2 Unknown Artificial Intelligence (AI) Stocks That Could Be Huge in 2024

2023 has been a fascinating year for investors. What started with hand-wringing and fear finished with the Dow Jones Industrial Average and S&P 500 indexes near record highs and the Nasdaq Composite not too far behind. There were at least two big reasons for the resurgence.

First, a recession that was predicted by many failed to materialize, thanks in part to efforts by the Federal Reserve. Outsized inflation was brought under control and the economy remained relatively strong despite some challenges. Second, an artificial intelligence (AI) wave of enthusiasm rolled over Wall Street. That wave helped push AI-influenced stocks like Microsoft and Nvidia to new record highs as their businesses generated terrific results.

The AI wave is expected to continue into 2024 and beyond, and investors are already looking elsewhere in the AI space for potential opportunities. Many companies are doing spectacular things with AI; here are two stocks to put on your radar in 2024.

1. UiPath offers real-world AI solutions

Think about the last time you called a customer service line. Did you get transferred multiple times and have to repeat the same identity verification information numerous times? Or did a single person help you and seem to know most of your information already just from your phone number? The difference between those two experiences relates to the technology they are using.

UiPath (NYSE: PATH) Robotic Process Automation (RPA) makes the latter possible, and its customers report soaring customer service ratings and a significant decline in call times. This is real value for the top and bottom lines.

A UiPath customer can also automate a tedious, labor-intensive accounts payable process. Previously, the customer's staff would open hundreds of emails per day containing invoices, download the attachments, and input them into their accounting system. This is a costly process. Using UiPath AI technology, the customer can automate much of this process, freeing employees to complete higher-level tasks.

On the financial front, UiPath reached $1.4 billion in annual recurring revenue (ARR) last quarter, with ARR growth of 24% year over year.

UiPath has a strong balance sheet with $1.8 billion in cash and investments and no long-term debt. The company isn't profitable on a generally accepted accounting principles (GAAP) basis yet, which is common with growing companies, but it produces positive cash flow from operations. This is encouraging, as is UiPath's 85% gross margin.

The stock trades at a price-to-sales (P/S) ratio of 12. Is this reasonable? It's tough to say at this point. The valuation is lower than other growing AI companies, such as Palantir Technologies, at 19 times sales, but the long-term prospects will ultimately come down to execution. If management executes and UiPath continues gaining new customers, the stock will probably do very well over the long haul. If growth stalls, investors will be disappointed. This is why it is wise to dedicate a modest part of a portfolio to small growth companies. Still, UiPath is an intriguing stock that investors should have on their radar, if not in their portfolio.

2. SoundHound AI is a stock to keep an eye on

Another company offering practical solutions is SoundHound AI (NASDAQ: SOUN). SoundHound's niche is conversational intelligence. The company's software enables ordering systems to understand and accurately update customers' orders in real-time using speech recognition technology. White Castle has signed up to roll this out at 100 drive-up locations in 2024.

SoundHound also offers speech-enabled software for automobiles. The user can speak conversationally and receive much more information than most vehicle systems offer today. This will be the standard for restaurants and vehicles in the not-so-distant future. However, SoundHound has significant competition from big tech and auto companies.

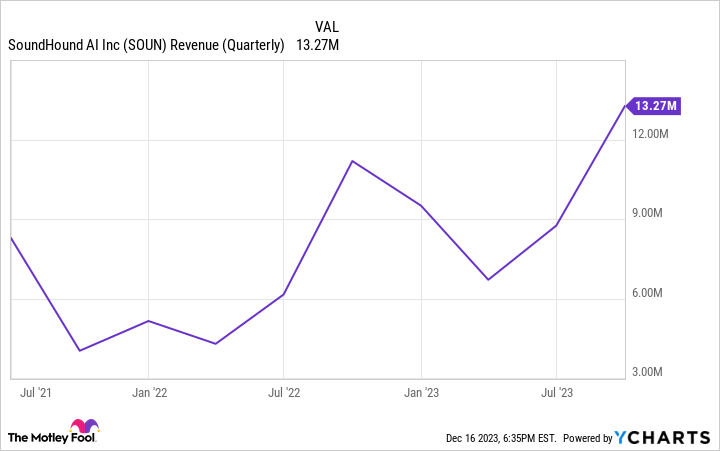

The competition has very deep pockets, while SoundHound produced just $13.3 million in sales last quarter and has less than $100 million cash on hand. On the other hand, this was a 52% sequential increase in sales, as shown below, and SoundHound reported increased traction with several customers.

Investors should also know that the number of shares outstanding increased 23% year over year last quarter.

SoundHound also trades at a P/S ratio near 12 but has a more challenging financial situation than UiPath. Still, there are several ways that investors can profit, including excellent execution that grows sales rapidly or the potential that a larger company loves the technology and makes an acquisition offer. In any event, this is another exciting stock and company AI investors should keep an eye on.

Should you invest $1,000 in UiPath right now?

Before you buy stock in UiPath, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and UiPath wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Bradley Guichard has positions in Nvidia and UiPath and has the following options: long January 2025 $2 calls on SoundHound AI and long September 2024 $630 calls on Nvidia. The Motley Fool has positions in and recommends Microsoft, Nvidia, Palantir Technologies, and UiPath. The Motley Fool has a disclosure policy.

2 Unknown Artificial Intelligence (AI) Stocks That Could Be Huge in 2024 was originally published by The Motley Fool