2 Supercharged Tech Stocks to Buy Without Any Hesitation

With the Nasdaq Composite index soaring about 60% from its bear market lows, it has become increasingly difficult to find reasonably priced tech stocks. However, by focusing on fast-growing businesses operating in markets with decades-long tailwinds, investors can locate a handful of top-tier stocks with reasonable valuations.

CrowdStrike (NASDAQ: CRWD) and Clear Secure (NYSE: YOU) are two companies that fit this bill, growing sales by 36% and 40%, respectively, in 2023. Both are in cybersecurity: CrowdStrike's platform reduces the number of vendors a company needs to protect itself from threats, and Clear Secure's biometric identity solutions make security checkpoints easier to manage.

Here's the case for buying these two supercharged tech stocks today.

CrowdStrike: The cybersecurity consolidator

Powered by artificial intelligence (AI) and machine learning (ML), CrowdStrike's Falcon platform offers over 20 modules -- unique cybersecurity products -- to its customers. Covering areas like cloud and endpoint security, threat exposure management, and information technology (IT) automation, CrowdStrike's multitude of modules makes it a perfect choice for vendor consolidation.

A recent study by research firm Gartner found that 75% of businesses are seeking to consolidate the number of cybersecurity vendors they work with. Against that backdrop, CrowdStrike's breadth of offerings is becoming increasingly valuable. In fact, 64% of the company's customers already use five or more modules, and 27% use seven or more, highlighting CrowdStrike's consolidating prowess. With most clients adopting many modules, the company has 580 customers spending over $1 million annually across its platform, which grew by 33% in 2023.

This long list of clients gives the company a massive trove of data to feed back into its AI-powered threat graph. Filtering through over 1 trillion data points daily, the company grows more robust with each new customer it adds and each new module its clients buy. As its network grows stronger with each customer and module added, it becomes a more attractive offering to prospective clients, creating a virtuous cycle.

Powered by this burgeoning network effect, CrowdStrike has seen its revenue rise 12-fold since its 2019 initial public offering, propelling its share price up over 400% over the same time.

This leaves the young cybersecurity company trading with a seemingly hefty market cap of roughly $78 billion at recent prices. However, with consulting firm McKinsey projecting the cybersecurity industry to grow from $150 billion today to between $1.5 trillion and $2 trillion over the long term, this market cap could prove comically undersized by 2034.

Home to a long list of awards and leadership designations from research firms like Gartner and Forrester, CrowdStrike is well positioned to remain the most significant disruptor in the cybersecurity space. This leadership recognition, paired with the company's growing array of modules, its ever-expanding network, and impressive ability to generate free cash flow (about one-third of revenue this past year), make CrowdStrike the perfect tech stock to buy today and add to over time.

Clear Secure: High growth, abundant cash, and a low valuation

Whereas CrowdStrike aims to serve as many customers in as many cybersecurity niches as possible, Clear Secure has one primary focus: identity verification. Best known for its 147 Clear Plus members-only priority lanes in 56 airports across the United States, Clear Secure helps its members quickly pass through security checkpoints using its biometric identity verification capabilities.

For $189 annually, customers can access these priority lanes by uploading a driver's license or passport on the Clear mobile app or at an airport kiosk. This time-saving and stress-reducing solution has proven to be a no-brainer for frequent flyers, with Clear Secure now home to 6.7 million paying members, which grew by 31% in 2023.

In addition to these members, the company counts 13 million non-paying members who use the Clear app to get flight details such as gate numbers or the estimated walking time to a terminal. This "Home to Gate" feature pairs perfectly with the company's free Reserve solution, which lets members book a time to go through security (but not be expedited through, like a Clear Plus member).

Best yet for investors, the company has ambitions to expand its identity verification prowess into new channels. Through its business-to-business product, Clear Verified, the company has partnered with enterprises in pro sports leagues, e-commerce, retail, financial services, hospitality, and healthcare. One major success story in this new growth area is its partnership with LinkedIn, where members could affirm their identities for free through Clear Secure and receive an indicator of their verification on the site.

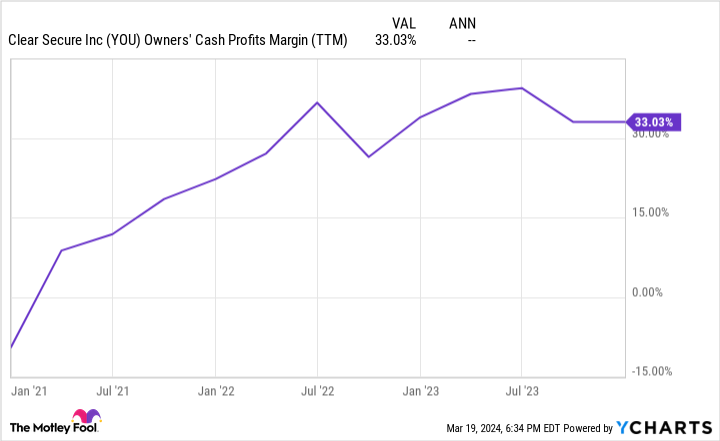

Armed with this growing number of use cases, it may be no surprise to learn that Clear Secure's revenue grew by 40% in 2023. While this growth is exciting in its own right, it was possibly outshined by the company's ballooning free cash flow margin of 33%.

And these results should not be a one-time feat. In fact, this free cash flow -- along with Clear Secure's sales -- should rise by more than 30% in 2024, according to management.

The cherry on top for investors? Despite this shift toward powerful cash creation, the company trades at a cheap valuation of just 9 times FCF.

Armed with over $700 million in cash and marketable securities, no debt, and nearly $200 million in FCF coming through the door in 2023, management boosted its share repurchase authorization to $128 million, to take advantage of today's low valuation. On top of these buybacks, this cash hoard should easily fund a growing dividend that yields around 1.3% at recent prices -- especially as these payouts only use 16% of Clear Secure's annual FCF.

This combination of high sales growth, strong FCF generation, abundant cash returns to shareholders, and a discounted valuation makes Clear Secure a stellar tech stock to buy without hesitation.

Should you invest $1,000 in CrowdStrike right now?

Before you buy stock in CrowdStrike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

Josh Kohn-Lindquist has positions in Clear Secure and CrowdStrike. The Motley Fool has positions in and recommends Clear Secure and CrowdStrike. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

2 Supercharged Tech Stocks to Buy Without Any Hesitation was originally published by The Motley Fool