinds.

About the Industry

The Zacks Domestic Auto industry includes companies that are engaged in designing, manufacturing and retailing vehicles across the globe. These include passenger cars, crossover vehicles, sport utility vehicles, trucks, vans, motorcycles and electric vehicles. The industry — which is highly consumer cyclic and provides employment to a large number of people — is at the forefront of innovation, courtesy of its nature and the transformation that it is going through. The widespread usage of technology and rapid digitization are resulting in a fundamental restructuring of the automotive market. Several companies in the industry have engine and transmission plants and conduct research and development, and testing of electric and autonomous vehicles.

Themes Influencing Industry's Fate

Lingering Effects of UAW Strike: While the United Auto Workers (UAW) have finally secured record deals with the Detroit 3 automakers — General Motors, Ford and Stellantis — after prolonged negotiations and an almost seven-week work stoppage, the impact of this historic strike is poised to be felt significantly in the near-term results and performance of the companies. For instance, General Motors anticipates that the lost production due to the strike will have a more pronounced impact in the fourth quarter, with an additional $600 million reduction in EBIT. On its latest earnings call, Ford notified that it resulted in the lost production of around 80,000 units, which would reduce 2023 EBIT by $1.3 billion. The strike-induced volatility prompted Ford and General Motors to withdraw their 2023 guidance.

Affordability Concerns Loom: Although current high-interest rates haven't dissuaded consumer interest in vehicles, there is a mounting worry about affordability that could impede future growth. Jonathan Smoke, the chief economist at Cox Automotive, envisions a potential constraint on new vehicle demand due to elevated pricing and the impact of high-interest rates. The increased cost of vehicle financing might prompt less affluent buyers to defer their purchases, posing a risk of decelerating vehicle demand that could affect industry players. Additionally, distribution inefficiencies, labor challenges, wage inflation and global logistics issues are exerting pressure on industry participants.

Soaring EV Popularity Both a Boon and a Bane: Climate change concerns, technological advancement and stringent fuel-emission standards are increasing green vehicles’ adoption by automakers and customers. Legacy automakers are going the extra mile to gain a strong foothold in this red-hot e-mobility space. They are introducing new EV models as the demand for environment-friendly cars continues to climb. Notably, EV sales surpassed 300,000 for the first time in the third quarter, up nearly 50% year over year. EVs contributed 7.9% to total U.S. auto sales in the third quarter, up from 6.1% a year ago and 7.2% in the second quarter. However, the substantial research and development expenses associated with high-tech car development pose a potential strain on near-term cash flows. Efficient cost management becomes crucial for sustaining healthy profit margins in this dynamic landscape.

Zacks Industry Rank Indicates Glum Prospects

The Zacks Automotive – Domestic industry within the broader Zacks Auto-Tires-Trucks sector currently carries a Zacks Industry Rank #154, which places it in the bottom 39% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dim near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are losing confidence in this group’s earnings growth potential. The industry’s earnings estimates for 2023 have declined 20% in the past three months.

Despite the industry’s tepid near-term prospects, we will present you with two industry participants worth considering for your portfolio. Before that, let’s take a look at the industry’s stock market performance and current valuation.

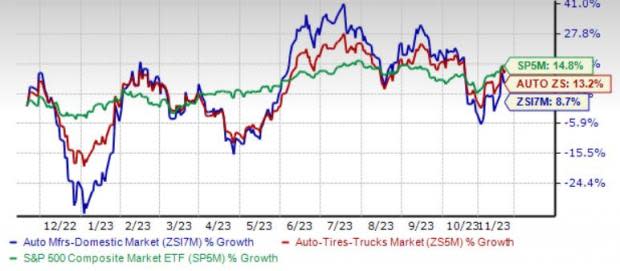

Industry Lags Sector & S&P 500

The Domestic Auto industry has underperformed the Zacks S&P 500 composite and the sector in the past year. The industry has moved up 8.7% compared with the S&P 500 and the sector’s growth of 14.8% and 13.2%, respectively, over the said time frame.

One-Year Price Performance

Industry's Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. On the basis of the trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 17.15X compared with the S&P 500’s 13.07X and the sector’s 13.56X. In the past five years, the industry has traded as high as 58.62X, as low as 8.78X and at a median of 18.79X, as the chart below shows.

EV/EBITDA Ratio (Past Five Years)

2 Stocks Worth Buying

PACCAR: This is one of the leading names in the trucking business, with reputed brands like Kenworth, Peterbilt and DAF. The DAF lineup, comprising the XF, XG and XD models, augurs well. Hydrogen fuel-cell Kenworth T680E and battery-powered Peterbilt 579 showcase PACCAR’s commitment to providing emissions-free commercial vehicles. Accelerated efforts toward electrification, connected vehicle services and advanced driver-assistance system options are set to bolster the company’s prospects. For PACCAR Parts’ segment, an expanding network of parts distribution centers, dealer locations and independent TRP stores, along with managed dealer inventory and innovative e-commerce systems, are aiding prospects. The firm’s low leverage and investor-friendly moves instill confidence. PACCAR’s strong balance sheet is complemented by A+/A1 credit ratings assigned by Standard & Poor's and Moody's, respectively.

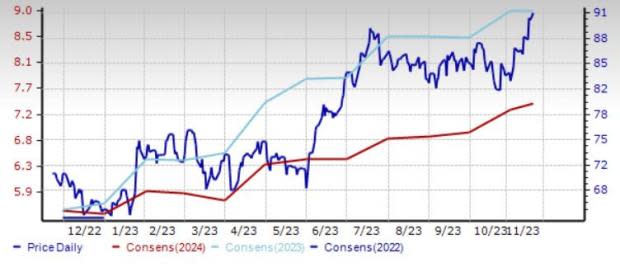

The Zacks Consensus Estimate for PCAR’s 2023 sales and earnings suggests year-over-year growth of 20% and 56%, respectively. The consensus mark for 2023 and 2024 earnings has moved north by 43 cents and 35 cents, respectively, in the past 30 days. PCAR currently carries a Zacks Rank #2 (Buy) and has a VGM Score of A.

Price & Consensus: PCAR

Canoo: This is a mobility technology company that designs, engineers, develops and manufactures electric vehicles, mainly delivery vehicles and pickups, for commercial and consumer markets in the United States. The company recently announced a significant milestone of delivering its initial batch of Oklahoma-manufactured electric vehicles to the state. This signifies the commencement of Canoo's phased manufacturing in Oklahoma, with Lifestyle Delivery Vehicle models set to be shipped to key customers and partners in 2023, followed by a ramp-up in production units in 2024.The company entered the revenue generation stage, posting its first-ever revenues of $519,000 in the third quarter of 2023.

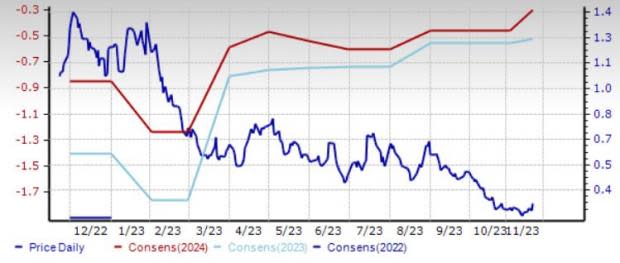

The Zacks Consensus Estimate for GOEV’s 2023 and 2024 earnings indicates year-over-year growth of 69% and 53%, respectively. The company managed to pull off an earnings beat in the trailing four quarters, the average surprise being 26%. PCAR currently carries a Zacks Rank #2 and has a VGM Score of A.

Price & Consensus: GOEV

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

Canoo Inc. (GOEV) : Free Stock Analysis Report