2 Undervalued High-Yield Names for High Total Returns

Even after some choppy weeks, the S&P 500 Index is still up more than 11% for 2023. But not all the stocks in the index have participated in this rally. Some are down a double-digit percentage year-to-date.

Sometimes the selloff in a stock is overdone, bringing high quality names to levels that should start to pique the interest of value investors. This is especially true if the stock in question has excellent fundamentals and the potential for significant returns.

The one positive of a declining share price is that the dividend yield can start to look appealing. The combination of potentially high returns and generous yield can make for very attractive total returns.

Criteria for Stock Selection

This article will explore three stocks that meet the following criteria:

Share price is down at least 10% since the start of 2023.

Have a GF Score of at least 90 out of 100.

Rated as undervalued by GuruFocus.

Have a dividend yield of at least 3%.

Have increased the dividend for at least 10 years.

Just 14 stocks meet the above criteria, including Extra Space Storage Inc (NYSE:EXR) and Pfizer Inc (NYSE:PFE).

Extra Space Storage Inc (NYSE:EXR)

First up is Extra Space Storage Inc (NYSE:EXR), a real estate investment trust that operates in the self-storage industry. The trust has a market capitalization of $25.5 billion and has generated revenue of more than $2 billion over the last year. The stock is lower by 16.5% so far this year.

Extra Space Storage Inc (NYSE:EXR)s primary competitive advantage is the sheer size of its business. Already the number two largest operator of self-storage stores in the U.S., Extra Space Storage expanded the reach of its business following its recent purchase of Life Storage for approximately $47 billion in an all-stock deal.

EXR's Expansion and Dividend Yield

This acquisition added 1,200 new locations to the trusts already sizeable footprint, making it the largest player in its industry. The trust now owns, operates, and develops self-storage locations in more than 40 U.S. states, Washington, D.C., and Puerto Rico. In total, Extra Space Storage Inc (NYSE:EXR)s self-storage locations number more than 3,500.

Extra Space Storage Inc (NYSE:EXR)s third-quarter dividend payment was split over two distributions due to the terms of the transaction involving Life Storage. The dividend is expected to remain intact going forward, so Extra Space Storages dividend growth streak of 14 years continues. Shares yield 5.3% presently, which is considerably higher than the average yield of 1.6% for the S&P 500 Index.

EXR's Performance Metrics and Valuation

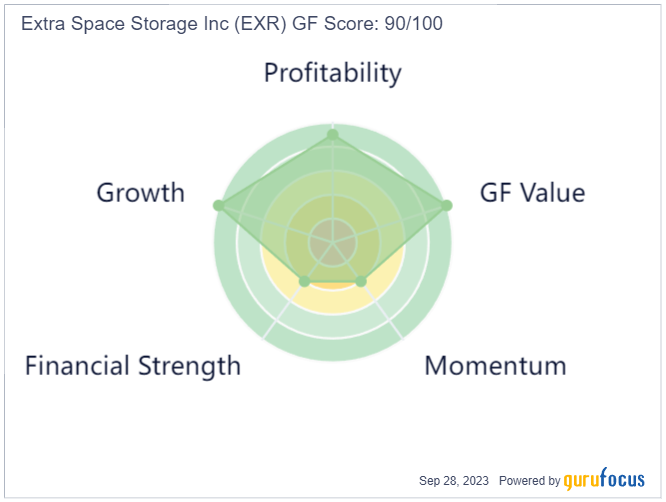

The share price may have declined for the year, but Extra Space Storage Inc (NYSE:EXR) performs well on most metrics. The trust has a GF Score of 90 out of 100, implying good outperformance potential. Extra Space Storage receives perfect scores for value and growth and near-perfect marks for profitability. That said, financial strength and momentum are weak.

