2 Warren Buffett Dividend Growth Stocks to Buy and Hold Forever

It is widely known that Warren Buffett, one of the greatest investors ever, loves dividend stocks. So it's not surprising that the company he leads, Berkshire Hathaway, has several excellent dividend stocks in its portfolio. Two of the best are Visa (NYSE: V) and Mastercard (NYSE: MA), the world's largest payment services companies. Let's find out why these businesses are solid options for investors interested in passive income whose favorite holding period -- like Buffett's -- is forever.

An unstoppable duopoly

Few people think about what happens once they swipe their credit cards in a store. The process is pretty intricate. Visa and Mastercard form the backbone of it. Both companies operate payment networks that allow credit-card transactions to be approved (or rejected) by connecting the bank that issued the card with that of the merchant's.

Visa and Mastercard pocket a fee for every transaction they help to facilitate. These two juggernauts have no notable competitors aside from one another. They practically run a duopoly that would be extremely challenging to topple, thanks to the network effects both companies benefit from. Take Visa: As of last year, there were more than 4 billion cards in circulation that had its logo.

Merchants who start new businesses and choose not to accept Visa cards as a payment method are turning away a significant percentage of their potential customers (at least in places where credit-card penetration is high). The more merchants take Visa, the more it becomes attractive to customers. Mastercard also benefits from this dynamic. That's partly why both companies continue to grow.

Strong financial results

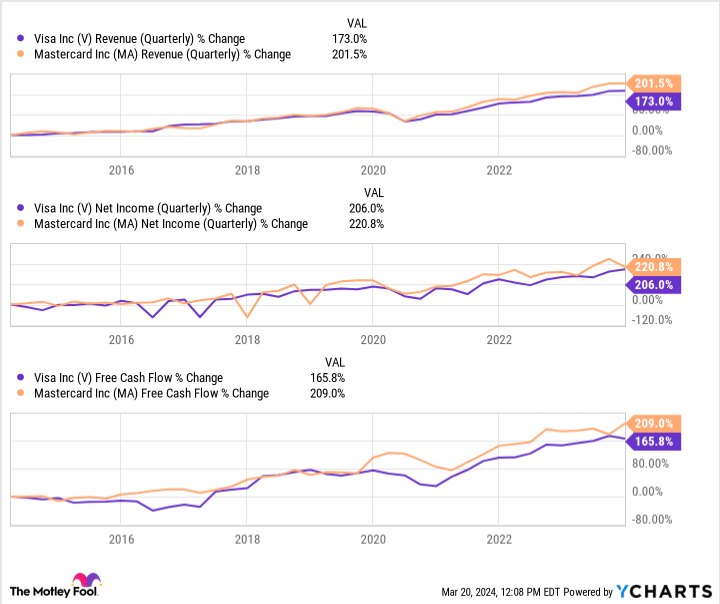

Visa and Mastercard have helped drive the move away from cash for years. As credit-card usage increases, both companies benefit from more transactions and higher revenue from fees. It's not surprising, then, that they have delivered excellent financial results in recent years.

Though lower than Visa's, Mastercard's revenue and earnings have grown faster. One key reason is that Mastercard has greater exposure in countries with lower credit-card penetration. In 2023, Mastercard generated $8.4 billion in sales from North America, an increase of 7% year over year. However, the company's revenue in international markets came in at $16.7 billion (almost 67% of its revenue), 16% higher than the previous year.

Visa separates its geographical segments into U.S. and international. In its fiscal 2023 ended Sept. 30, Visa's U.S. revenue rose 10% year over year to $14.1 billion. The company's international sales climbed 12% to $18.5 billion, or about 57% of its revenue. Visa's international segment also includes Canada, a country lumped into Mastercard's slower-growing North American unit.

These comparisons aside, Visa and Mastercard have plenty of growth opportunities because the trend of phasing out cash and check transactions should continue for a long time. While it may not seem so to some, many people still rely on cash, especially in regions with lower credit-card penetration. As Mastercard Chief Executive Officer Michael Miebach said on the company's third-quarter 2023 earnings call: "There remains a significant opportunity to convert cash and check to commercial card products."

Visa's management has made the same point countless times, even emphasizing that in developed markets like the U.S., there remains a surprisingly large number of card-less transactions. These two giants should continue to ride this wave for the foreseeable future.

Excellent dividend records

During the past decade, Visa and Mastercard have increased their payouts at an incredible pace.

Generating plenty of profits and free cash flow can allow a company to do that. Still, both have plenty of room for dividend hikes given their relatively modest cash payout ratios (both are about 20% of net income). Though neither sports a particularly high forward yield -- Visa's 0.73% beats out Mastercard's 0.55% -- through the combination of robust underlying operations, attractive growth opportunities, and competitive advantages, Visa and Mastercard look like no-brainer dividend stocks to buy and hold for good.

Should you invest $1,000 in Visa right now?

Before you buy stock in Visa, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Visa wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Mastercard, and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

2 Warren Buffett Dividend Growth Stocks to Buy and Hold Forever was originally published by The Motley Fool