2 Utility Stocks to Buy and 1 to Avoid

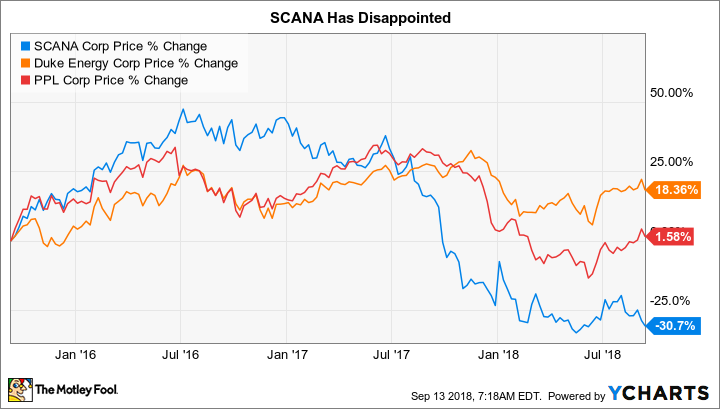

Investing in utilities is usually a pretty boring affair, with the main attraction normally being a reliable quarterly dividend payment. Recent events at SCANA Corporation (NYSE: SCG), however, have been anything but boring. Dominion Energy could be the company's savior, but not if the government gets in the way.

That's why investors would be better off investing in high-yielding Duke Energy Corporation (NYSE: DUK) or PPL Corporation (NYSE: PPL). Here's what you need to know to decide.

Uncertainty reigns

The bad news at SCANA really got started when it began construction of a nuclear power plant. The project was hit with cost overruns and delays, which led to a lot of bad press and an increasingly tense relationship with key stakeholders -- like the South Carolina government, along with customers and regulators. But things got really bad when the company's contractor, Westinghouse, filed for bankruptcy. That led SCANA to halt nuclear construction altogether.

Image source: Getty Images

Without regulatory relief, SCANA could have a hard time remaining solvent thanks to the debt related to the now-canceled nuclear plant. It has already been forced to cut its dividend by 80%. Larger utility Dominion Energy has stepped into the fray, offering to buy SCANA, but the deal needs approval -- and Dominion says it will walk away if any changes are made to its proposal.

The problem is that some stakeholders are balking at the deal. So the best case is that SCANA gets absorbed into Dominion, and the worst case is you own a very troubled utility that may not survive its nuclear foibles. The risk/reward trade-off here just doesn't add up, and most investors should avoid SCANA. (And if you want to own Dominion, just buy Dominion.)

Some alternatives

That's where Duke Energy comes in. This utility canceled its nuclear plans before they derailed the company, and the construction troubles it had at a clean coal plant are now in the past. In fact, it has revamped its entire business in recent years, selling carbon-based merchant power assets and foreign operations, buying a natural gas utility, and expanding its reach in renewable power. Today the utility's business is largely driven by regulated assets and long-term contract businesses (midstream pipelines and renewable merchant power).

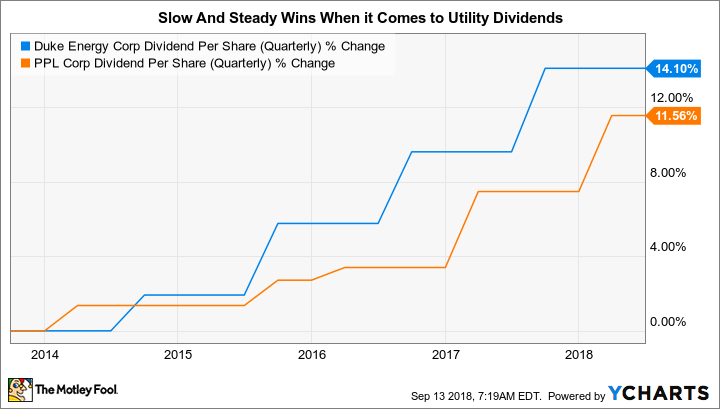

It has plans to spend roughly $37 billion across its various businesses between 2018 and 2022. This spending, roughly 90% of which will be on regulated assets, should help it get approval for rate hikes and support the company's projection of 4% to 6% annual earnings and dividend growth over that span. That's not exciting, but it's got a high chance of hitting these targets since the spending is for necessary upgrades and equipment that are not controversial in any way. And with a robust 4.4% yield, investors are getting an above market yield backed by what should be inflation-beating dividend growth. Duke is boring, but in a good way.

PPL is a little more of a stretch, but not much more. This company owns utility assets in the United States and the United Kingdom. That means that currency fluctuations can have a big impact on results over short periods of time, and that it has to deal with two very different sets of government regulations. It also has a coal-heavy generating fleet. Concerns around these issues have left investors less than enthusiastic about PPL stock, even though it offers a very generous yield of 5.3%.

Here's the thing: Currency fluctuations are likely to wash out over the long term. And the added diversification of the UK assets could be viewed as a net positive as the energy sector continues to evolve -- note that oil giants Total and Royal Dutch Shell have been investing in electric assets lately. And those pesky coal plants, well, they need to be replaced over time, which is exactly the type of spending that regulators like to see when considering rate hikes. So far from being a negative, the company's need to upgrade its asset base should probably be seen as a net positive.

DUK Dividend Per Share (Quarterly) data by YCharts

PPL is currently calling for earnings growth of around 5% a year through 2020. Backing that up is spending of roughly $10 billion between 2018 and 2020. It has another $5.4 billion planned for 2021 and 2022, so there's still more growth to come after 2020.

The dividend, meanwhile, should continue to expand, though only in the low single digits. However, over the last decade annualized distribution growth has basically kept pace with the historical average for inflation growth, ensuring that investors' buying power hasn't been eroded. Investors looking to maximize current income should do a deep dive at PPL.

Some clarity is needed

There's a huge amount of uncertainty at SCANA today. If the Dominion deal gets all of the approvals it needs, the outlook is for better days ahead -- but there's a lot of pushback against the agreement. And a negative outcome would be very bad for SCANA and its shareholders. That's a risk/reward trade-off that's not worth taking for most investors, since utilities are usually expected to be boring income investments -- not turnaround plays.

If boring income is what you are really after, Duke and PPL are better bets. Duke has growth plans in place that will keep earnings and dividends moving higher at a mid-single digit clip through 2022. PPL offers a higher yield and slightly lower earnings and dividend growth prospects. However, for income-focused investors that might be a worthwhile trade off.

Either, however, is a better option than SCANA today.

More From The Motley Fool

Reuben Gregg Brewer owns shares of Dominion Energy, Inc. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.