These 2 ‘Strong Buy’ Penny Stocks Could Go Boom, Say Analysts

Nearly three months into 2024, it’s clear that the bullish trends are here to stay. Markets hit a bottom in late October, but since then the S&P 500 has gained 27% and now stands at more than 5,200. The NASDAQ index is up 30% from its own October 27 low point. These are bull-market numbers, and show little sign of stopping.

Watching the market from Oppenheimer, chief investment strategist John Stoltzfus comments on the market outlook: “S&P 500 earnings results over the most recent two quarterly reporting seasons, economic data that persists in showing resilience, the Fed’s mandate-sensitive monetary policy, and prospects for innovation coupled with cross generational demographic needs that suggest a shift in mindset driven not so much by fear and greed but a need to invest for intermediate to longer-term goals suggest to us an opportunity to tweak our target higher… We are increasing our year-end target price for the S&P 500 to $5,500 (from $5,200).”

The growing appetite for risk among investors bodes well for the overall stock market, but it is especially good for the higher-risk stocks. For those willing to embrace this risk, the potential rewards can be substantial. The penny stocks, equities priced below $5 per share, exemplify this combination of risk and reward, with the potential to double or even triple the initial investment.

Given the inherent volatility of these investments, Wall Street analysts recommend doing some due diligence before pulling the trigger, noting that not all penny stocks are bound for greatness.

With this in mind, we set out on our own search for compelling investments that are set to boom. Using TipRanks’ database, we pulled two penny stocks that have amassed enough analyst support to earn a “Strong Buy” consensus rating. Not to mention, each offers massive upside potential.

Lineage Cell Therapeutics (LCTX)

First up is a micro-cap biotherapeutic firm working to create cell therapies that target severe conditions with high unmet medical needs. The company uses a proprietary cell-based platform to develop its therapies and can create lines of terminally-differentiated human cells capable of supporting or replacing cells that are dysfunctional or absent due to injury or degenerative disease. The company’s drug candidates, designed on this platform, assist the natural immune system in putting up an effective defense against a wide range of conditions.

Lineage currently has five candidates in its research pipeline. Three of these are in preclinical stages – but the other two are undergoing human clinical trials. Of these, the more advanced is OpRegen, an ophthalmological drug being tested in the treatment of dry AMD with geographic atrophy.

Lineage is developing this drug in a partnership agreement with Roche affiliate Genentech, which promises lucrative future royalties. For now, the key developments revolve around upcoming data releases. Study results from the Phase 1/2a clinical trial, covering 24 months of testing, are set for release at the 2024 Retinal Cell & Gene Therapy Innovation Summit, scheduled for May 3. The company’s presentation will include long-term follow-up data from 10 out of 12 patients, covering anatomical and functional results.

OpRegen is the subject of an ongoing Phase 2a study on the optimization of subretinal surgical delivery. The study will evaluate safety and activity in up to 60 patients and began in March of last year. The trial is being run by Roche and interim data from the study is likely to be Lineage’s next major catalyst.

Covering Lineage for Baird, analyst Jack Allen is enthusiastic about OpRegen as the company’s main draw for investors. He writes of the program’s overall prospects, “We continue to believe OpRegen’s profile which features both positive anatomical and functional changes is differentiated in the GA space. For context, neither of the approved GA therapies have been shown to improve vision function (not even slow decline), rather they were primarily approved on studies focused on slowing lesion growth… With an estimated ~2.5M GA patient in the developed markets (US and EU) and no approved treatments for this disease we believe that Roche’s annual sales of this asset could easily top $4B, which could translate to over $500M in annual royalties to Lineage, a dynamic that should drive significant upside to Lineage’s valuation in the long term.”

“Moving forward, we remain positive on the potential for Lineage’s cell therapy pipeline and anticipate investor appreciation for the OpRegen opportunity will increase in the coming months as additional data are presented,” the analyst added.

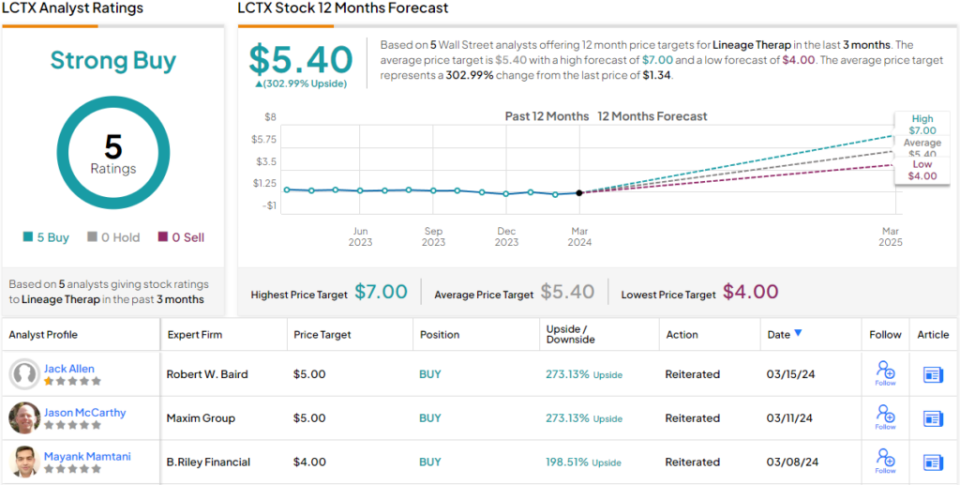

To this end, Allen rates LCTX shares an Outperform (i.e. Buy), while his $5 price target shows his confidence in a robust 275% upside potential for the next 12 months. (To watch Allen’s track record, click here)

