2 Top Tech Stocks That Could Make You a Millionaire

The tech industry has a long history of providing investors with reliable gains. Since 2019, the Nasdaq-100 Technology Sector has risen more than 135%, far exceeding the S&P 500's 82% growth.

The innovative nature of tech makes it an ever-expanding space where companies benefit from consistent demand for various hardware and software upgrades. So it's not surprising that Warren Buffett's holding company Berkshire Hathaway has dedicated at least 45% of its portfolio to tech stocks. Meanwhile, Berkshire's portfolio posted a nearly 20% compound annual gain from 1965 to 2023 and is now worth $370 billion.

In 2023, a boom in artificial intelligence (AI) captivated Wall Street. Excitement over the budding market sent numerous tech stocks soaring, with growth unlikely to slow soon. The generative technology can potentially boost countless markets, from consumer products to cloud computing, autonomous vehicles, machine learning, and more.

The tech industry has made a lot of millionaires over the years but has plenty of room left to run, with the AI market on its own projected to expand at a compound annual growth rate of 37% through 2030, hitting nearly $2 trillion.

So here are two top tech stocks that could make you a millionaire.

1. Alphabet

As the home of brands including Android, YouTube, Chrome, and the many products under Google, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has become a tech behemoth. The company attracts billions of users to its offerings and has a long history of delivering consistent gains to its investors.

Over the past five years, Alphabet's annual revenue climbed 90% to $307 billion, while operating income rose 135% to $84 billion. And in that period, its stock soared 146%.

Alphabet built a lucrative digital advertising business, which has become its biggest growth catalyst. With more than 80% of the search-engine market and supremacy in online video sharing and smartphone operating systems, the tech company has almost endless opportunities for ad revenue.

In Alphabet's most recent quarter, the fourth quarter of 2023, revenue increased by more than 13% year over year, beating expectations by $1 billion. Ad revenue slightly missed expectations in the quarter. However, its AI-focused Google Cloud segment posted revenue growth of 26% to $9 billion. Meanwhile, Google Cloud's operating income reached $864 million, versus the $186 million in losses it reported in the year-ago period.

The company's gradual expansion into AI is promising, as it could boost multiple areas of its business. Alphabet could offer more efficient advertising, create a search experience closer to ChatGPT, expand its AI cloud services, and more.

Alphabet is on an exciting growth path, with solid positions in multiple areas of tech. Meanwhile, its free cash flow hit $70 billion last year, indicating it has the funds to keep up with the completion and invest in its business.

Moreover, Alphabet is trading at a bargain to its competitors. This chart shows Alphabet has the lowest forward price-to-earnings (P/E) ratio among some of the most prominent names in tech.

Alongside a lucrative ad business, a growing role in AI, and a range of potent brands, Alphabet is a tech stock that could make you a millionaire over the long term and is worth considering this month.

2. Nvidia

Nvidia (NASDAQ: NVDA) has made a lot of millionaires over the last year, with its stock up 235% since February 2023. However, it appears to only just be getting started, suggesting it's not too late to see major gains from the chipmaker's stock.

Nvidia dominated the graphics processing unit (GPU) market for years, significantly ahead of rivals Advanced Micro Devices and Intel. The company's supremacy in the industry positioned it to immediately begin supplying its hardware to countless AI-minded companies right at the start of the AI boom last year.

As a result, Nvidia's earnings skyrocketed since the start of 2023, thanks to a spike in chip sales. In Q4 2024, ended in January, the company's revenue increased by 265% year over year to $22 billion. Meanwhile, operating income jumped 983% to nearly $14 billion. The monster growth was primarily owed to a 409% increase in data center revenue as GPU demand soared.

In addition to increased earnings, Nvidia's free cash flow is up 430% in the last year to more than $27 billion, significantly higher than AMD's $1 billion and Intel's negative $14 billion.

So, despite new GPU releases from both chipmakers, Nvidia's head start in AI potentially pushed it further ahead with greater cash reserves to continue investing in its technology and retain its market supremacy.

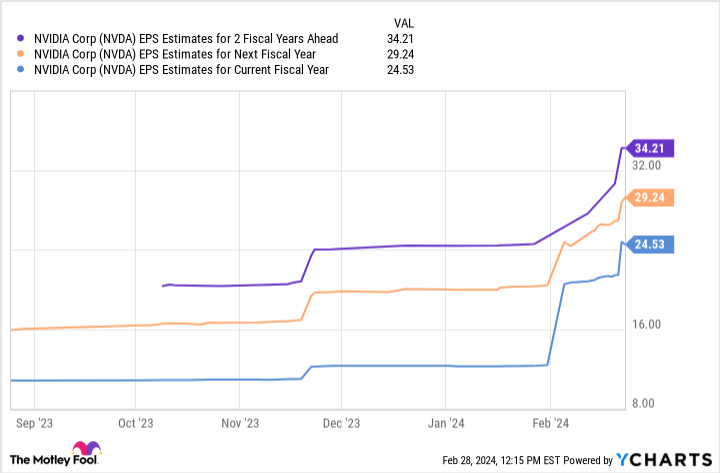

This chart shows Nvidia's earnings could hit $34 per share over the next two fiscal years. Multiplying that figure by the company's forward P/E of 32 yields a stock price of $1,094.

Considering its current position, these projections would see Nvidia's stock rise 39% by fiscal 2027. In addition to a dominating position in a high-growth market like AI, Nvidia is a screaming buy this month.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Berkshire Hathaway, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

2 Top Tech Stocks That Could Make You a Millionaire was originally published by The Motley Fool