2 Ultra-High-Yield Real Estate Stocks to Buy Hand Over Fist, and 1 to Avoid

Real estate can be a great spot to score a big-time income stream. Many real estate investment trusts (REITs) offer ultra-high dividend yields. That enables income-focused investors to generate a lot more income from every dollar they invest.

Realty Income (NYSE: O) and Vici Properties (NYSE: VICI) currently offer dividend yields approaching 6%, which is several times above the S&P 500's 1.3% dividend yield. That makes them great REITs to buy for income.

However, not all of the sector's eye-popping yields are worth it for income-focused investors. One REIT investors should avoid is AGNC Investment (NASDAQ: AGNC). Its nearly 15% dividend yield might not last forever.

A durable income stock

Realty Income has lived up to its name. The REIT has paid 645 consecutive monthly dividends throughout its 55-year operating history. Since coming public in 1994, the REIT has raised its payment 124 times, including for the last 106 consecutive quarters. It has grown its payout at a 4.3% compound annual rate since coming public and has never reduced its payment.

That steady upward march should continue. Realty Income expects to grow its adjusted funds from operations (FFO) at a 4% to 5% annual rate over the long term.

A few factors drive that view:

Durable income: Realty Income net leases its properties to high-quality tenants in industries relatively resistant to economic downturns and the pressures of e-commerce.

Long growth runway: The REIT's total addressable market opportunity is nearly $14 trillion. It has expanded its opportunity set by adding new property types (gaming, vertical farming, and data centers) and geographies (several European countries) to its portfolio. It also recently launched a real estate credit platform (preferred equity).

Strong financial profile: Realty Income has a low dividend payout ratio (about 75% of its adjusted FFO) and one of the highest credit ratings in the REIT sector.

The company has the financial flexibility to continue expanding its portfolio of income-producing real estate. That should enable it to grow its cash flow and big-time dividend (currently yielding almost 6%).

A low-risk wager

Vici Properties also offers a dividend yield approaching 6%. The REIT focused on gaming properties and experiential real estate has increased its payout in all six years since its formation. The payout has grown at a peer-leading 7.6% compound annual rate since the end of 2018.

That big-time dividend is on an extremely firm foundation. Vici Properties generates stable cash flow backed by very long-term net leases. It also has a conservative dividend payout ratio (around 75% of its adjusted FFO) and a strong investment-grade balance sheet.

The company's strong financial profile enables it to continue investing in experiential real estate. While it already owns many of the premier gaming properties in the U.S., it has expanded internationally and added new nongaming property types to its portfolio (experiential resorts, health and wellness properties, and destination golfing resorts). Because of that, it still has a very long growth runway ahead.

The risk of another cut looms large

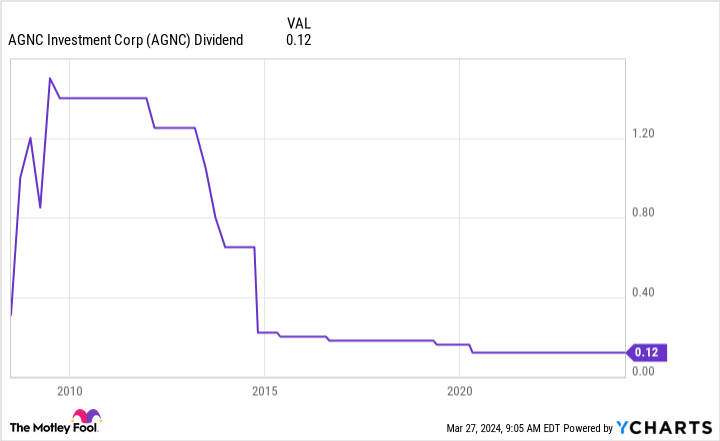

While Realty Income and Vici Properties have steadily increased their big-time dividends, AGNC Investment's payout has gone in the opposite direction:

The mortgage REIT has had to cut its dividend several times over the years because of the impact changes in interest rates have on its income. The company primarily invests in mortgage-backed securities (MBS) protected against credit losses by government agencies like Fannie Mae. While that eliminates one risk, it opens the door to another big one: reinvestment risk.

As borrowers repay their mortgages, AGNC must reinvest that money into new MBS investments. Changes in interest rates often leave it with no choice but to reinvest in lower-yielding MBS, which can impact the REIT's income. On the other side of the equation, rising interest rates make it more expensive for the REIT to borrow money to fund new MBS investments. These two dynamics can squeeze the margins it earns on its investments.

The company noted on its fourth-quarter call that it's currently earning enough on its investments to cover its overhead and dividend. However, if market conditions change, it might not be able to make enough money to cover its dividend. That potential for another dividend cut makes the REIT too risky for income-focused investors.

Focus on the more sustainable payouts

Realty Income and Vici Properties offer something AGNC Investment can't provide its investors: income sustainability. Whereas their payments are likely to continue rising, AGNC Investment's big-time dividend may get cut again. That's why income-focused investors should avoid its payout and buy the more sustainable dividends offered by Realty Income and Vici Properties instead.

Should you invest $1,000 in AGNC Investment Corp. right now?

Before you buy stock in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AGNC Investment Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Matt DiLallo has positions in Realty Income and Vici Properties. The Motley Fool has positions in and recommends Realty Income and Vici Properties. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Real Estate Stocks to Buy Hand Over Fist, and 1 to Avoid was originally published by The Motley Fool