2 Top Ranked Utilities Stock to Buy After the Steep Correction

Following the steep rally in interest rates, the Utilities Sector has experienced its worst sell-off since the financial crisis. Defensive investors have rotated from Utilities into Treasuries now that the fixed income instruments are offering nearly 5% yields. It is hard to blame them when they can get such generous yields with practically zero risk.

However, at these levels, a number of utilities stocks look extremely appealing, with nice dividend yields, strong earnings expectations, and very little risk. Furthermore, if you look for those stocks which are showing relative strength against the industry and top Zacks Ranks, there are some real gems.

Image Source: TradingView

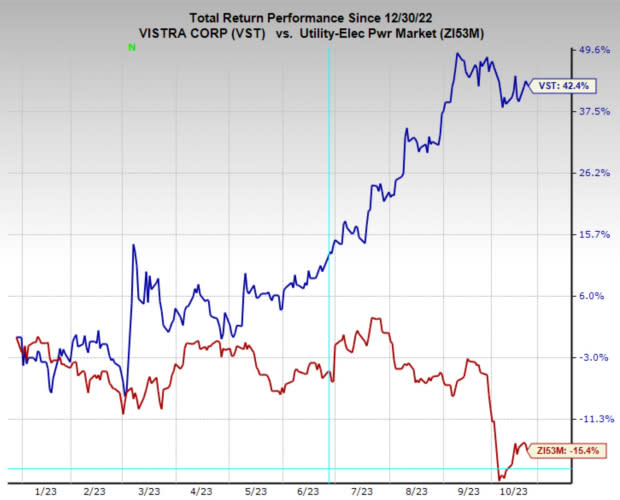

Vistra

Vistra VST is a leading integrated power company that operates across the energy value chain. With a diverse portfolio, it offers electricity generation, wholesale energy sales, and retail services to residential and commercial customers. The company focuses on sustainable and efficient energy solutions while managing a range of energy sources, including natural gas, coal, and renewables.

Vistra has far outperformed the sector YTD and has even outperformed the broad market. It also pays a dividend yield of 2.5% and has raised the payment by an average of 13.3% annually over the last five years.

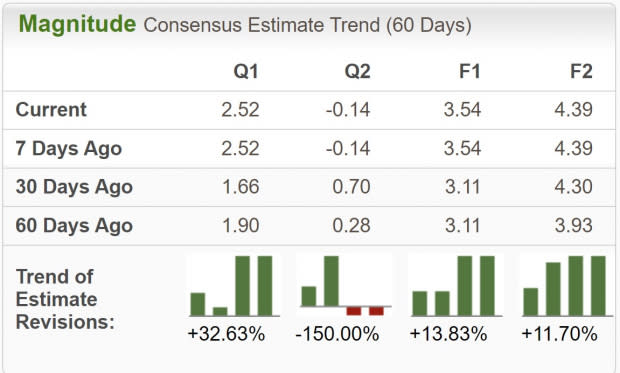

Image Source: Zacks Investment Research

Excluding next quarter’s earnings, analysts have revised earnings estimates significantly higher over the last two months. Current quarter earnings have been increased by 33% and are expected to grow 67% YoY to $2.52 per share, while FY23 earnings are forecast to climb 220% YoY to $3.54 per share. Vistra boasts a Zacks Rank #1 (Strong Buy) rating.

Image Source: Zacks Investment Research

In addition to very reasonable earnings multiple of 9.1x, which is below the industry average of 13x, and below its five-year median of 11.2x, VST has a very nice technical trade setup.

If VST stock can trade above the $32.80 level, it should make a run for the highs. Alternatively, if it trades below the $31 level, it may be worth waiting for another opportunity.

Image Source: TradingView

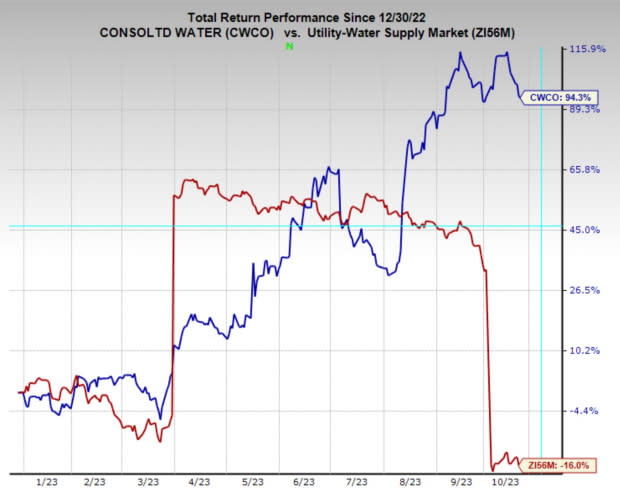

Consolidated Water

Consolidated Water CWCO is a water solutions company that engages in the development and operation of seawater desalination plants and water distribution systems. Headquartered in the Cayman Islands, the company provides fresh water through its desalination facilities to various locations, particularly in the Caribbean region. Consolidated Water focuses on sustainable water supply solutions, addressing water scarcity challenges in areas with limited access to fresh water sources.

Consolidated Water has well outperformed the sector YTD and has put up strong returns over the last decade. The stock has compounded at an annual rate of 9% over the last decade.

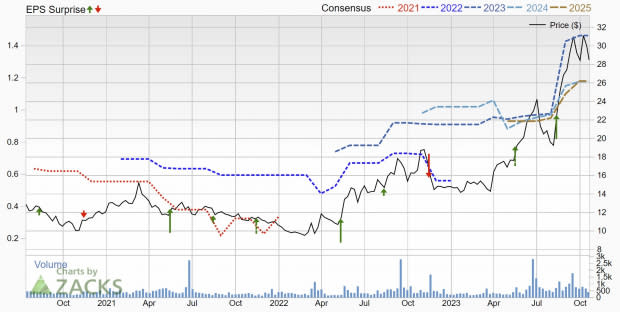

Image Source: Zacks Investment Research

Earnings estimates have gone vertical in the last month as analysts have unanimously upgraded CWCO stock, giving it a Zacks Rank #1 (Strong Buy) rating. Current quarter earnings estimates have been raised by 12% and are projected to grow a whopping 660% YoY to $0.38 per share.

Image Source: Zacks Investment Research

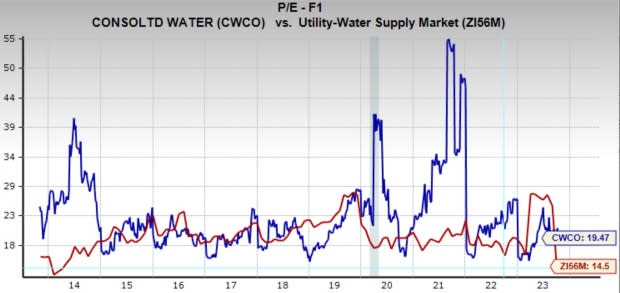

CWCO is trading at a one year forward earnings multiple of 19.5x, which is above the industry average of 14.5x, and below its 10-year median of 21.3x.

Image Source: Zacks Investment Research

Bottom Line

If you want steady returns, with the potential to outperform the market at current levels, look no further than top-ranked utility stocks. Both Consolidated Water and Vistra are two of the top performing names in the sector whose businesses are unlikely to be at risk any time in the foreseeable future.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Consolidated Water Co. Ltd. (CWCO) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report