2 Undervalued Dividend Aristocrats for Growth and Income

The Dividend Aristocrats are considered by many to be among the best dividend growth stocks in the market place.

These companies have attained Dividend Aristocrat status due to their strong business models and abilities to endure recessions. These names are among the largest in the world and have raised their dividend for at least 25 consecutive years.

There are currently just 67 Dividend Aristocrats, further proving how the exclusive nature of the index is and how difficult increasing distributions can be.

Warning! GuruFocus has detected 5 Warning Sign with MKC. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Just as important is total returns as buying overvalued stocks because of their income can often lead to poor results. This analysis will examine two Dividend Aristocrats that are trading below their intrinsic value that also offer market-beating dividend yields.

McCormick

The first name for consideration is McCormick & Co. (NYSE:MKC). Founded in the late 1800s, the company has transformed from a small, door-to-door business into a giant in the spice and seasoning industry. McCormick is valued at $21 billion and generates revenue of $6.4 billion annually.

One of the companys competitive advantages is simply its vast size compared to competitors. Today, McCormick controls roughly 20% of the spice and seasoning market, making it the largest name in a highly fragmented industry. This gives it significant advantages over small players when it comes to store placement and pricing power.

McCormicks portfolio of products includes its namesake branded spices, but also Lawrys, Zatarains and Thai Kitchen. Some of the more recent additions to the product lineup include Frank RedHot in 2017 and Cholula Hot Sauce in 2020. The addition of these two brands positioned the company to have the top two grossing hot sauces in what is a $5 billion market.

The company also offers its products to consumers and industry customers all over the world, providing it some diversification within its business.

It also tends to hold up well during recessions. Earnings per share grew 22% during the 2007 to 2009 period and 6% in 2020 and 8% in 2021 during the worst of the Covid-19 pandemic.

A dominating business model has paved the way for the company to grow its dividend for 36 consecutive years. The dividend has a compound annual growth rate of 9% since 2013. The dividend is likely to continue to grow due to the expected payout ratio of 59% for the year. Shares yield 2%, which is ahead of the average yield of 1.5% for the S&P 500 Index.

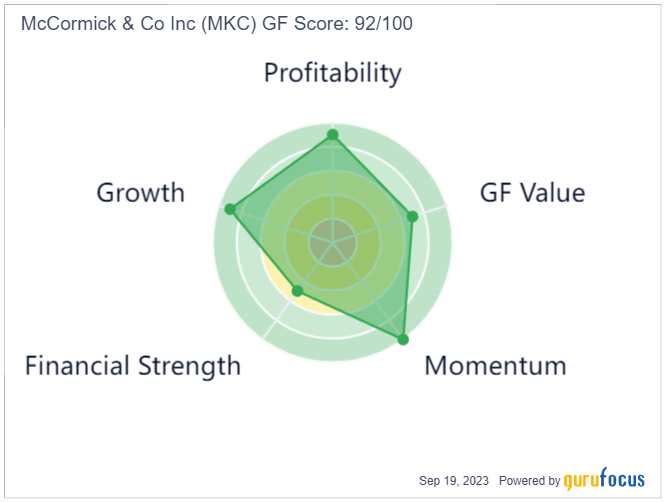

McCormick has a GF Score of 92 out of 100. Stocks with higher scores often outperform those with lower scores, according to GuruFocus research. The company's score implies above-average returns moving forward.

The company has a perfect score for momentum and near-perfect marks for growth and profitability. These are partially offset by average scores for value and financial strength.