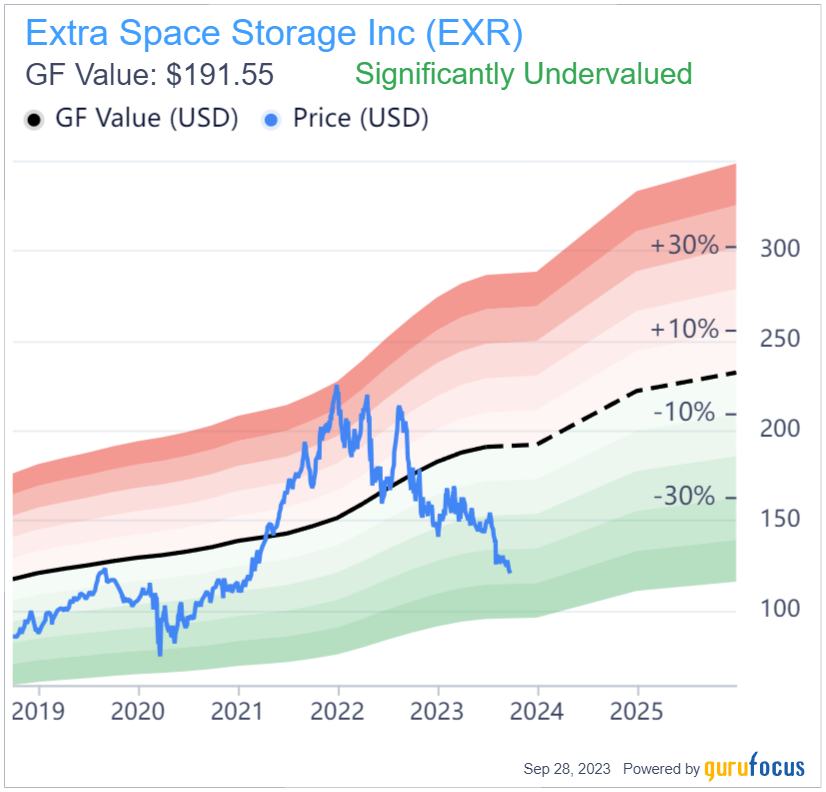

The GF Value Line implies that Extra Space Storage Inc (NYSE:EXR) is significantly undervalued at the moment. With a GF Value of $191.55, investors could see a 59% return if the stock were to reach its GF Value.

Pfizer Inc (NYSE:PFE)

The second name for consideration is Pfizer Inc (NYSE:PFE), a leading global pharmaceutical company. The company is valued at $181 billion and has generated more than $181 billion of revenue over the last year. Shares are down almost 38% so far this year.

Few pharma companies can match the size and scale of Pfizer Inc (NYSE:PFE), as it truly is a global leader. The company has some of the most successful pharmaceutical and vaccines in the world.

PFE's Business Strategy and Dividend Yield

It was one of the first companies to bring a Covid-19 vaccine to market, which has greatly aided results in the past few years. However, the demand for vaccines and the anti-viral drug Paxlovid has fallen as the pandemic has eased and usage has dropped, leading to declines on the top- and bottom-lines in recent quarters.

That said, Pfizer Inc (NYSE:PFE) used the success of its Covid-19-related business to acquire other companies that can help bolster its pipeline. This includes the 2022 acquisition of GBT for its sickle cell treatments and the 2021 purchase of Trillium for its cancer therapeutics.

Even with the roll off of revenue from its Covid-19 treatments, Pfizer Inc (NYSE:PFE) still expects revenue and earnings per share for 2023 to be above pre-covid levels as the core business remains healthy. There are some therapeutics that will lose patent protection, such as Eliquis and Ibrance, that will be a headwind in the years ahead, but the Pfizers acquisition spree and its pipeline should help to offset these losses.

The steep decline in share price has caused the yield to reach 5.1%. This is one of the highest yields for the stock in more than a decade. Since 2013, Pfizer Inc (NYSE:PFE)s average yield is 3.6%. Pfizer has also raised its dividend for 14 consecutive years, so the companys dividend growth track record is solid.

