2 Undervalued Lithium Mining Stocks to Consider

Lithium mining is front and center today as we discuss some of the prospects embedded in the industry and elaborate on two best-in-class lithium mining stocks, namely Sociedad Quimica y Minera de Chile S.A. (NYSE:SQM) and Albemarle Corp. (NYSE:ALB).

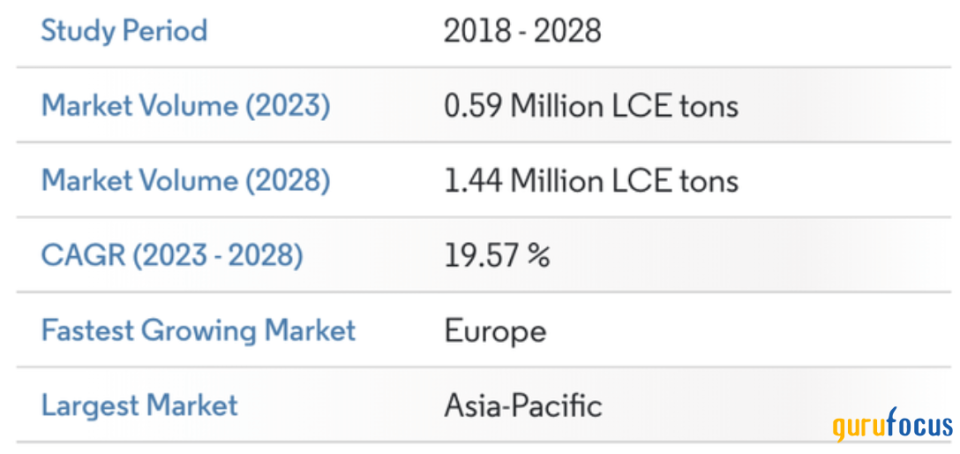

The growing demand for lithium stems from its end market, primarily comprising battery-powered renewable energy companies. Although the perpetual renewable energy mix is yet to be consolidated, empirical data suggests that the lithium production industry might grow at an annualized rate of 19.57% until 2028, setting a platform for stocks such as Sociedad Quimica y Minera and Albemarle to achieve secular growth.

Source: Mordor Research

Let's traverse into an in-depth discussion about the two stocks in focus.

Sociedad Quimica y Minera de Chile

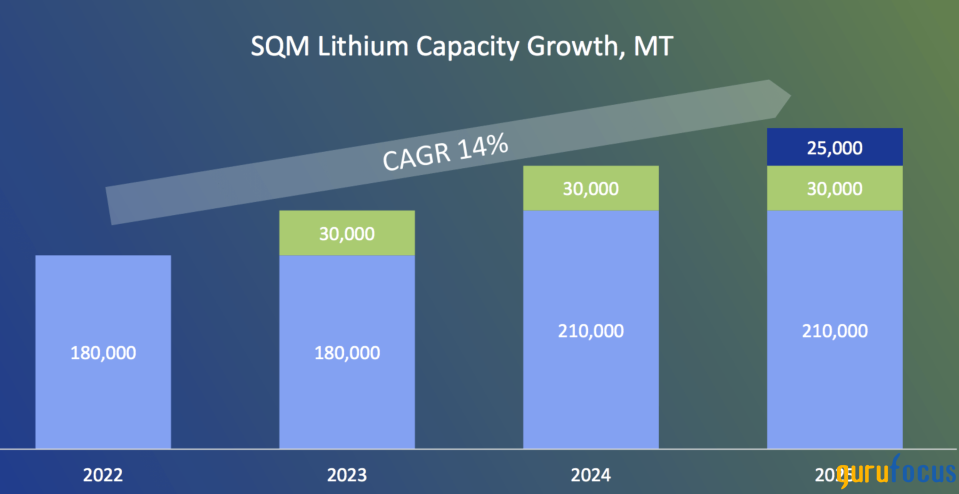

Sociedad Quimica y Minera de Chile (NYSE:SQM) is a Chilean lithium miner that holds down approximately 20% of the global lithium market. The company has a production capacity of 180,000 metric tonnes per year. Moreover, it is set to reach a refinery capacity of approximately 40,000 metric tonnes per year by the end of 2024, lending it critical downstream assistance.

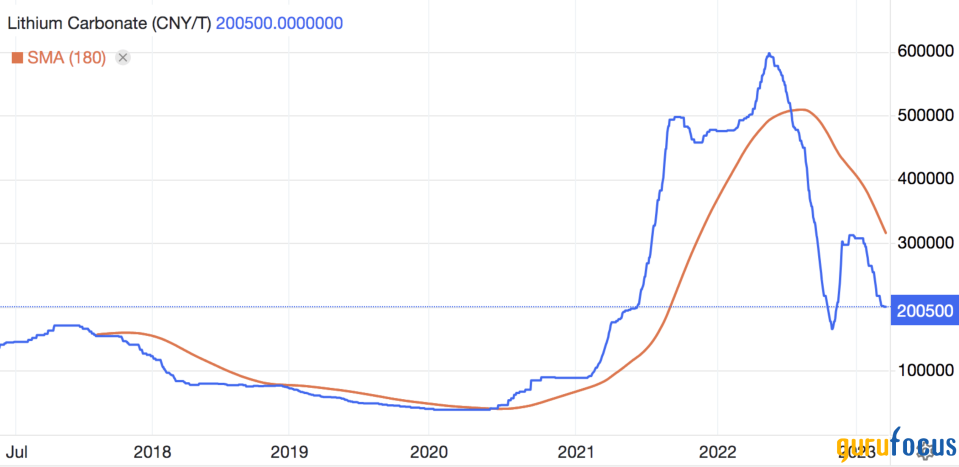

Lithium prices have slumped in the past 12 months, concurrently resulting in Sociedad Quimica y Minera de Chile's second-quarter revenue of $2.05 billion, settling 27.01% lower than the same time last year. However, as illustrated in the diagram below, lithium is priced below its simple moving average, and a pending global interest rate pivot might send the commodity back into a competitively priced territory.