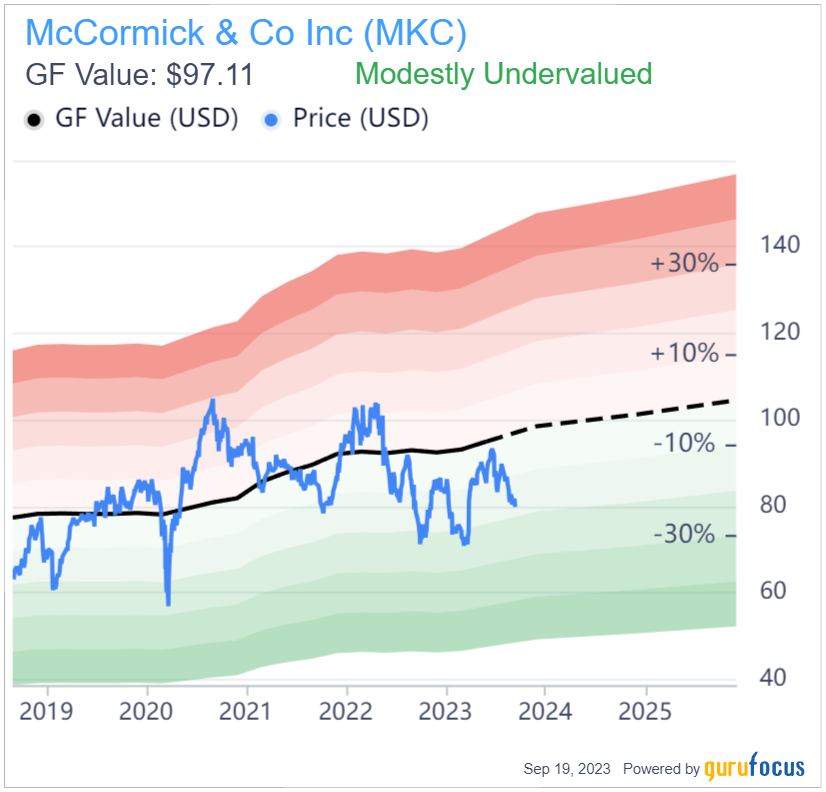

McCormick is trading at a discount to its GF Value Line. This suggests the stock is trading at a discount to its intrinsic value, based on the companys historical ratios, past financial performance and analysts projections for future.

The stock has a current price-to-GF Value ratio of 0.82. Reaching its GF Value would result in a potential return of nearly 23% from current levels before the added benefit of the dividend.

J.M. Smucker

The second stock to consider is J.M. Smucker Co. (NYSE:SJM), which was founded in 1897. Originally, the company consisted of a small cider mill that used apples to produce apple cider and butter. Today, the company is valued at $13 billion and produces revenue in excess of $8 billion annually.

J.M. Smuckers portfolio consists of a wide variety of products that consumers have come to trust. This includes its namesake Smuckers products as well as brands such as Jif, Folgers, Dunkin and Knotts Berry Farm. In addition, the company sells pet foods such as Milk Bone and 9Lives. This diverse lineup of products allows the company to reach a variety of customers needs. J.M. Smucker also has the leading position in multiple categories.

The company also enjoys strong brand loyalty. It has raised its prices in recent years to help offset inflationary pressures, but volumes have remained steady or increased, showing that consumers have been willing to pay up for these brands.

As with McCormick, J.M. Smucker also resides in the packaged food space, which is an area of the economy that tends to be more recession-proof than most. For example, the companys earnings per share grew 39% from 2007 to 2009. J.M. Smucker performed reasonably well during the Covid-19 pandemic as well, with earnings growth 3% and 14% in 2020 and 2021.

On the strength of this business model, J.M. Smucker has raised its dividend for 27 consecutive years, making the company one of the newest Dividend Aristocrats. Shareholders have seen their dividends grow by 6.5% annually over the last decade. The stocks dividend yield of 3.3% should be safe as the expected payout ratio for this year is just 52%.