PFE's Performance Metrics and Valuation

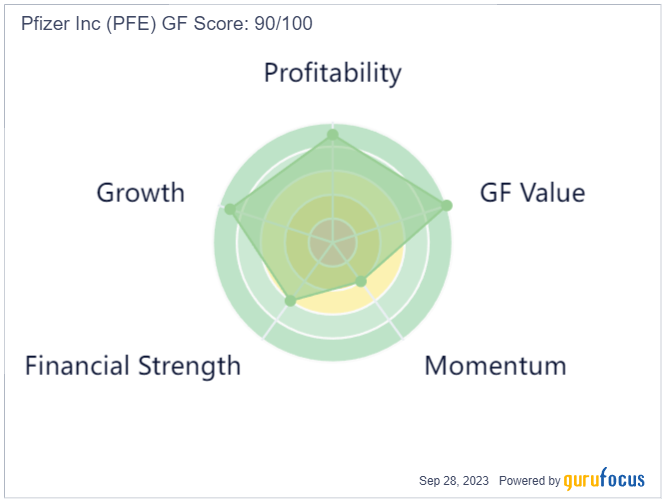

Pfizer Inc (NYSE:PFE)s GF Score is 90 out of 100, suggesting that the stock could see outperformance. This rating is backed by perfect or near-perfect showings for value, growth, and profitability. Financial strength and momentum receive average scores.

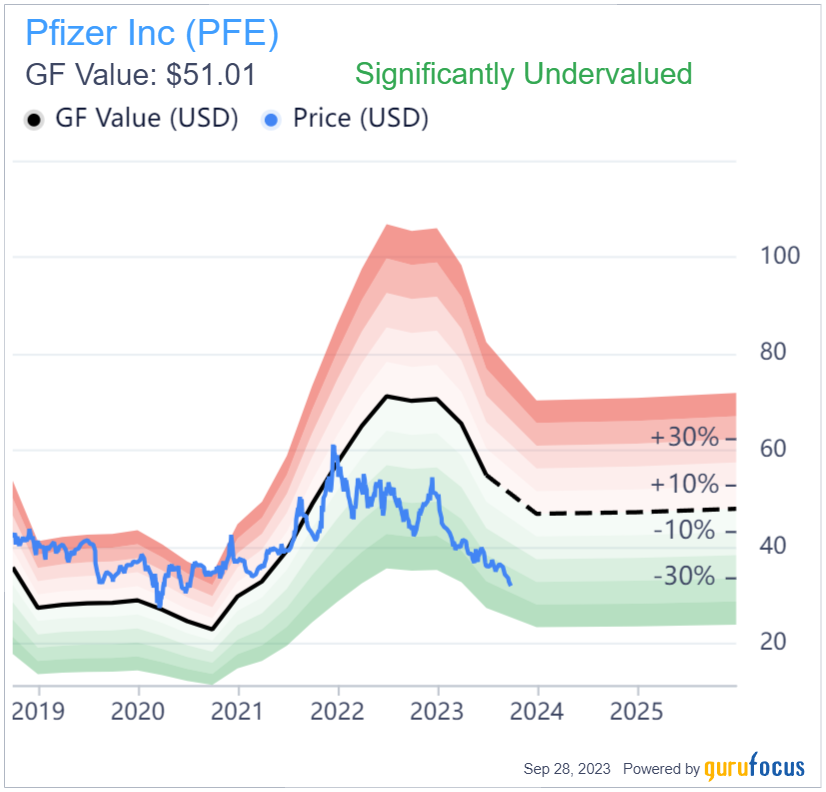

The GF Value Line shows the stock is significantly undervalued. Shareholders could see a 60% return if the stock were to reach its GF Value of $51.01.

Final Thoughts

Extra Space Storage Inc (NYSE:EXR) and Pfizer Inc (NYSE:PFE) are two examples of companies that have suffered a steep decline even as the market as a whole has rallied this year. Both stocks are down a double-digit percentage, but each company has a sound business model and industry-leading fundamentals. Each stock is also trading well off its intrinsic value, which could mean strong rates of return.

At the same time, both stocks offer a 5%+ dividend yield, effectively paying investors to wait for the market to reprice shares. Investors looking for deep value and high yields should consider adding Extra Space Storage Inc (NYSE:EXR) and Pfizer Inc (NYSE:PFE) to their portfolio.

This article first appeared on GuruFocus.