2 Top Stocks to Profit From the Buoyant Auto Retail Industry

The Zacks Auto Retail and Whole Sales industry is set for robust growth, driven by high demand for new vehicles amid improved inventory levels. Additionally, rising prices of new vehicles will also boost margins. However, falling used car prices pose a challenge, squeezing profits for both retail and wholesale dealers.

Meanwhile, mergers and acquisitions are fueling growth and scalability. Digitization is also playing a pivotal role, offering enhanced customer engagement and convenience. Striking a balance between digital innovation, cost management and customer experience will be crucial for sustained success in the evolving auto retail landscape. If you want to cash in on the encouraging prospects of the retail auto industry, consider investing in Group 1 Automotive GPI and Rush Enterprises RUSHA.

Industry Overview

The automotive sector’s performance depends on the retail and wholesale network. Through dealership and retail chains, companies in the Zacks Auto Retail and Whole Sales industry carry out several tasks. These include the sale of new and used vehicles, light trucks as well as auto parts, execution of repair and maintenance services and arrangement of vehicle financing. The industry is dependent on business cycles and economic conditions. Consumers and businesses spend more on big-ticket items when they have higher disposable income. On the contrary, when income is tight, discretionary expenses are the first to be slashed. Importantly, the coronavirus pandemic has brought considerable changes in the operating environment, with the industry focusing more on e-commerce retailing.

Key Themes Influencing the Industry

High Demand for New Vehicles to Act as Key Catalyst: Auto retailers are poised to benefit from a surge in new vehicle sales as demand for personal mobility and new models continues to grow. Total new-vehicle sales in the United States are projected to reach 1,381,200 units in June 2023, marking a significant 22.6% increase year over year. Pent-up demand and improving inventory levels will boost sales. Retail sales are expected to rise 16.6% in June. Additionally, new vehicle prices are also on the rise, with consumers estimated to spend $47.9 billion on new vehicles, representing a $6 billion increase from June 2022.

M&A Activities Driving Growth and Scalability: Mergers and acquisitions are playing a vital role in driving growth within the industry. A surge in consolidation is underway, with 2021 marking a significant year for dealership M&A activities. This trend has continued into 2022 and 2023 as well, with dealerships actively pursuing expansion and capitalizing on economies of scale. Both large and smaller dealer groups are seeking to broaden their market reach by adding more stores, enabling a wider selection of vehicles across various price points and expanding their customer base geographically. These strategic expansion efforts are enhancing the scalability, revenue generation, and competitive edge of auto retailers. Dealership mergers and acquisitions are reshaping the industry, fostering increased profitability and operational efficiency.

Digitization Driving Success: The auto retail industry has embraced digitization, leveraging online platforms and services for enhanced customer engagement and convenience. Initiatives like home delivery and curbside pick-up are driving increased online traffic. Advanced digital solutions offer shoppers a personalized and comprehensive experience. With the momentum of digitization gaining strength, auto retail companies are well-positioned to achieve unprecedented levels of success, leveraging the power of technology to propel their growth and meet evolving customer expectations. Balancing digital innovation with cost management, optimizing operations and prioritizing customer experience are crucial for industry participants.

Falling Used Car Prices to Squeeze Profits: The falling prices of used vehicles are expected to negatively impact the profitability of both retail and wholesale auto dealers. In May, wholesale used vehicle prices hit their lowest point of the year, coinciding with a decline in sales due to high interest rates and inflated retail prices. Cox Automotive's Manheim Used Vehicle Value Index (which tracks the prices of used vehicles sold at wholesale auctions) reported a 2.7% drop in prices from April to May at wholesale auctions. Additionally, Cox estimates an 11% year-over-year decrease in used retail sales for May. These declines in sales and wholesale prices indicate a weakening used vehicle market, posing challenges for U.S. auto dealers.

Zacks Industry Rank Indicates Encouraging Outlook

The Zacks Auto Retail & Whole Sales industry is a nine-stock group within the broader Zacks Auto-Tires-Trucks sector. The industry currently carries a Zacks Industry Rank #111, which places it in the top 44% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates promising near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are confident in this group’s earnings growth potential. Over the past six months, the industry’s earnings estimates for 2023 have increased around 3.6%.