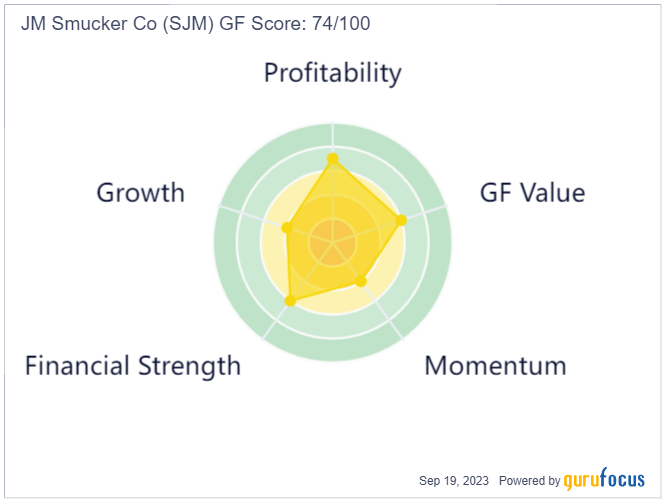

J.M. Smuckers GF Score is 74 out of 100 as the stock is expected to produce just average returns.

The company has average scores for profitability, value and financial strength. Growth and momentum are on the lower end of the scale.

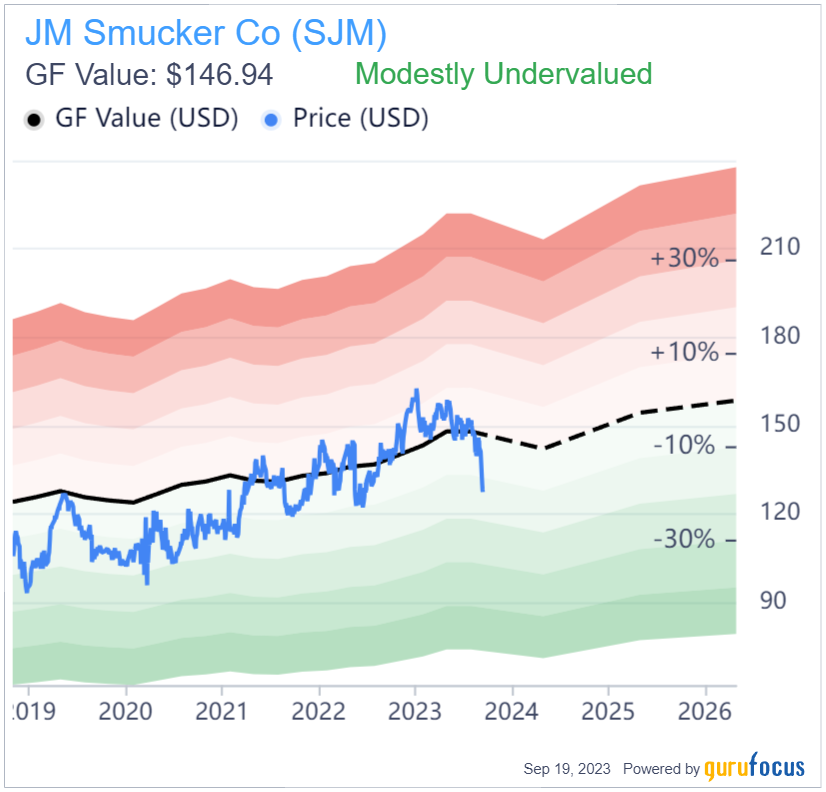

That said, J.M. Smucker is trading at a sizeable discount to its GF Value Line. At a ratio of 0.86, J.M. Smucker could provide a return of nearly 16%. Add in the dividend yield and total returns could begin to approach 20%.

Final thoughts

There are less than 70 Dividend Aristocrats in the entire marketplace, demonstrating just how difficult it is for companies to increase dividends for at least 25 consecutive years. To qualify as such, a company must have a business model that works in all economic environments by offering products and services customers rely upon.

McCormick and J.M. Smucker are two Dividend Aristocrats who have proven their respective business models can mean dividend growth for multiple decades. Each stock could also see double-digit returns given that each name is trading well below its intrinsic value. Investors looking for growth and income should consider adding each name to their watchlist.

This article first appeared on GuruFocus.