These 2 “Strong Buy” Penny Stocks Could Soar to $17 (Or Higher), Say Analysts

Let’s take a moment to talk about opportunity, share price, and risk/reward considerations. These are some of the factors investors must consider when moving into penny stocks – and we haven’t even touched on the fundamental soundness of the company or its business model.

Penny stocks – as their name suggests, they once traded for just a pennies per share, but these days are considered those equities trading at less than $5 – are a challenging market niche. The penny stock critics make valid points when defending their stance. Sure, the price tag may look like a steal, but the fact that shares are trading at such low levels could reflect overwhelming headwinds or weak fundamentals.

That being said, the fans offer up a solid argument as well. Not only does the low price mean you get more shares for your money, but hefty returns are also on the table. Even seemingly insignificant share price appreciation can result in colossal percentage gains that other more well-known or expensive names aren’t as likely to deliver.

The nature of these investments presents somewhat of a dilemma. How are investors supposed to separate the penny stocks that are ready to take off on an upward trajectory from those set to remain down in the dumps?

To help with the due diligence process, we used TipRanks’ database to zero in on only the penny stocks that have received bullish support from the analyst community. We found two that are backed by enough analysts to earn a “Strong Buy” consensus rating. Not to mention each offers up massive upside potential and could climb to $17 or even higher.

AlloVir, Inc. (ALVR)

We’ll start with AlloVir, a clinical-stage biopharma company working on new allogenic, virus-specific T cell therapies (VSTs) to target a range of dangerous viral diseases with high unmet medical needs. The company’s drug candidates are developed on a proprietary platform and are designed as off-the-shelf VSTs to restore patients’ immunity and act as treatments or preventative therapies.

The most advanced of AlloVir’s drug candidates has successfully completed its proof-of-concept trials and is now undergoing late-stage pivotal testing against multiple viruses. The candidate, posoleucel, targets six pathogens – adenovirus (AdV), BK virus (BKV), cytomegalovirus (CMV), Epstein-Barr virus (EBV), human herpesvirus 6 (HHV-6), and JC virus (JCV). Posoleucel is showing promise in its clinical trials and has the potential to radically transform the standard of care for patients undergoing organ transplants.

The company has released positive data from the Phase 2 trial of the drug in the treatment of BK disease in kidney transplant patients. This development was complemented by continuing enrollment in no fewer than three Phase 3 global registrational trials of posoleucel, for which data releases are expected in 2H24. These include the treatment of AdV infection, the treatment of vHC (virus-associated hemorrhagic cystitis), and the prevention of clinically significant infection or disease from AdV, BK, CMV, EBV, HHV-6, and JCV.

One of the company’s largest corporate shareholders, Gilead Sciences, apparently likes what it sees. The pharma giant made a large purchase, totaling ~2.93 million shares at the end of Q2. This brings Gilead’s total holding in ALVR to ~16.63 million shares, valued at more than $41 million at current prices.

With ALVR shares trading for $2.50, some analysts also think that now is the time to pull the trigger.

Among the bulls is Bank of America’s Jason Zemansky who sees several reasons to back this name. The analyst writes, “Supported by solid phase 2 proof-of-concept data and given high unmet need, we think lead asset posoleucel has compelling and underappreciated upside (2030e BofA $1.5B vs. cons $1.3B) – with three ongoing pivotal studies capable of driving a near-term re-rating (data expected mid-24)… With limited downside risk at current levels in concert with a catalyst rich 18 mos that could see AlloVir transition into a commercial stage company, we see positive risk/reward for shares.”