Overall, the Strong Buy consensus rating on Lineage’s shares is unanimous, based on 5 recent positive analyst recommendations. The shares are trading for $1.35 each, and the $5.40 average price target, even more bullish than the Baird view, suggests that a one-year gain of ~303% lies ahead. (See LCTX stock forecast)

MDxHealth (MDXH)

From biopharmas, we’ll switch over to medical diagnostics. MDxHealth is another micro-cap firm in the healthcare sector, but rather than focus on treatment options, its work is aimed at early detection. The company is working to commercialize precision diagnostics that provide medical professionals and patients with actionable molecular information needed to create personalized treatment plans.

MDxHealth does this by using proprietary genomic, epigenetic, and other molecular technologies to develop accurate tests to make diagnoses and prognoses for urologic cancers and other urologic diseases. The company has several diagnostic tests on the market, including three focused on prostate cancer and one on urinary tract infections.

The company’s two main products are the Select mdx test for prostate cancer, used pre-biopsy, and the Confirm mdx test for prostate cancer, used post-biopsy. The first is used as a screener for aggressive prostate cancer. It is a urine test, proven to be highly predictive, given to men at risk for the disease before initial biopsies are conducted. The second test is given after a negative biopsy and is used to identify patient populations with clinically significant, but undetected, prostate cancer.

This company recently released its financial results for 4Q23 and showed sound revenues and a deeper-than-anticipated earnings loss. At the top line, the company’s quarterly revenue of $19.39 million was up 50% year-over-year – and it skated over the forecast by just under half a million dollars. At the bottom line, the company’s GAAP EPS of 39 cents missed the forecast by 8 cents per share. We should note here that MDxHealth’s revenues have been on an upward trend since the beginning of last year.

For BTIG analyst Mark Massaro, this stock shows clear potential in a growth field. Massaro writes of the company, “MDx Health executed nearly flawlessly operationally in 2023 and announced it is evaluating a number of growth opportunities in the form of new partnerships or possible acquisitions… MDXH delivered another strong quarter as it drove a Q4 revenue beat and reiterated that its 2024 revenue guide is above where we/the Street were modeling as they guided for +12-15% Y/Y growth. We think there is upside to this guide and for context, MDXH drove +89% Y/Y revenue growth in 2023 and +42% Y/Y organically. We view MDx Health as an attractive small-cap growth and value stock and a one-stop-shop in prostate diagnostics testing, and trades at just ~1.1x our 2025 rev estimate of $90M, below peer historical averages of ~3-7x.”

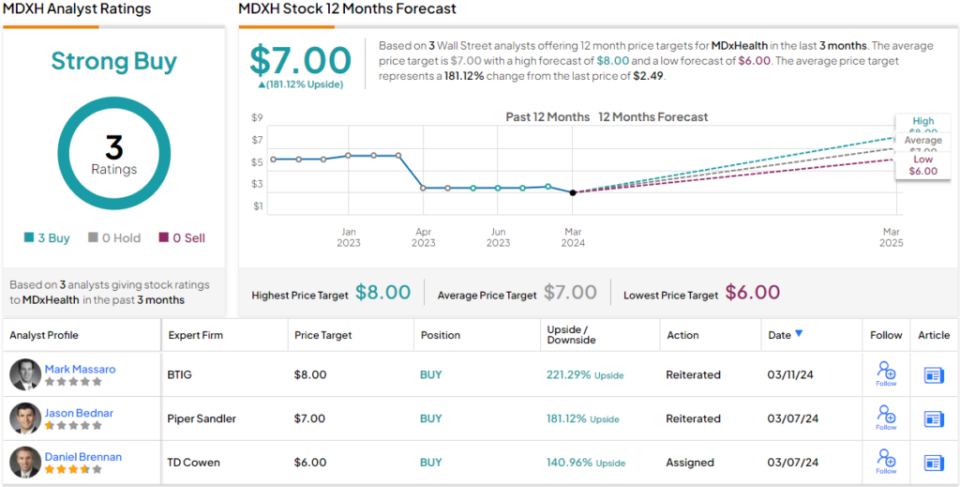

Looking ahead, Massaro quantifies his stance with a Buy rating and an $8 price target that suggests a 221% upside potential on the one-year horizon. (To watch Massaro’s track record, click here)

All in all, there are 3 recent analyst reviews of this micro-cap stock, and they are all positive – giving the shares a unanimous Strong Buy consensus rating. The stock’s $7 average target price and $2.49 trading price together imply a one-year upside of 181%. (See MDxHealth stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.