Source: Trading Economics

A few primary draws toward Sociedad Quimica y Minera de Chile are its best-in-class status, expansion pipeline and attractive valuation metrics.

The company has a low-cost structure compared to its peers, with its operating profit margin of 48.76% within the 99th industry percentile, displaying the leverage provided by access to a lithium-dense terrain in Chile.

Further, Sociedad Quimica y Minera de Chile is in the midst of expanding its output capacity to 210,000 metric tonnes due to solid execution of its capital expenditure roadmap, including construction of the Antofagasta Carmen Lithium plant and early production from its China-based Sichuan Refinery.

Source: Sociedad Quimica y Minera de Chile

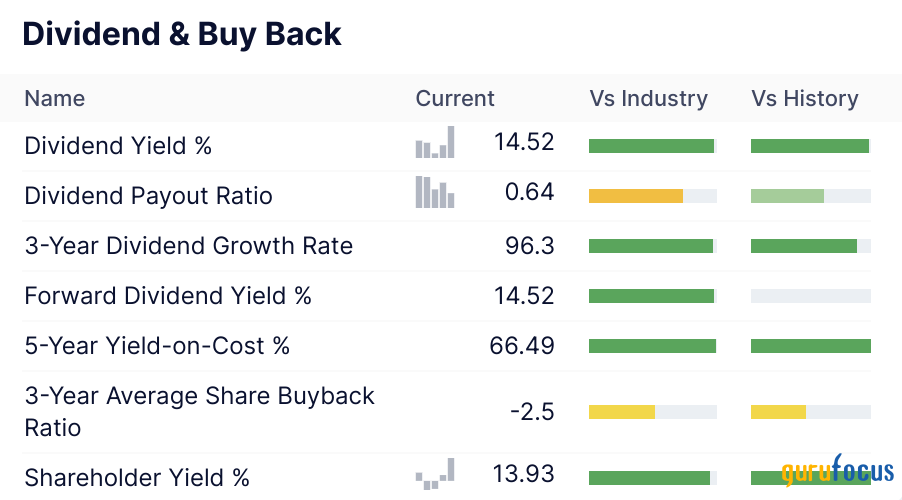

As previously mentioned, Sociedad Quimica y Minera de Chile has stellar valuation metrics. For example, its price-to-earnings multiple ranks within the 98th industry percentile, while it also presents a dividend yield of 14.52%, conveying its spectacular total return prospects.

Albemarle

Albemarle (NYSE:ALB) is a U.S.-based resources company with operations spanning the U.S., Australia, Chile, China and Argentina. The company has a substantial footprint in the lithium mining industry with a total production capacity of 225,000 tonnes per year.

Among Albemarle's key assets are Salar De Atacama in Chile, Silver Peak in Nevada and Greenbushes in Australia, which, as per the company's second quarter, contributed to net sales of $2.4 billion, yielding a 60% year-over-year increase.

As discussed above, the company's stealth was once more illustrated in its latest operating quarter as Albemarle blasted past estimates. However, a critical aspect to take notice of is its strategic supply deals, which have brought it significant success in the last few years. For example, the company recently agreed to a supply deal with Ford (NYSE:F), which will see it sell approximately 100,000 metric tonnes of lithium hydroxide to one of America's most prominent electric vehicle manufacturers.

As with Sociedad Quimica y Minera, Albemarle has a solid cost structure coupled with a robust balance sheet.

The company's operating profit margin of 30.69% is within the 97th industry percentile, illustrating its advantageous cost base and economies of scale. In addition, Albemarle has a current ratio of 1.74, suggesting it possesses a liquid balance sheet, allowing it to glide through its capital expenditure roadmap without delay.

Albemarle's price-earnings ratio of 5.57 and dividend yield of 0.87% suggest it is more of a capital appreciation play than an income-generating investment. Nevertheless, I would not be surprised if the company increases its dividend payout in the coming years.

Noteworthy risks

Sociedad Quimica y Minera and Albemarle possess numerous top-down risks.

The first risk to notice is the unstable political environment in Chile, whose leadership has claimed it will nationalize its local lithium industry.

Fears of a nationalization add significant risk to both Sociedad Quimica y Minera de Chile and Albemarle's stocks as they have lithium interests in the country.

Another risk is the cyclical attributes of commodity stocks. Global disinflation might play a part and cause lithium prices to deplete even further, leaving both companies in an uphill battle.

Final word

Lithium mining is gaining ground as secular demand for the commodity provides latitude to best-in-class miners such as Sociedad Quimica y Minera de Chile and Albemarle to embark on a secular growth trajectory.

Key metrics illustrate that the companies have achieved economies of scale. Moreover, both companies have ambitious capital expenditure roadmaps, providing their investors with much to be optimistic about.

Although both stocks possess risks, their salient features suggest they will likely provide investors with the demanded utility.

This article first appeared on GuruFocus.