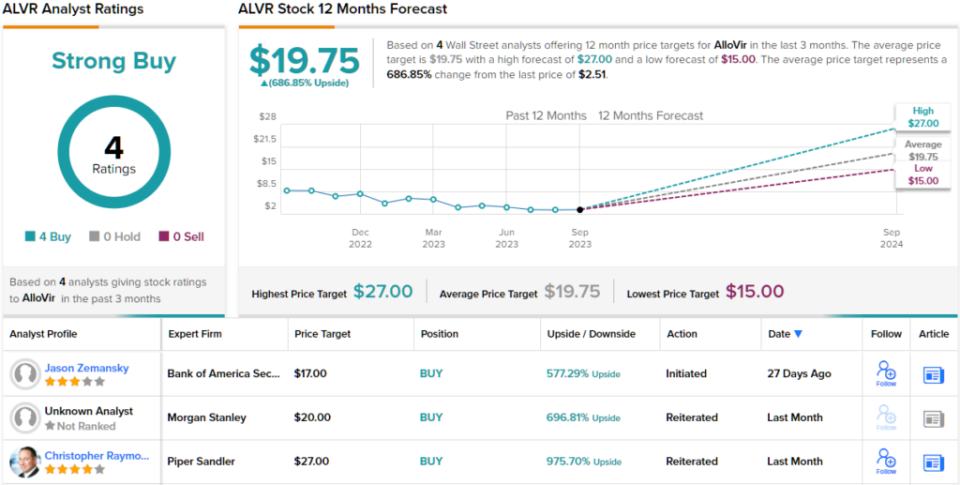

In line with his bullish stance, Zemansky rates ALVR a Buy, and his $17 price target implies room for a stunning 577% upside potential in the next 12 months. (To watch Zemansky’s track record, click here)

While highly bullish, this is no outlier among the analyst views of AlloVir. The stock has 4 recent positive reviews, for a unanimous Strong Buy consensus rating. The stock has a $19.75 average price target, suggesting an impressive ~687% upside potential from the current share price. (See ALVR stock forecast)

Delcath Systems (DCTH)

The second penny stock we’re looking at here is Delcath Systems, a biotech firm focused on interventional oncology. The company specializes in the development of minimally invasive surgical treatments designed to enhance the effectiveness of chemotherapies.

Delcath has developed two primary products, both proprietary. The first is the HEPZATO Kit, designed for melphalan hydrochloride for injection/hepatic delivery system. The second is the CHEMOSAT, a hepatic delivery system for melphalan percutaneous hepatic perfusion, or PHP. Both products are optimized to administer a high dose of chemotherapy drugs directly to the liver while also controlling the general systemic exposure and side effects that can accompany a PHP procedure.

For cutting-edge biotech companies, the ‘Holy Grail’ is regulatory approval or a positive step in that direction. Delcath has already achieved this feat, receiving FDA approval on August 15 for the use of the Hepzato Kit in the treatment of metastatic uveal melanoma—an eye cancer known for metastatic involvement of the liver. This regulatory approval makes Delcath’s product the only FDA-approved liver-directed therapy for this cancer.

The regulatory approval caught the attention of BTIG analyst Marie Thibault, who wrote of Delcath: “We believe the company’s percutaneous hepatic perfusion system offers a safe, effective treatment option for metastatic uveal melanoma (mUM). With FDA approval in hand, we view DCTH as a compelling investment that hinges on commercial execution and treatment adoption. We think the strong clinical data from the FOCUS trial can support gradual treatment adoption and believe peak annual sales in the U.S. can top $250M. In addition, DCTH has multiple indications in the pipeline that could offer a significantly larger market opportunity over the long term.”

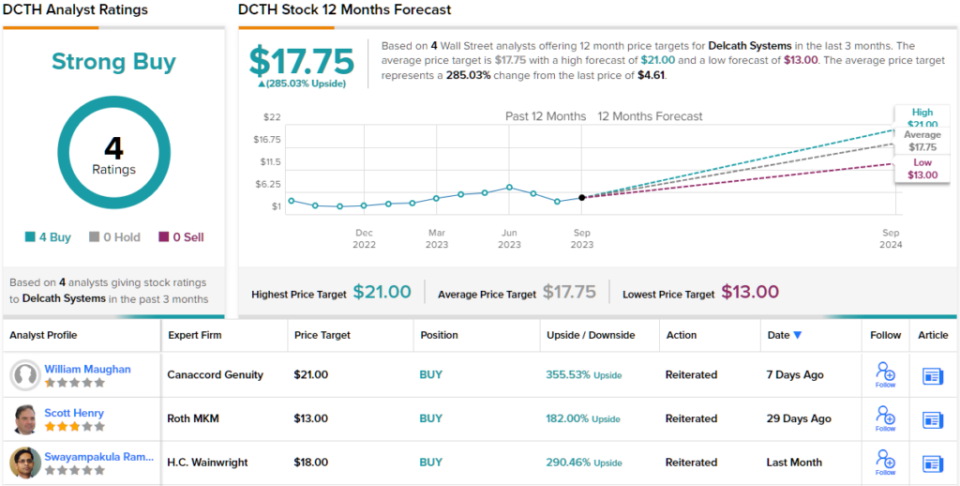

Quantifying her bullish stance, Thibault gives the stock a Buy rating along with a $20 price target, implying a robust 328% upside potential on the one-year horizon. (To watch Thibault’s track record, click here)

Once again, we’re looking at a stock with a unanimously positive Strong Buy analyst consensus rating, based on 4 recent analyst reviews. DCTH is selling for $4.67, and its $17.75 average price target points toward a one-year gain of 285%. (See DCTH stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.