Before we present a couple of stocks that you may place your bets on, let’s take a look at the industry’s recent stock-market performance and valuation picture.

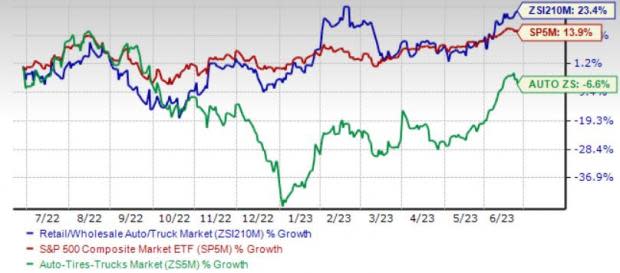

Industry Tops Sector and S&P 500

The Zacks Auto Retail & Whole Sales industry has outperformed the Zacks S&P 500 composite as well as the Auto, Tires and Truck sector over the past year. The industry has gained 23.4% over this period compared with the S&P 500’s growth of 13.9%. Meanwhile, the sector has declined 6.6% over the same timeframe.

One-Year Price Performance

Industry's Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the enterprise value/ earnings before interest tax depreciation and amortization (EV/EBITDA) ratio.

On the basis of the trailing 12-month EV/EBITDA, the industry is currently trading at 6.07X compared with the S&P 500’s 13.23X and the sector’s trailing 12-month EV/EBITDA of 13.29X.

Over the past five years, the industry has traded as high as 10.09X, as low as 4.25X and at a median of 6.54X, as the chart below shows.

EV/EBITDA Ratio (Past 5 Years)

Fuel Your Portfolio With These 2 Auto Retail Stocks

Group 1: It is one of the leading automotive retailers in the world, with operations primarily located in the United States and the UK. Group 1’s acquisitions of dealerships and franchises to expand and optimize its portfolio are likely to boost the firm’s prospects. So far this year, GPI acquired companies with a total expected annualized revenues of around $1 billion. Group 1 is also riding on the strength of its aftersales business and anticipates trends to remain robust for the rest of 2023. The company has hiked its dividend 12 times in the last five years, with an average annualized growth rate of 11.04%.

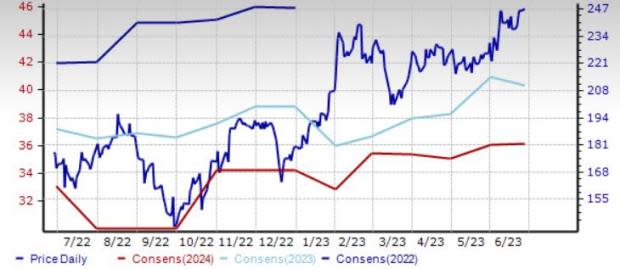

Group 1 carries a Zacks Rank #2 (Buy) and has a VGM Score of A. The Zacks Consensus Estimate for GPI’s 2023 sales implies growth of 3%. The consensus mark for 2023 and 2024 EPS has moved north by 34 cents and 10 cents, respectively, in the past 30 days. The company surpassed earnings estimates in the last four quarters, the average being 9.7%.

Price & Consensus: GPI

Rush: It is a leading provider of solutions to the commercial vehicle industry. The company is known for the ownership and operation of Rush Truck Centers, which is the largest network of commercial vehicle dealerships across North America. With over 150 locations spanning 23 states and Ontario, Canada, including 125 franchised dealership locations, Rush is a dominant force in the industry. Strong FCF generation, disciplined expense management approach and investor-friendly moves are praiseworthy. Rush has increased its payout six times in the last five years, with an average annualized growth rate of 32.3%. The company aims to generate $10 billion in annual revenues by 2027.

Rush carries a Zacks Rank #2 and has a VGM Score of A. The consensus mark for 2023 and 2024 EPS has moved north by 27 cents and 2 cents, respectively, in the past 60 days. The long-term earnings growth rate for the company is pegged at 15%, higher than the industry’s 10%.

Price & Consensus : RUSHA

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

Rush Enterprises, Inc. (RUSHA) : Free Stock Analysis Report